1 Company Presentation May 2023

2 Disclaimers Market Data In this presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which KORE expects to compete and other industry data. We obtained this information and these statistics from a variety of publicly available sources, including reports by market research firms and other public company filings. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Forward-Looking Statements This presentation includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. KORE's actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements generally are accompanied by words such as "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "should," "would," "plan," "predict," "potential," "seem," "seek," "future," "outlook,“ “target” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements relating to the proposed acquisition of Twilio’s IoT business, its expected consummation and the benefits thereof, statements regarding estimates and forecasts of revenue and other financial and performance metrics, future capital availability, projections regarding recent customer engagements, projections of market opportunity and conditions, the total contract value (TCV) of signed contracts and potential revenue opportunities in KORE’s sales funnel, and related expectations. These statements are based on various assumptions and on the current expectations of KORE’s management. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor or other person as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of KORE. These forward-looking statements are subject to a number of risks and uncertainties, including general economic, financial, legal, political and business conditions and changes in domestic and foreign markets; the potential effects of COVID-19; risks related to the rollout of KORE's business and the timing of expected business milestones; risks relating to the integration of KORE’s acquired companies, changes in the assumptions underlying KORE's expectations regarding its future business; our ability to negotiate and sign a definitive contract with a customer in our sales funnel; our ability to realize some or all of the Total Contract Value (TCV) of customer contracts as revenue, including any contractual options available to customers or contractual periods that are subject to termination for convenience provisions; the effects of competition on KORE's future business; and the outcome of judicial proceedings to which KORE is, or may become a party. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that KORE presently does not know or that KORE currently believes are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect KORE's expectations, plans or forecasts of future events and views as of the date of this presentation. KORE anticipates that subsequent events and developments will cause these assessments to change. However, while KORE may elect to update these forward-looking statements at some point in the future, KORE specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing KORE's assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. The information in this presentation was obtained from KORE Group Holdings, Inc. (“KORE or the “Company”) and other sources. Neither KORE nor UBS Securities LLC (the “Advisor”) makes any representation or warranty, expressed or implied, as to the accuracy or completeness of the information contained in this presentation, and nothing contained herein is, or shall be relied upon as, a promise or representation, whether as to the past or to the future. Only those representations and warranties that are made in a definitive written agreement relating to a transaction, when and if executed, and subject to any limitations or restrictions as may be specified in such definitive agreement, shall have any legal effect. This presentation does not purport to include all of the information that may be required to evaluate such transaction and any recipient hereof should conduct its own independent analysis of KORE and the data contained or referred to herein. The Advisor has not independently verified any of such information and assume no responsibility for its accuracy or completeness. Neither KORE nor its Advisor expect to update or otherwise revise the presentation or other materials supplied herewith.

3 Disclaimers (Continued) Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, © or ® symbols, but KORE will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Use of Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we believe the following non-GAAP measures are useful in evaluating our operational performance. We use the following non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors in assessing our operating performance. “EBITDA” is defined as net income (loss) before interest expense or interest income, income tax expense or benefit, and depreciation and amortization. Such adjustments may include stock-based compensation, integration and acquisition-related charges, tangible and intangible asset impairment charges, certain contingent liability reversals, transformation, and foreign currency transaction gains and losses. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are intended as supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. We believe that the use of EBITDA, Adjusted EBITDA and Adjusted EBITDA margin provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware that when evaluating EBITDA, Adjusted EBITDA and Adjusted EBITDA margin we may incur future expenses similar to those excluded when calculating these measures. In addition, our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate Adjusted EBITDA in the same fashion. Because of these limitations, EBITDA, Adjusted EBITDA and Adjusted EBITDA margin should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA, Adjusted EBITDA and Adjusted EBITDA margin on a supplemental basis. You should review the reconciliation of net loss to EBITDA, Adjusted EBITDA and Adjusted EBITDA margin below and not rely on any single financial measure to evaluate our business. We have not provided the forward-looking GAAP equivalents for the forward-looking non-GAAP financial measures EBITDA or a GAAP reconciliation as a result of the uncertainty regarding, and the potential variability of, reconciling items. Accordingly, a reconciliation of this non-GAAP guidance metric to its corresponding GAAP equivalents is not available without unreasonable effort. However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results and, as such, we also believe that any reconciliations provided would imply a degree of precision that could be confusing or misleading to investors. “Organic revenue” is defined as GAAP revenues adjusted for the impact of foreign currency exchange and acquisitions and (a) for IoT Connectivity, exclusion of revenue of non core customers and LTE pricing adjustments and (b) for IoT Solutions, exclusion of LTE transition revenue from our largest customer. “Organic revenue growth” is defined as the year over year change in organic revenue divided by organic revenue in the prior period. “Organic Gross Profit” is defined as GAAP gross profit adjusted for the impact of foreign currency exchange and acquisitions and (a) for IoT Connectivity, exclusion of revenue and costs associated with non-core customers and LTE pricing adjustments and (b) for IoT Solutions, exclusion of LTE transition revenue and costs from our largest customer. “Organic Gross Profit Margin” is defined as Organic Gross Profit divided by Organic Revenue for that period. “Organic Normalized Adjusted EBITDA” is defined as Adjusted EBITDA, adjusted for the items outlined in Organic Revenue and Organic Gross Profit, in addition to further adjustments for (i) burdening certain historical periods for go-forward public company related costs to the extent these costs were not already incurred, and (ii) removing $1mm of one-time costs related to non-recurring audit expenses in Q1’2023. “Organic Normalized Adjusted EBITDA Margin” is defined as Organic Normalized Adjusted EBITDA divided by Organic Revenue for that period

4 Today's Presenters Romil Bahl President & CEO, KORE Previous Experience Romil Bahl has been serving as KORE’s CEO since October 2017. He brings over 30 years of SaaS, information technology, professional services and IoT experience in high-growth environments. Prior to KORE, Romil served as President and CEO of Lochbridge, a leading technology consulting and solutions provider in the IoT and digital enablement space (sold to DMI in 2017). Romil earned an MBA from The University of Texas at Austin and a Bachelor of Engineering degree from the Directorate of Marine Engineering & Technology in Kolkata, West Bengal, India Paul Holtz EVP, CFO & Treasurer, KORE Previous Experience Paul Holtz has been serving as KORE’s CFO since March 2022, after serving as interim CFO since November 2021. He joined KORE in March 2017 and has extensive public company experience in the technology and SaaS space. Prior to joining KORE, Paul served in various finance & operations roles at Blackberry. Paul received his bachelor's degree in Business Administration and Accounting from Wilfrid Laurier University and is a member of the Chartered Professional Accountants of Canada

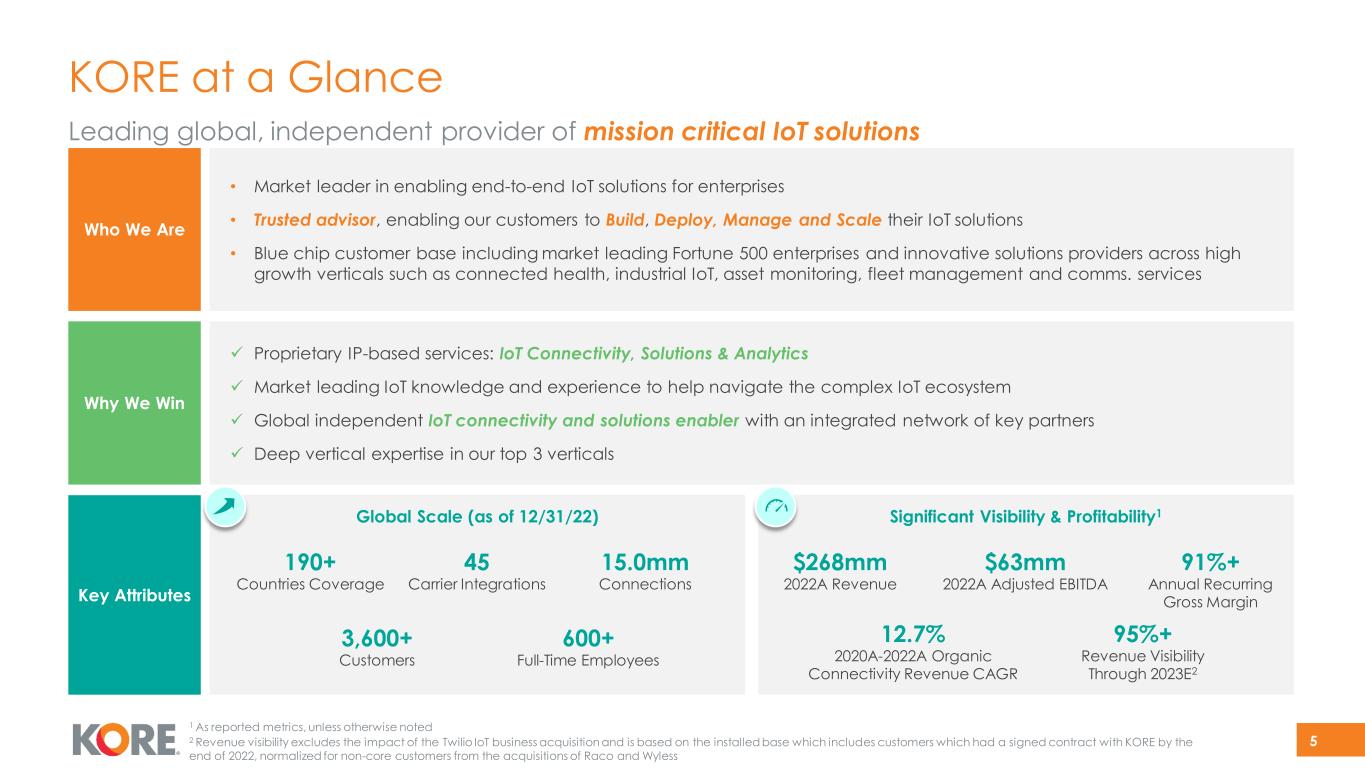

KORE at a Glance 5 Leading global, independent provider of mission critical IoT solutions • Market leader in enabling end-to-end IoT solutions for enterprises • Trusted advisor, enabling our customers to Build, Deploy, Manage and Scale their IoT solutions • Blue chip customer base including market leading Fortune 500 enterprises and innovative solutions providers across high growth verticals such as connected health, industrial IoT, asset monitoring, fleet management and comms. services Who We Are ✓ Proprietary IP-based services: IoT Connectivity, Solutions & Analytics ✓ Market leading IoT knowledge and experience to help navigate the complex IoT ecosystem ✓ Global independent IoT connectivity and solutions enabler with an integrated network of key partners ✓ Deep vertical expertise in our top 3 verticals Why We Win Significant Visibility & Profitability1Global Scale (as of 12/31/22) Key Attributes 190+ Countries Coverage 45 Carrier Integrations 15.0mm Connections 3,600+ Customers 600+ Full-Time Employees $268mm 2022A Revenue $63mm 2022A Adjusted EBITDA 91%+ Annual Recurring Gross Margin 12.7% 2020A-2022A Organic Connectivity Revenue CAGR 95%+ Revenue Visibility Through 2023E2 1 As reported metrics, unless otherwise noted 2 Revenue visibility excludes the impact of the Twilio IoT business acquisition and is based on the installed base which includes customers which had a signed contract with KORE by the end of 2022, normalized for non-core customers from the acquisitions of Raco and Wyless

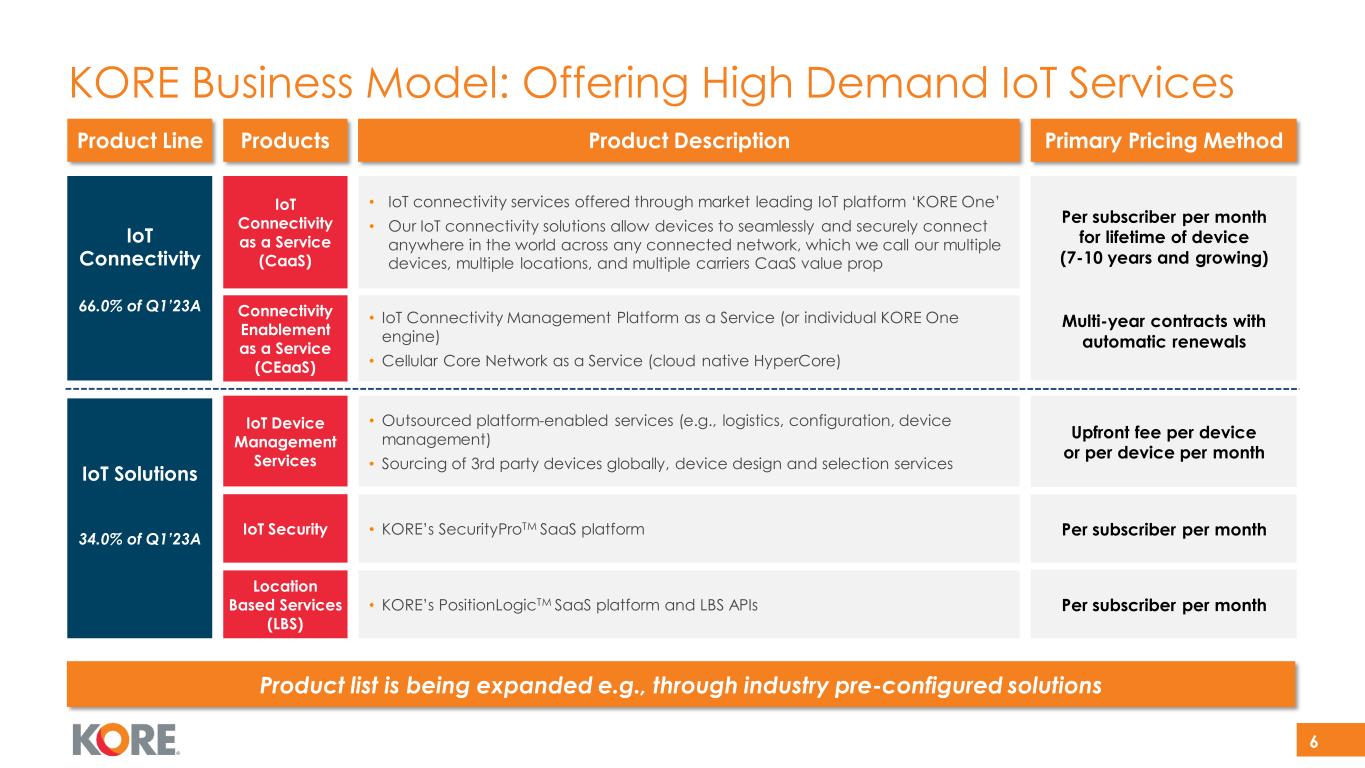

6 Primary Pricing MethodProduct Line Product Description IoT Connectivity 66.0% of Q1’23A Per subscriber per month for lifetime of device (7-10 years and growing) Multi-year contracts with automatic renewals IoT Solutions 34.0% of Q1’23A Products • IoT connectivity services offered through market leading IoT platform ‘KORE One’ • Our IoT connectivity solutions allow devices to seamlessly and securely connect anywhere in the world across any connected network, which we call our multiple devices, multiple locations, and multiple carriers CaaS value prop IoT Connectivity as a Service (CaaS) • IoT Connectivity Management Platform as a Service (or individual KORE One engine) • Cellular Core Network as a Service (cloud native HyperCore) Connectivity Enablement as a Service (CEaaS) Location Based Services (LBS) • KORE’s PositionLogicTM SaaS platform and LBS APIs Per subscriber per month IoT Security • KORE’s SecurityProTM SaaS platform Per subscriber per month IoT Device Management Services • Outsourced platform-enabled services (e.g., logistics, configuration, device management) • Sourcing of 3rd party devices globally, device design and selection services Upfront fee per device or per device per month 6 KORE Business Model: Offering High Demand IoT Services Product list is being expanded e.g., through industry pre-configured solutions

7 Inability to contextualize and analyze data Challenges in interoperability and compatibility Lack of solution deployment planning and experience Issues in compliance with regulations Fragmented ecosystem requiring multiple partners Lack of in- house IoT expertise and resources Risks and pitfalls in IoT Security Fleet Mgmt. Connected Blood Sugar Monitors Connected Gas Tank Monitors Connected Alcohol Monitors Offender Trackers Smart Meters Smart City Lighting Systems Home Security Top Challenges in IoT DeploymentsSample IoT Use Cases IoT Use Cases are Everywhere… Deployments are Complex

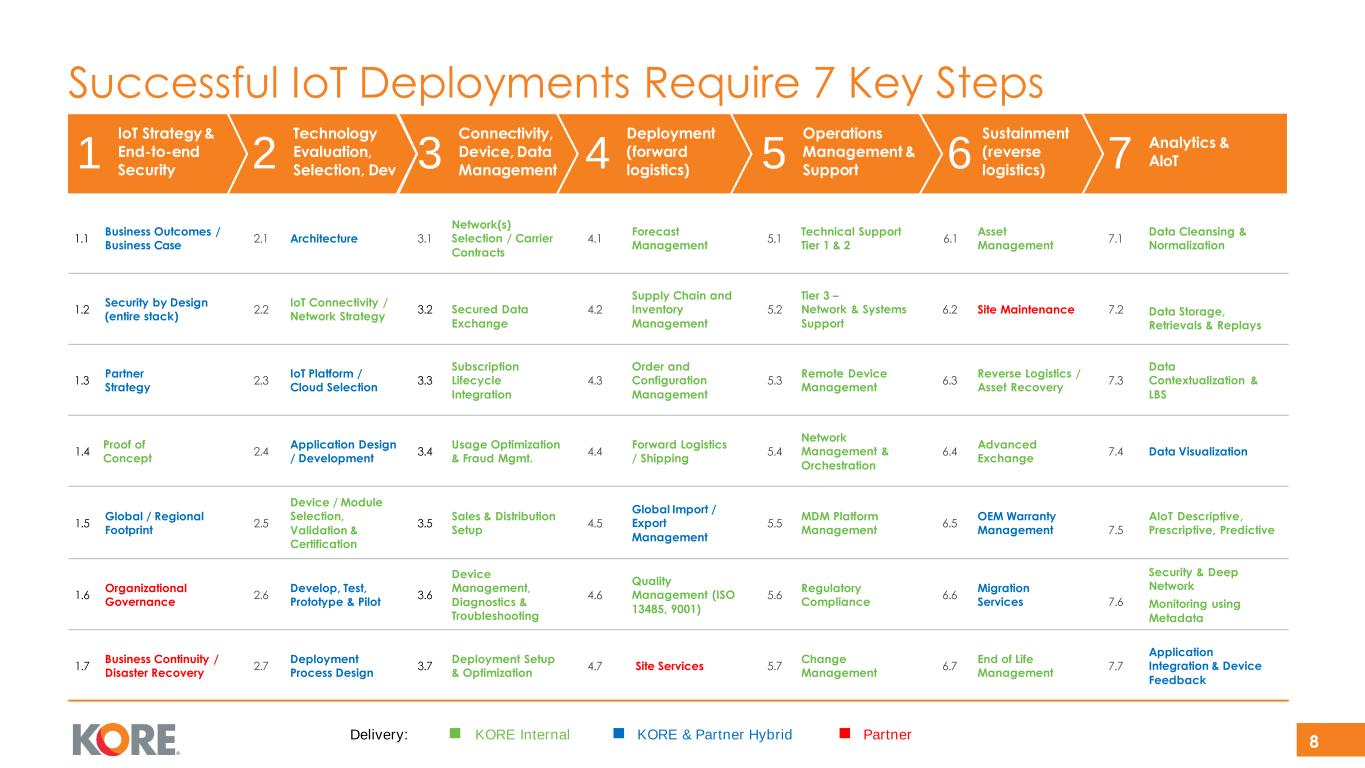

8 Successful IoT Deployments Require 7 Key Steps • How these services are delivered through KORE and Partn ers Delivery: KORE Internal KORE & Partner Hybrid Partner 1.1 Business Outcomes / Business Case 2.1 Architecture 3.1 Network(s) Selection / Carrier Contracts 4.1 Forecast Management 5.1 Technical Support Tier 1 & 2 6.1 Asset Management 7.1 Data Cleansing & Normalization 1.2 Security by Design (entire stack) 2.2 IoT Connectivity / Network Strategy 3.2 Secured Data Exchange 4.2 Supply Chain and Inventory Management 5.2 Tier 3 – Network & Systems Support 6.2 Site Maintenance 7.2 Data Storage, Retrievals & Replays 1.3 Partner Strategy 2.3 IoT Platform / Cloud Selection 3.3 Subscription Lifecycle Integration 4.3 Order and Configuration Management 5.3 Remote Device Management 6.3 Reverse Logistics / Asset Recovery 7.3 Data Contextualization & LBS 1.4 Proof of Concept 2.4 Application Design / Development 3.4 Usage Optimization & Fraud Mgmt. 4.4 Forward Logistics / Shipping 5.4 Network Management & Orchestration 6.4 Advanced Exchange 7.4 Data Visualization 1.5 Global / Regional Footprint 2.5 Device / Module Selection, Validation & Certification 3.5 Sales & Distribution Setup 4.5 Global Import / Export Management 5.5 MDM Platform Management 6.5 OEM Warranty Management 7.5 AIoT-Descriptive, Prescriptive, Predictive 1.6 Organizational Governance 2.6 Develop, Test, Prototype & Pilot 3.6 Device Management, Diagnostics & Troubleshooting 4.6 Quality Management (ISO 13485, 9001) 5.6 Regulatory Compliance 6.6 Migration Services 7.6 Security & Deep Network Monitoring using Metadata 1.7 Business Continuity / Disaster Recovery 2.7 Deployment Process Design 3.7 Deployment Setup & Optimization 4.7 Site Services 5.7 Change Management 6.7 End of Life Management 7.7 Application Integration & Device Feedback 1 4 5 6 7 IoT Strategy & End-to-end Security Technology Evaluation, Selection, Dev Deployment (forward logistics) Operations Management & Support Sustainment (reverse logistics) Analytics & AIoT32 Connectivity, Device, Data Management

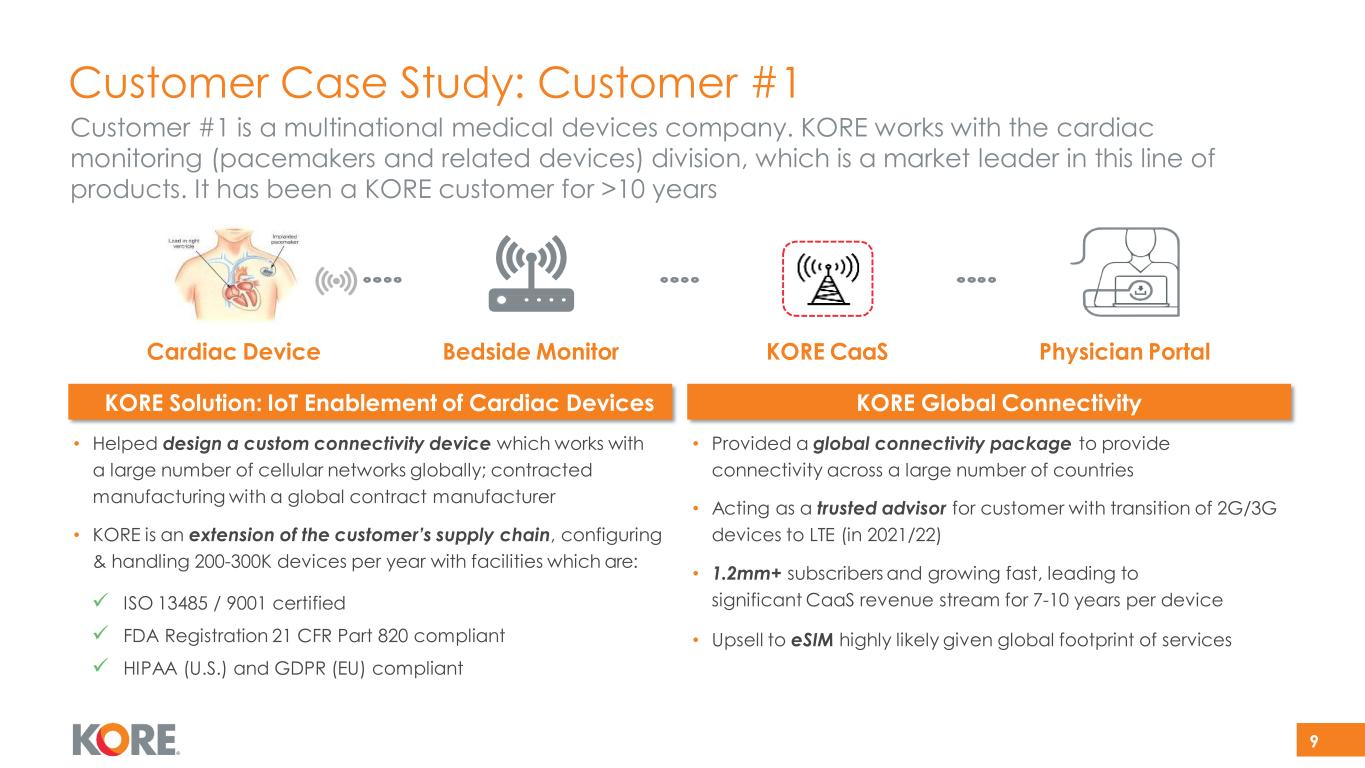

9 Customer #1 is a multinational medical devices company. KORE works with the cardiac monitoring (pacemakers and related devices) division, which is a market leader in this line of products. It has been a KORE customer for >10 years • Provided a global connectivity package to provide connectivity across a large number of countries • Acting as a trusted advisor for customer with transition of 2G/3G devices to LTE (in 2021/22) • 1.2mm+ subscribers and growing fast, leading to significant CaaS revenue stream for 7-10 years per device • Upsell to eSIM highly likely given global footprint of services • Helped design a custom connectivity device which works with a large number of cellular networks globally; contracted manufacturing with a global contract manufacturer • KORE is an extension of the customer’s supply chain, configuring & handling 200-300K devices per year with facilities which are: ✓ ISO 13485 / 9001 certified ✓ FDA Registration 21 CFR Part 820 compliant ✓ HIPAA (U.S.) and GDPR (EU) compliant KORE CaaS Physician PortalCardiac Device Bedside Monitor KORE Global ConnectivityKORE Solution: IoT Enablement of Cardiac Devices Customer Case Study: Customer #1

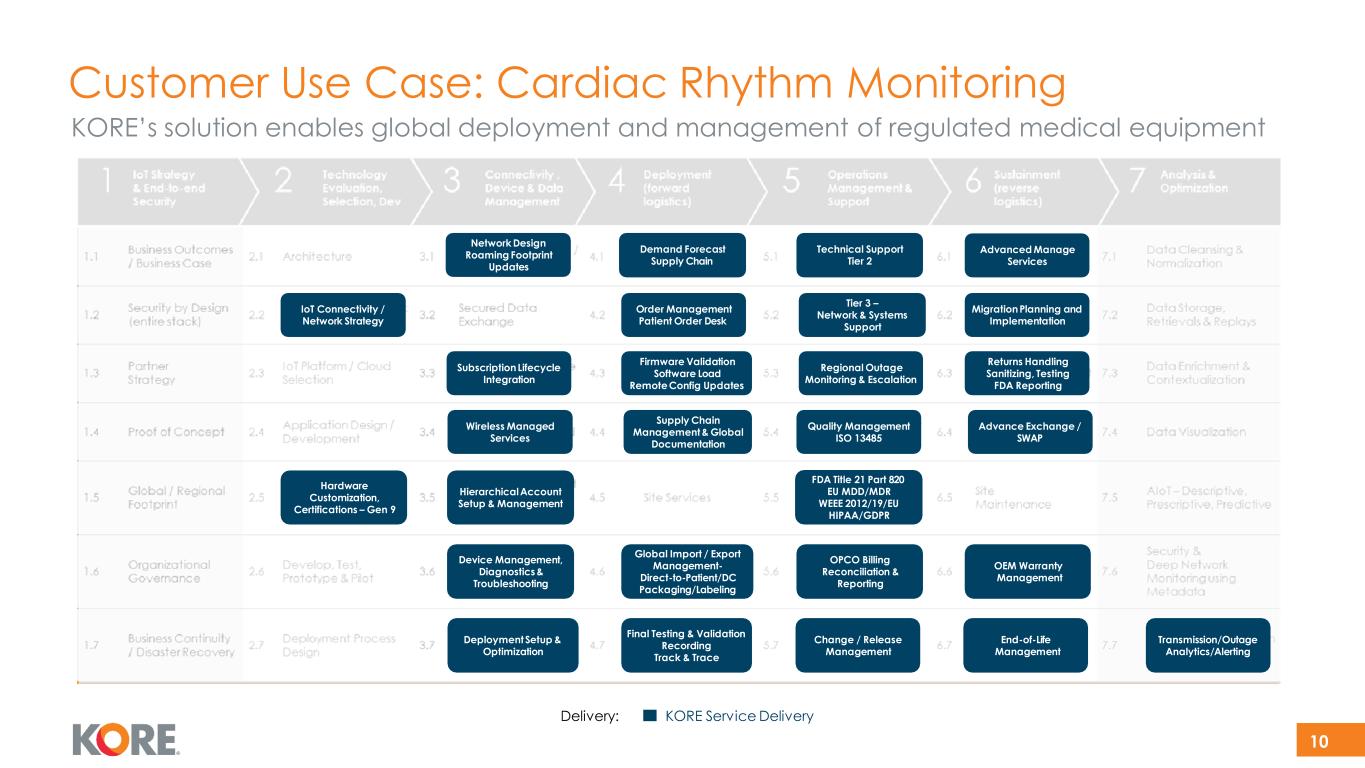

10 Customer Use Case: Cardiac Rhythm Monitoring KORE Service DeliveryDelivery: Hardware Customization, Certifications – Gen 9 Demand Forecast Supply Chain DeploymentSetup & Optimization SubscriptionLifecycle Integration Network Design Roaming Footprint Updates Wireless Managed Services OPCO Billing Reconciliation & Reporting Transmission/Outage Analytics/Alerting Firmware Validation Software Load RemoteConfig Updates Advanced Manage Services FDA Title 21 Part 820 EU MDD/MDR WEEE 2012/19/EU HIPAA/GDPR Quality Management ISO 13485 Returns Handling Sanitizing, Testing FDA Reporting Final Testing & Validation Recording Track & Trace Global Import / Export Management- Direct-to-Patient/DC Packaging/Labeling HierarchicalAccount Setup & Management Device Management, Diagnostics & Troubleshooting Order Management Patient Order Desk Supply Chain Management & Global Documentation Technical Support Tier 2 Tier 3 – Network & Systems Support Regional Outage Monitoring & Escalation Change / Release Management Advance Exchange / SWAP MigrationPlanning and Implementation OEM Warranty Management End-of-Life Management IoT Connectivity / Network Strategy KORE’s solution enables global deployment and management of regulated medical equipment

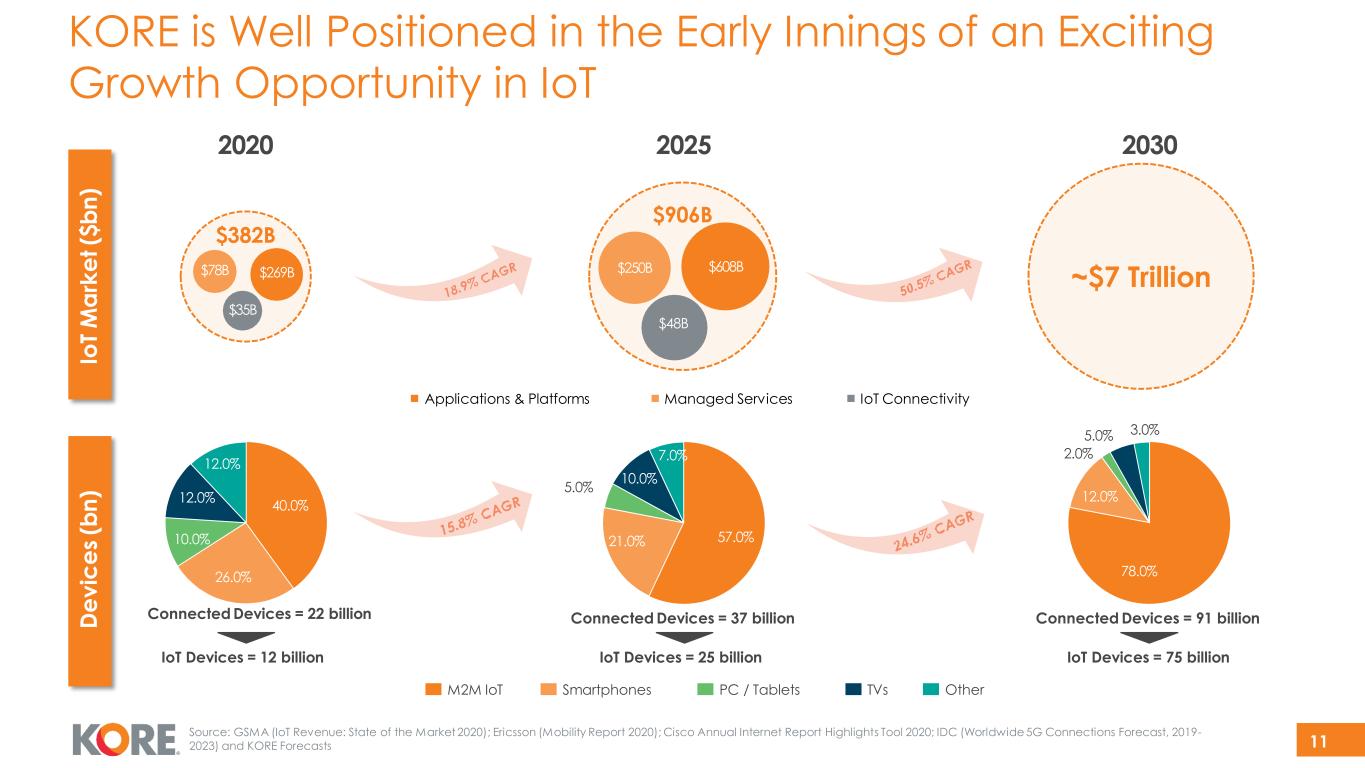

11 Io T M a rk e t ($ b n ) D e v ic e s (b n ) Applications & Platforms Managed Services IoT Connectivity $906B ~$7 Trillion $382B $78B $35B $269B $250B $608B $48B IoT Devices = 12 billion Connected Devices = 37 billion IoT Devices = 75 billion Connected Devices = 91 billion 40.0% Connected Devices = 22 billion 10.0% 12.0% 12.0% M2M IoT Smartphones PC / Tablets TVs Other 57.0%21.0% 10.0% 5.0% 7.0% 78.0% 12.0% 2.0% 5.0% 3.0% Source: GSMA (IoT Revenue: State of the Market 2020); Ericsson (Mobility Report 2020); Cisco Annual Internet Report Highlights Tool 2020; IDC (Worldwide 5G Connections Forecast, 2019- 2023) and KORE Forecasts 2020 2025 2030 KORE is Well Positioned in the Early Innings of an Exciting Growth Opportunity in IoT IoT Devices = 25 billion 26.0%

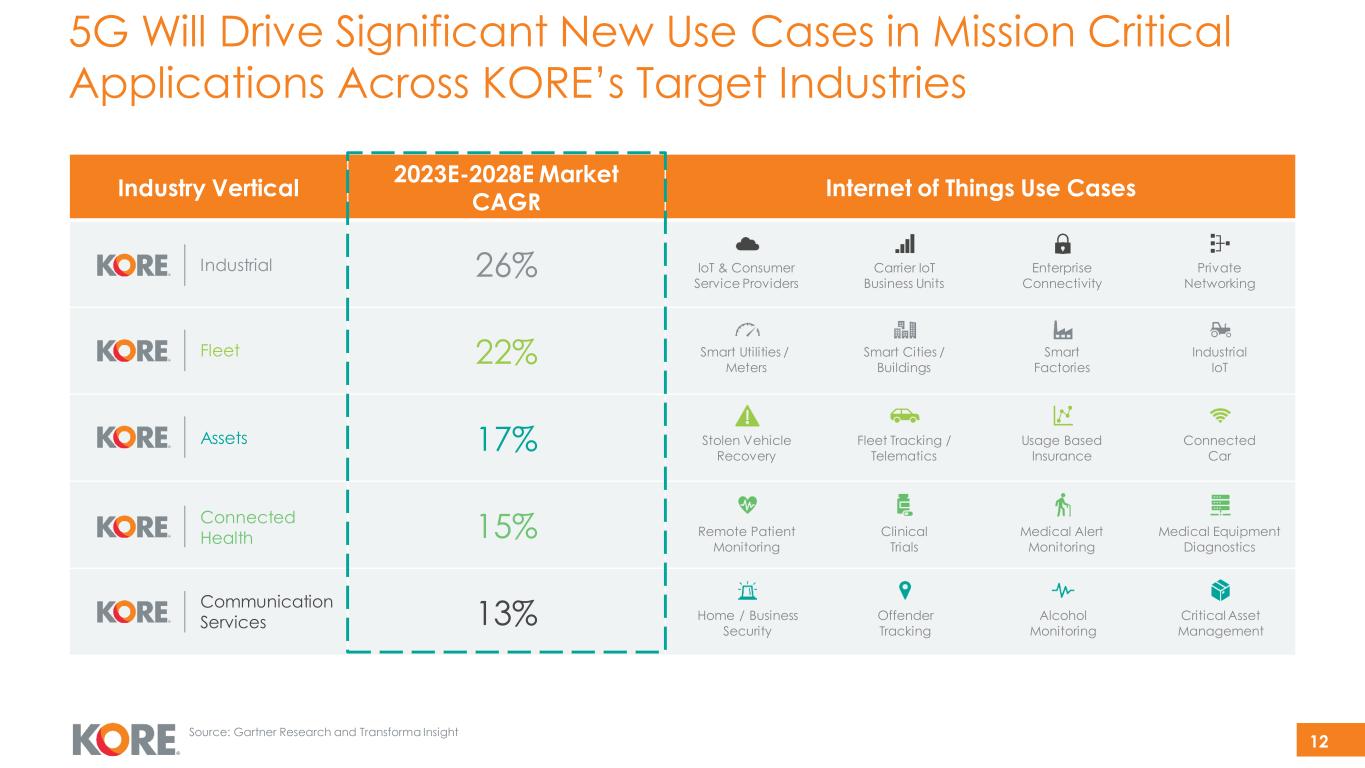

12 Industry Vertical 2023E-2028E Market CAGR Internet of Things Use Cases 26% 22% 17% 15% 13% Source: Gartner Research and Transforma Insight 5G Will Drive Significant New Use Cases in Mission Critical Applications Across KORE’s Target Industries IoT & Consumer Service Providers Carrier IoT Business Units Enterprise Connectivity Private Networking Communication Services Smart Utilities / Meters Smart Cities / Buildings Smart Factories Industrial IoT Industrial Remote Patient Monitoring Clinical Trials Medical Alert Monitoring Medical Equipment Diagnostics Connected Health Stolen Vehicle Recovery Fleet Tracking / Telematics Usage Based Insurance Connected Car Fleet Home / Business Security Offender Tracking Alcohol Monitoring Critical Asset Management Assets

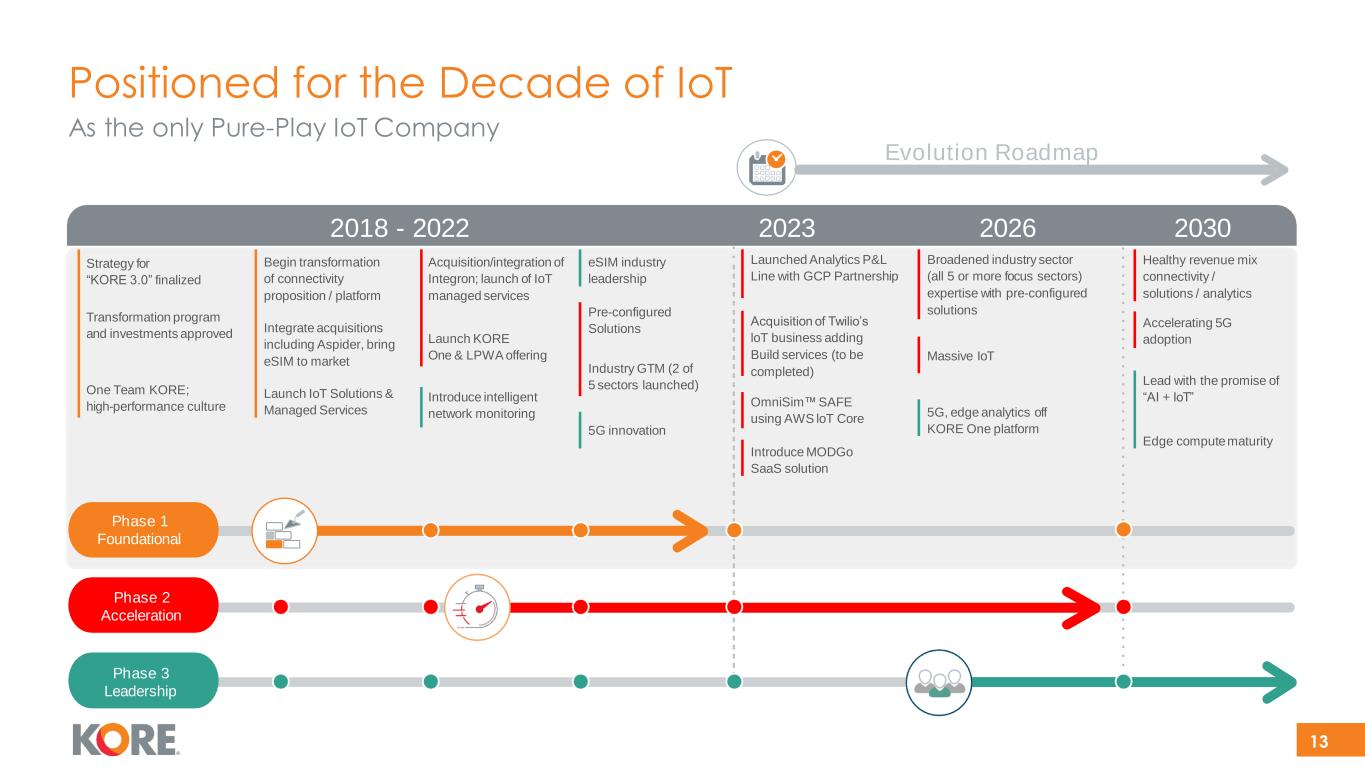

13 Broadened industry sector (all 5 or more focus sectors) expertise with pre-configured solutions Massive IoT 5G, edge analytics off KORE One platform Healthy revenue mix connectivity / solutions / analytics Accelerating 5G adoption Lead with the promise of “AI + IoT” Edge computematurity 2023 20302018 - 2022 Strategy for “KORE 3.0” finalized Transformation program and investments approved One Team KORE; high-performance culture Begin transformation of connectivity proposition / platform Integrate acquisitions including Aspider, bring eSIM to market Launch IoT Solutions & Managed Services Acquisition/integration of Integron; launch of IoT managed services Launch KORE One & LPWA offering Introduce intelligent network monitoring eSIM industry leadership Pre-configured Solutions Industry GTM (2 of 5 sectors launched) 5G innovation Phase 1 Foundational Evolution Roadmap 2026 As the only Pure-Play IoT Company Launched Analytics P&L Line with GCP Partnership Acquisition of Twilio’s loT business adding Build services (to be completed) OmniSim™SAFE using AWS loT Core Introduce MODGo SaaS solution Positioned for the Decade of IoT Phase 2 Acceleration Phase 3 Leadership

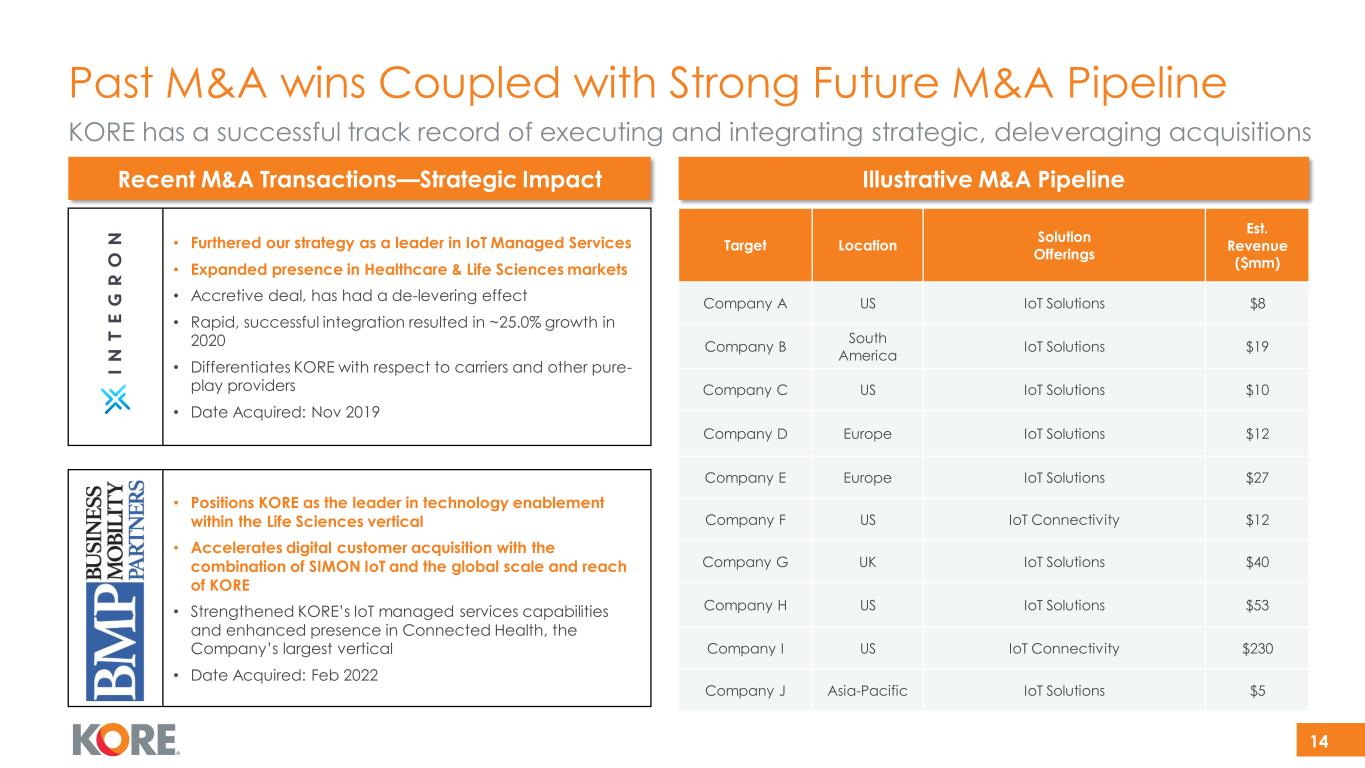

14 Illustrative M&A PipelineRecent M&A Transactions—Strategic Impact KORE has a successful track record of executing and integrating strategic, deleveraging acquisitions Target Location Solution Offerings Est. Revenue ($mm) Company A US IoT Solutions $8 Company B South America IoT Solutions $19 Company C US IoT Solutions $10 Company D Europe IoT Solutions $12 Company E Europe IoT Solutions $27 Company F US IoT Connectivity $12 Company G UK IoT Solutions $40 Company H US IoT Solutions $53 Company I US IoT Connectivity $230 Company J Asia-Pacific IoT Solutions $5 • Furthered our strategy as a leader in IoT Managed Services • Expanded presence in Healthcare & Life Sciences markets • Accretive deal, has had a de-levering effect • Rapid, successful integration resulted in ~25.0% growth in 2020 • Differentiates KORE with respect to carriers and other pure- play providers • Date Acquired: Nov 2019 • Positions KORE as the leader in technology enablement within the Life Sciences vertical • Accelerates digital customer acquisition with the combination of SIMON IoT and the global scale and reach of KORE • Strengthened KORE’s IoT managed services capabilities and enhanced presence in Connected Health, the Company’s largest vertical • Date Acquired: Feb 2022 Past M&A wins Coupled with Strong Future M&A Pipeline

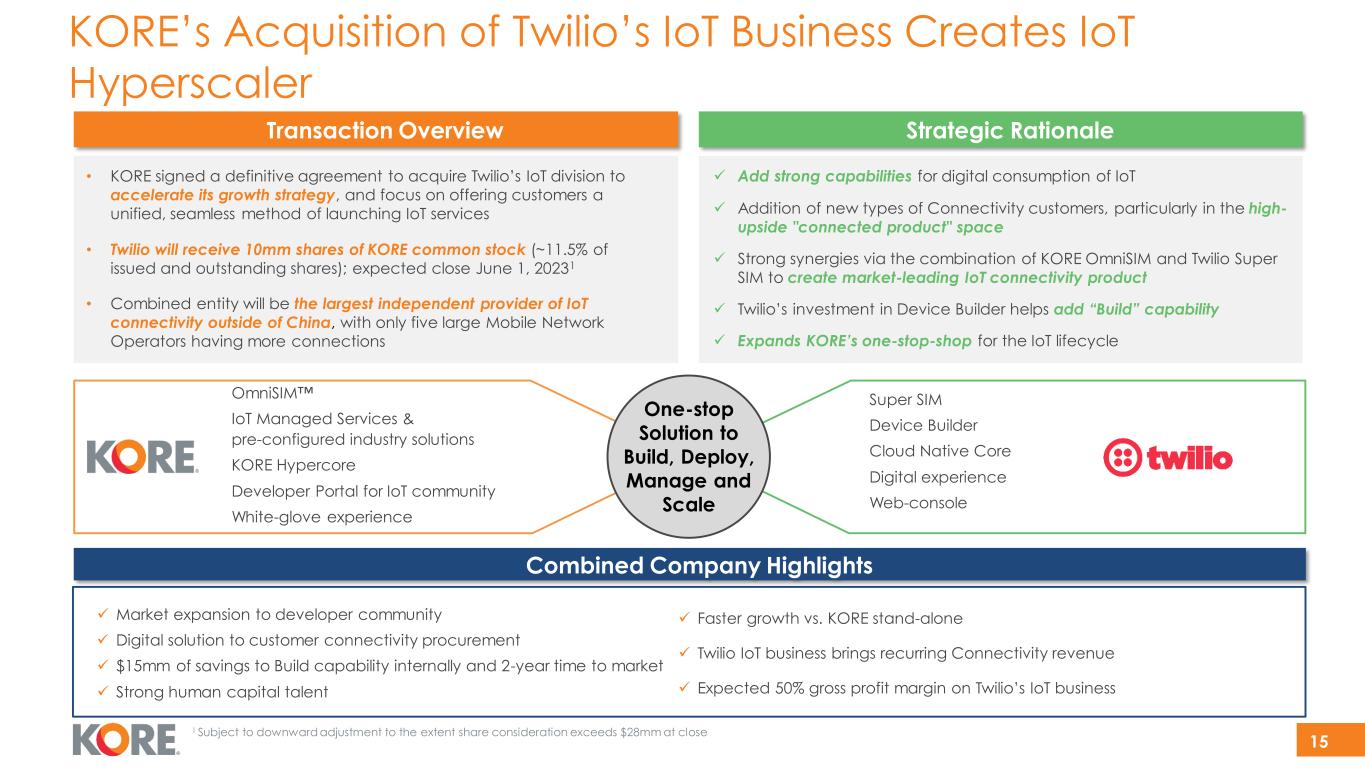

15 • KORE signed a definitive agreement to acquire Twilio’s IoT division to accelerate its growth strategy, and focus on offering customers a unified, seamless method of launching IoT services • Twilio will receive 10mm shares of KORE common stock (~11.5% of issued and outstanding shares); expected close June 1, 20231 • Combined entity will be the largest independent provider of IoT connectivity outside of China, with only five large Mobile Network Operators having more connections ✓ Add strong capabilities for digital consumption of IoT ✓ Addition of new types of Connectivity customers, particularly in the high- upside "connected product" space ✓ Strong synergies via the combination of KORE OmniSIM and Twilio Super SIM to create market-leading IoT connectivity product ✓ Twilio’s investment in Device Builder helps add “Build” capability ✓ Expands KORE’s one-stop-shop for the IoT lifecycle Transaction Overview Strategic Rationale OmniSIM™ IoT Managed Services & pre-configured industry solutions KORE Hypercore Developer Portal for IoT community White-glove experience One-stop Solution to Build, Deploy, Manage and Scale KORE’s Acquisition of Twilio’s IoT Business Creates IoT Hyperscaler 15 Super SIM Device Builder Cloud Native Core Digital experience Web-console ✓ Market expansion to developer community ✓ Digital solution to customer connectivity procurement ✓ $15mm of savings to Build capability internally and 2-year time to market ✓ Strong human capital talent ✓ Faster growth vs. KORE stand-alone ✓ Twilio IoT business brings recurring Connectivity revenue ✓ Expected 50% gross profit margin on Twilio’s IoT business Combined Company Highlights 1 Subject to downward adjustment to the extent share consideration exceeds $28mm at close

16 One-time headwinds created by 2G and 3G sunsets are largely in rear-view mirror, positioning KORE to showcase industry leading organic growth, approaching 20% by 2025 ✓ ✓ Transformed from being an IoT connectivity provider to a Company that offers a broad array of technology-driven services to deliver end-to-end IoT solutions: Connectivity, Solutions, and Analytics KORE’s strengthened financial profile and product suite will enable the Company to capitalize on the approaching ‘Decade of IoT’ with 75-80 billion devices connected by 2030 ✓ Delivering a variety of mission-critical IoT solutions, including some that enable customers to improve their sustainability footprint and ESG profile (“IoT for Good”) ✓ Senior Management has Positioned KORE for Long-Term Success in the Exciting Growth Market of IoT Attacking multiple organic growth vectors and track record of executing accretive M&A, highlighted by BMP & Simon acquisition (early 2022) and the Integron acquisition (late 2019) ✓ High quality new business sales pipeline is the largest it has been in Company’s history and represents opportunity to grow new business TCV for 5th year in a row ✓ Massive upsell and cross-sell opportunities that are underpinned by eSIM product which is helping take wallet share at existing connectivity customers, with a quick ramp to revenue ✓

Key Company Highlights

18 Key Company Highlights Large and growing market with increasing demand for IoT connectivity and solutions over the next decade 1 Leading independent IoT solution provider backed by extensive IP that creates high barriers to entry2 IoT solutions that improve customers’ ESG profile5 Strong leadership team with a proven track record7 High quality sales pipeline supported by attainable growth initiatives 6 Well-diversified revenue across blue-chip customer base with truly global coverage4 Strong recurring revenue, gross profit, and earnings profile that is resilient to macroeconomic cycles3

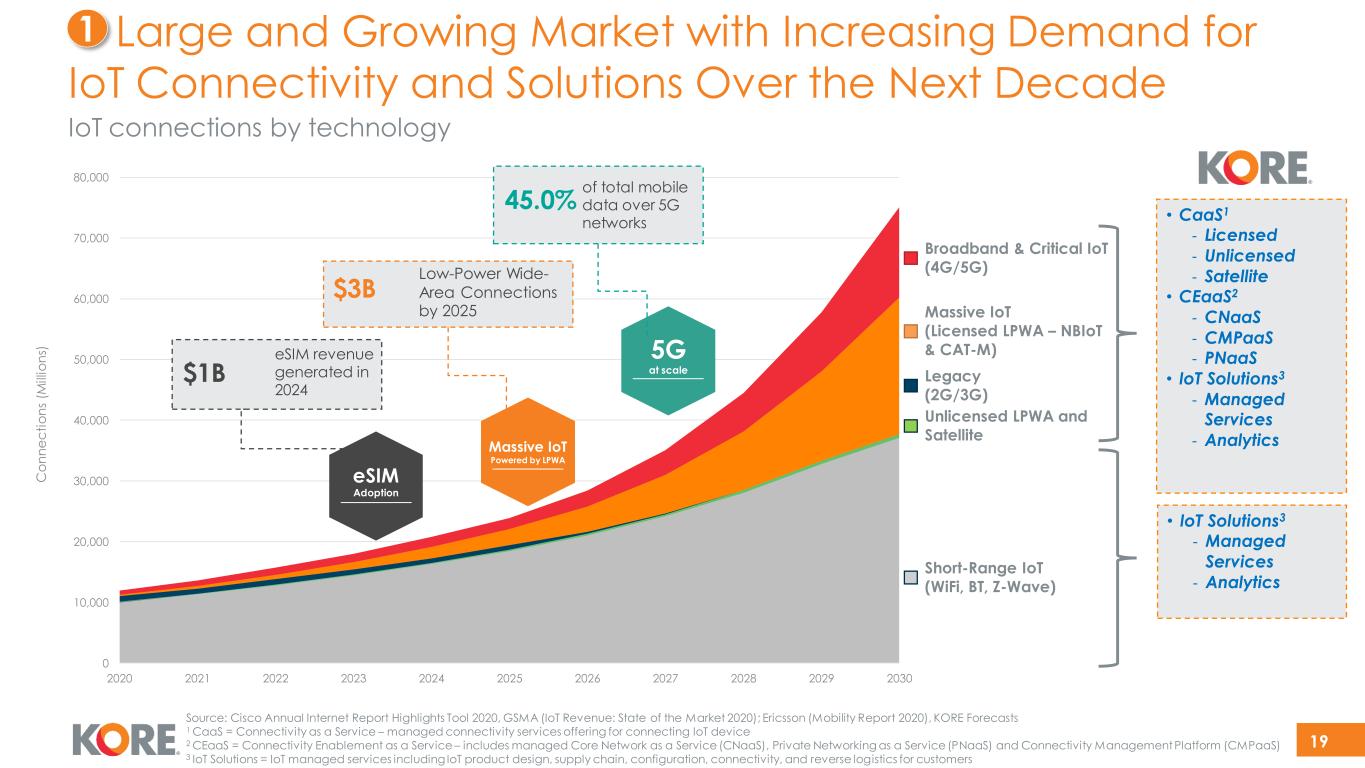

19 • CaaS1 ‐ Licensed ‐ Unlicensed ‐ Satellite • CEaaS2 ‐ CNaaS ‐ CMPaaS ‐ PNaaS • IoT Solutions3 ‐ Managed Services ‐ Analytics 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 C o n n e c ti o n s (M ill io n s) Massive IoT Powered by LPWA $3B Low-Power Wide- Area Connections by 2025 5G at scale of total mobile data over 5G networks 45.0% eSIM Adoption eSIM revenue generated in 2024 $1B Broadband & Critical IoT (4G/5G) Massive IoT (Licensed LPWA – NBIoT & CAT-M) Legacy (2G/3G) Unlicensed LPWA and Satellite Short-Range IoT (WiFi, BT, Z-Wave) • IoT Solutions3 ‐ Managed Services ‐ Analytics Source: Cisco Annual Internet Report Highlights Tool 2020, GSMA (IoT Revenue: State of the Market 2020); Ericsson (Mobility Report 2020), KORE Forecasts 1 CaaS = Connectivity as a Service – managed connectivity services offering for connecting IoT device 2 CEaaS = Connectivity Enablement as a Service – includes managed Core Network as a Service (CNaaS), Private Networking as a Service (PNaaS) and Connectivity Management Platform (CMPaaS) 3 IoT Solutions = IoT managed services including IoT product design, supply chain, configuration, connectivity, and reverse logistics for customers 1 IoT connections by technology Large and Growing Market with Increasing Demand for IoT Connectivity and Solutions Over the Next Decade

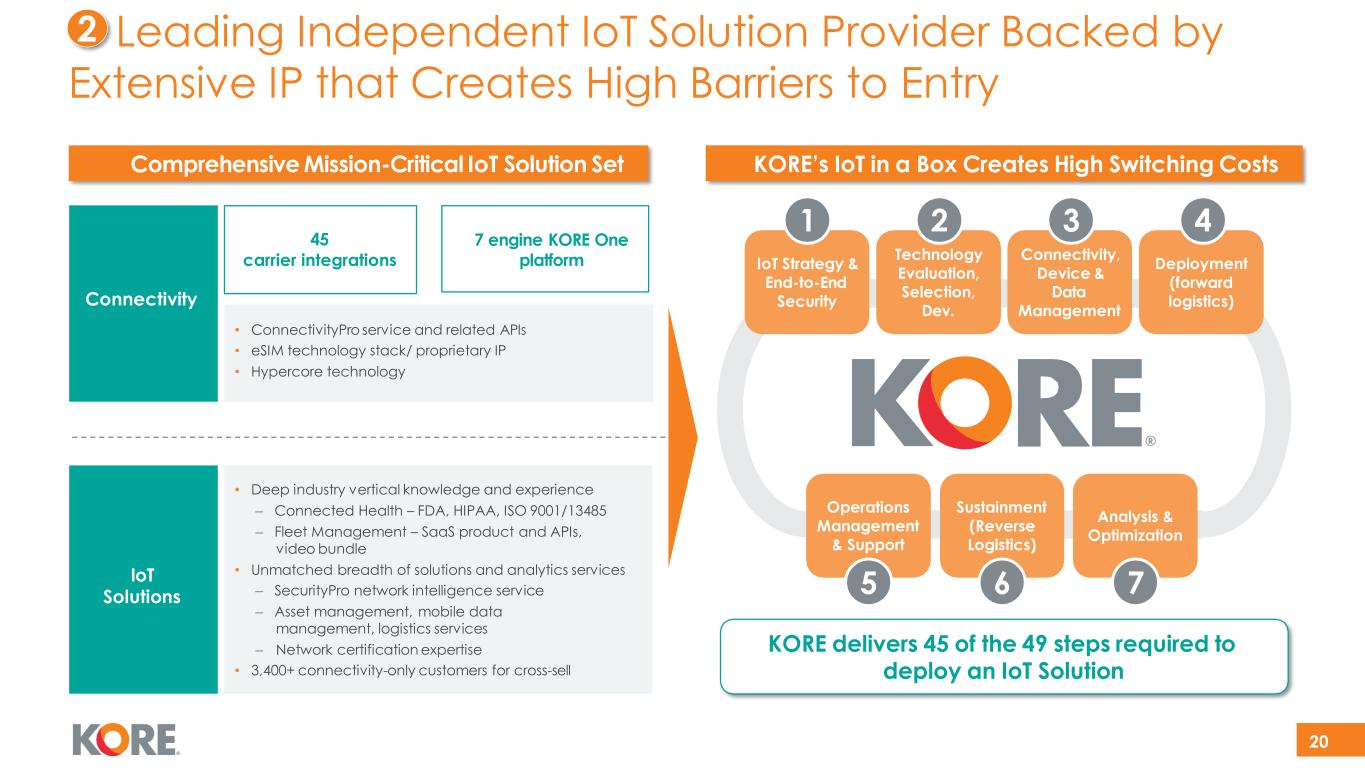

20 • ConnectivityPro service and related APIs • eSIM technology stack/ proprietary IP • Hypercore technology Connectivity IoT Solutions • Deep industry vertical knowledge and experience ‒ Connected Health – FDA, HIPAA, ISO 9001/13485 ‒ Fleet Management – SaaS product and APIs, video bundle • Unmatched breadth of solutions and analytics services ‒ SecurityPro network intelligence service ‒ Asset management, mobile data management, logistics services ‒ Network certification expertise • 3,400+ connectivity-only customers for cross-sell Comprehensive Mission-Critical IoT Solution Set KORE’s IoT in a Box Creates High Switching Costs End-to-End Security Selection, Dev. Data Management (forward logistics) Operations Management & Support Sustainment (Reverse Logistics) Analysis & Optimization 1 IoT Strategy & 2 Technology Evaluation, 3 Connectivity, Device & 4 Deployment 5 6 7 KORE delivers 45 of the 49 steps required to deploy an IoT Solution 45 carrier integrations 7 engine KORE One platform Leading Independent IoT Solution Provider Backed by Extensive IP that Creates High Barriers to Entry 2

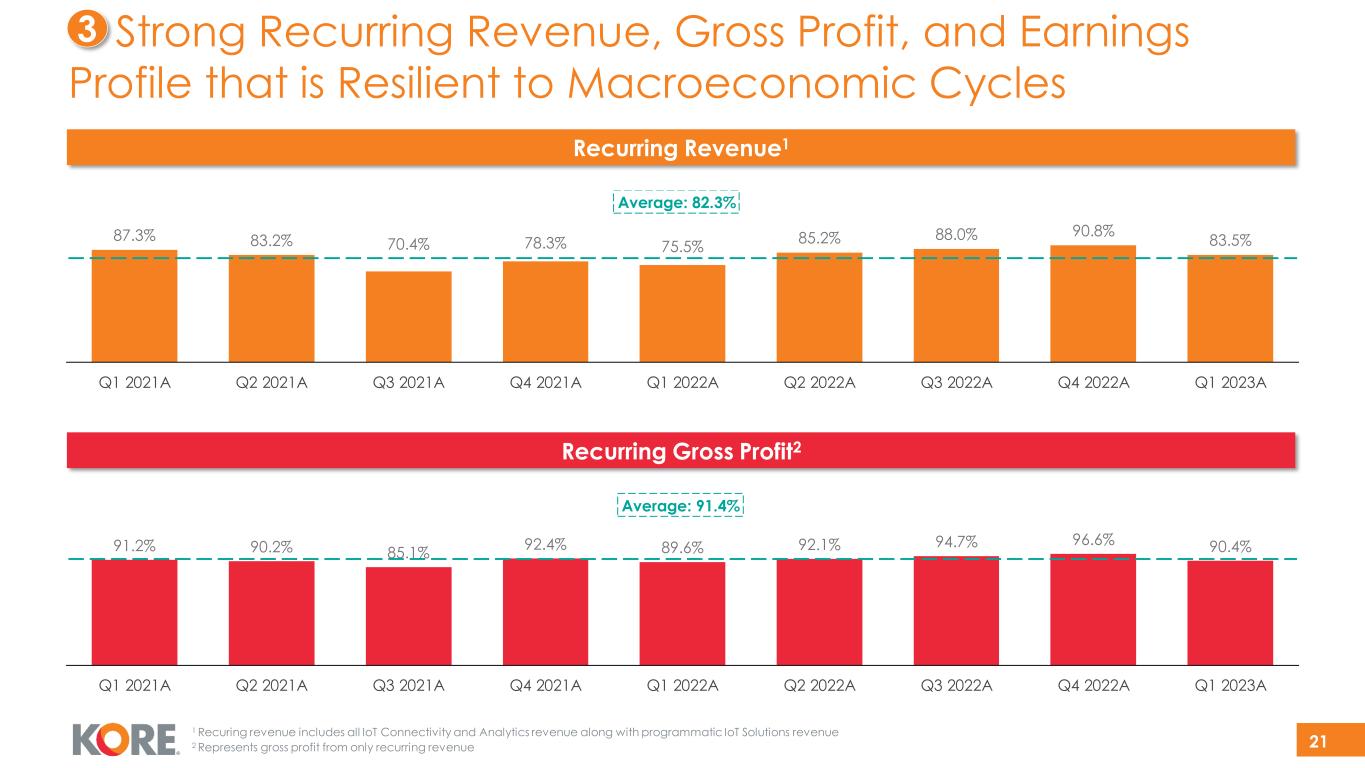

21 91.2% 90.2% 85.1% 92.4% 89.6% 92.1% 94.7% 96.6% 90.4% Average: 91.4% Q1 2021A Q2 2021A Q3 2021A Q4 2021A Q1 2022A Q2 2022A Q3 2022A Q4 2022A Q1 2023A 87.3% 83.2% 70.4% 78.3% 75.5% 85.2% 88.0% 90.8% 83.5% Average: 82.3% Q1 2021A Q2 2021A Q3 2021A Q4 2021A Q1 2022A Q2 2022A Q3 2022A Q4 2022A Q1 2023A Recurring Gross Profit2 Strong Recurring Revenue, Gross Profit, and Earnings Profile that is Resilient to Macroeconomic Cycles 3 Recurring Revenue1 1 Recuring revenue includes all IoT Connectivity and Analytics revenue along with programmatic IoT Solutions revenue 2 Represents gross profit from only recurring revenue

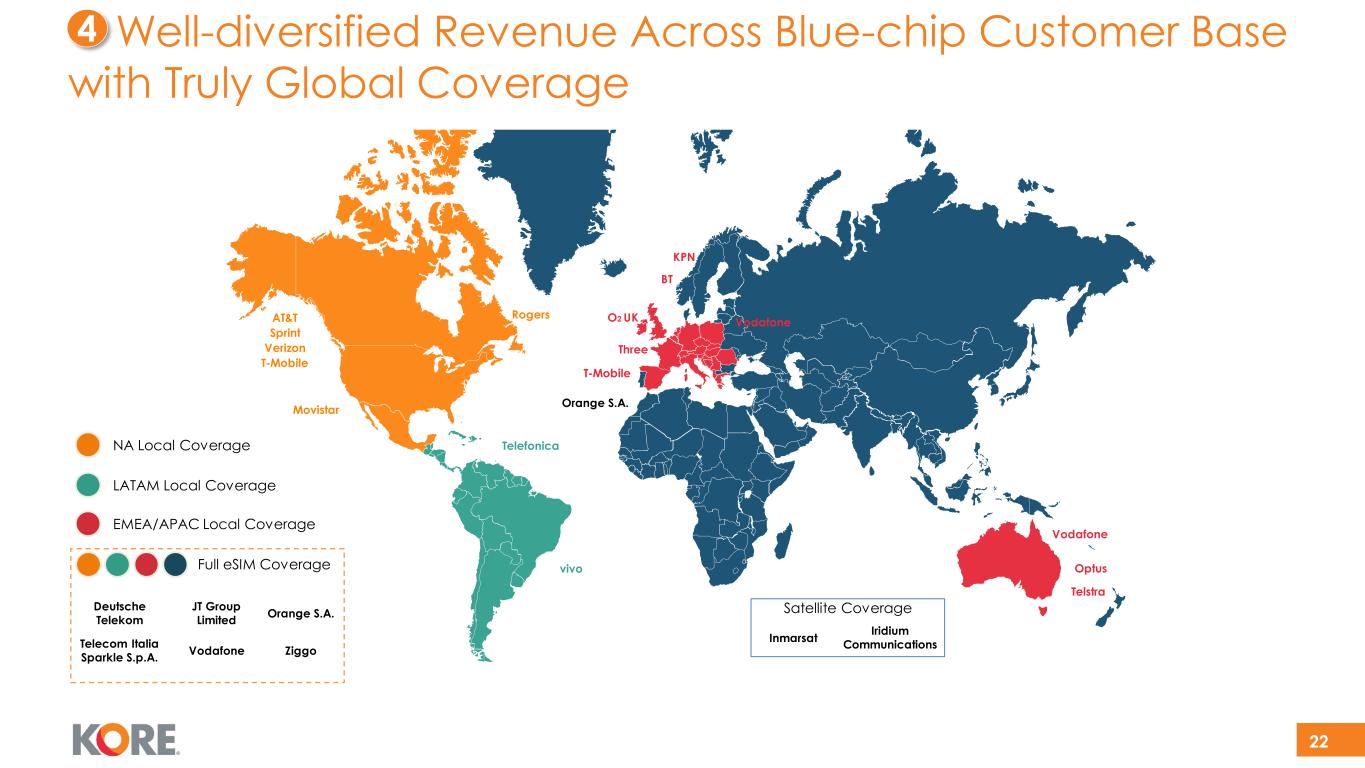

22 Full eSIM Coverage NA Local Coverage LATAM Local Coverage EMEA/APAC Local Coverage Satellite Coverage Well-diversified Revenue Across Blue-chip Customer Base with Truly Global Coverage 4 AT&T Sprint Verizon T-Mobile Movistar Telefonica Rogers vivo O2 UK Three Orange S.A. T-Mobile BT Optus Vodafone KPN Telstra Inmarsat Iridium Communications Vodafone Ziggo Deutsche Telekom Orange S.A. JT Group Limited Telecom Italia Sparkle S.p.A. Vodafone

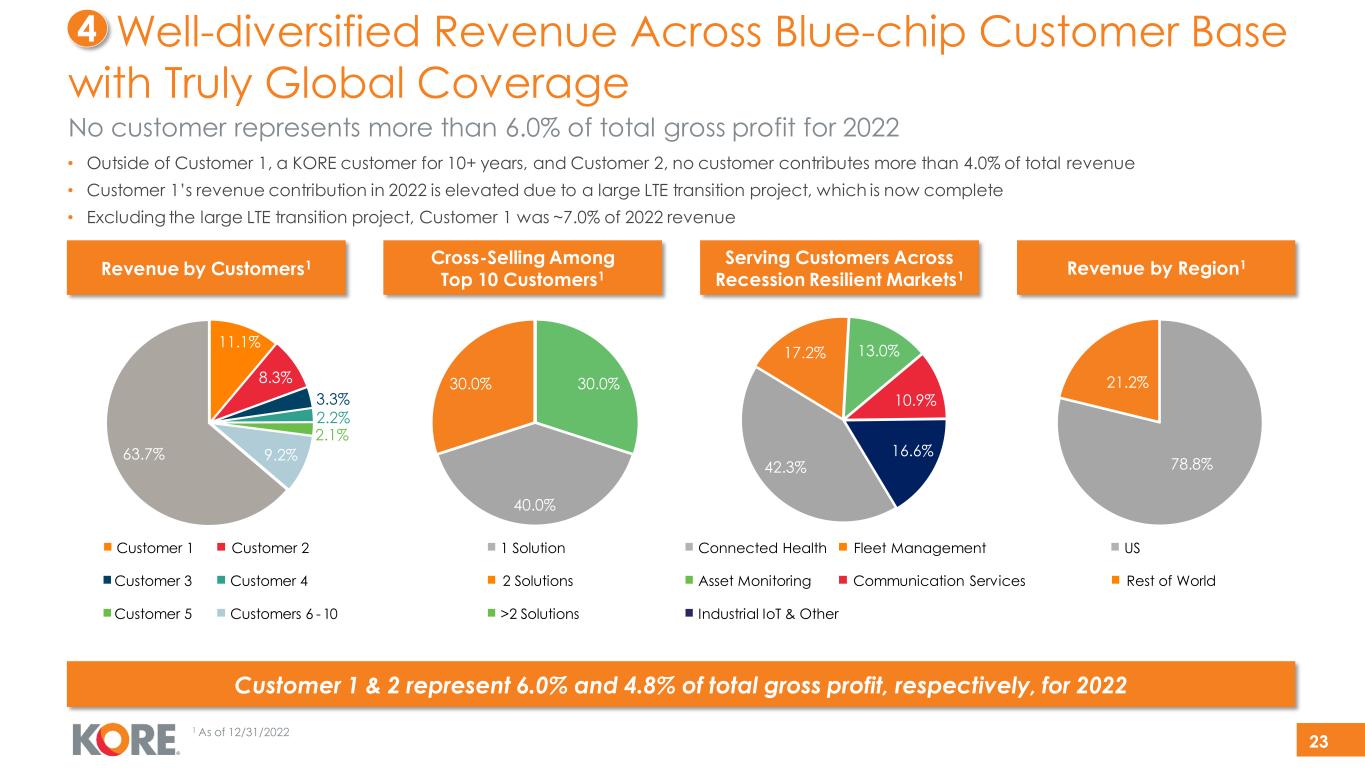

23 • Outside of Customer 1, a KORE customer for 10+ years, and Customer 2, no customer contributes more than 4.0% of total revenue • Customer 1’s revenue contribution in 2022 is elevated due to a large LTE transition project, which is now complete • Excluding the large LTE transition project, Customer 1 was ~7.0% of 2022 revenue Revenue by Customers1 Customer 1 Customer 2 Customer 3 Customer 4 Customer 5 Customers 6 - 10 10.6% Well-diversified Revenue Across Blue-chip Customer Base with Truly Global Coverage 4 Cross-Selling Among Top 10 Customers1 40.0% 30.0% 30.0% 1 Solution 2 Solutions >2 Solutions 11.1% 8.3% 3.3% 2.2% 2.1% 9.2%63.7% Revenue by Region1 78.8% 21.2% US Rest of World 1 As of 12/31/2022 Serving Customers Across Recession Resilient Markets1 42.3% 17.2% 13.0% 10.9% 16.6% Industrial IoT & Other Connected Health Fleet Management Asset Monitoring Communication Services No customer represents more than 6.0% of total gross profit for 2022 Customer 1 & 2 represent 6.0% and 4.8% of total gross profit, respectively, for 2022

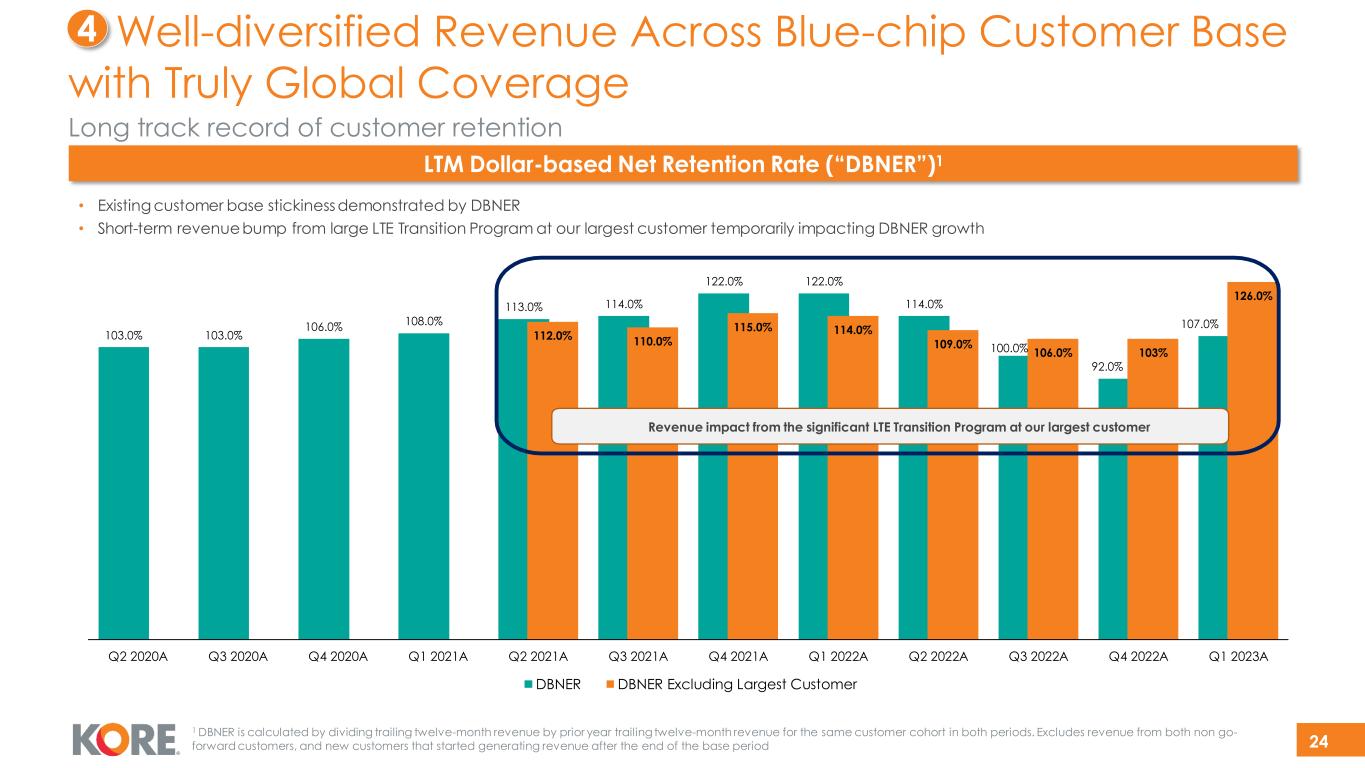

24 103.0% 103.0% 106.0% 108.0% 113.0% 114.0% 122.0% 122.0% 114.0% 100.0% 92.0% 107.0% 112.0% 110.0% 115.0% 114.0% 109.0% 106.0% 103% 126.0% Q2 2020A Q3 2020A Q4 2020A Q1 2021A Q2 2021A Q3 2021A Q4 2021A Q1 2022A Q2 2022A Q3 2022A Q4 2022A Q1 2023A DBNER DBNER Excluding Largest Customer • Existing customer base stickiness demonstrated by DBNER • Short-term revenue bump from large LTE Transition Program at our largest customer temporarily impacting DBNER growth LTM Dollar-based Net Retention Rate (“DBNER”)1 Revenue impact from the significant LTE Transition Program at our largest customer 4 Well-diversified Revenue Across Blue-chip Customer Base with Truly Global Coverage Long track record of customer retention 1 DBNER is calculated by dividing trailing twelve-month revenue by prior year trailing twelve-month revenue for the same customer cohort in both periods. Excludes revenue from both non go- forward customers, and new customers that started generating revenue after the end of the base period

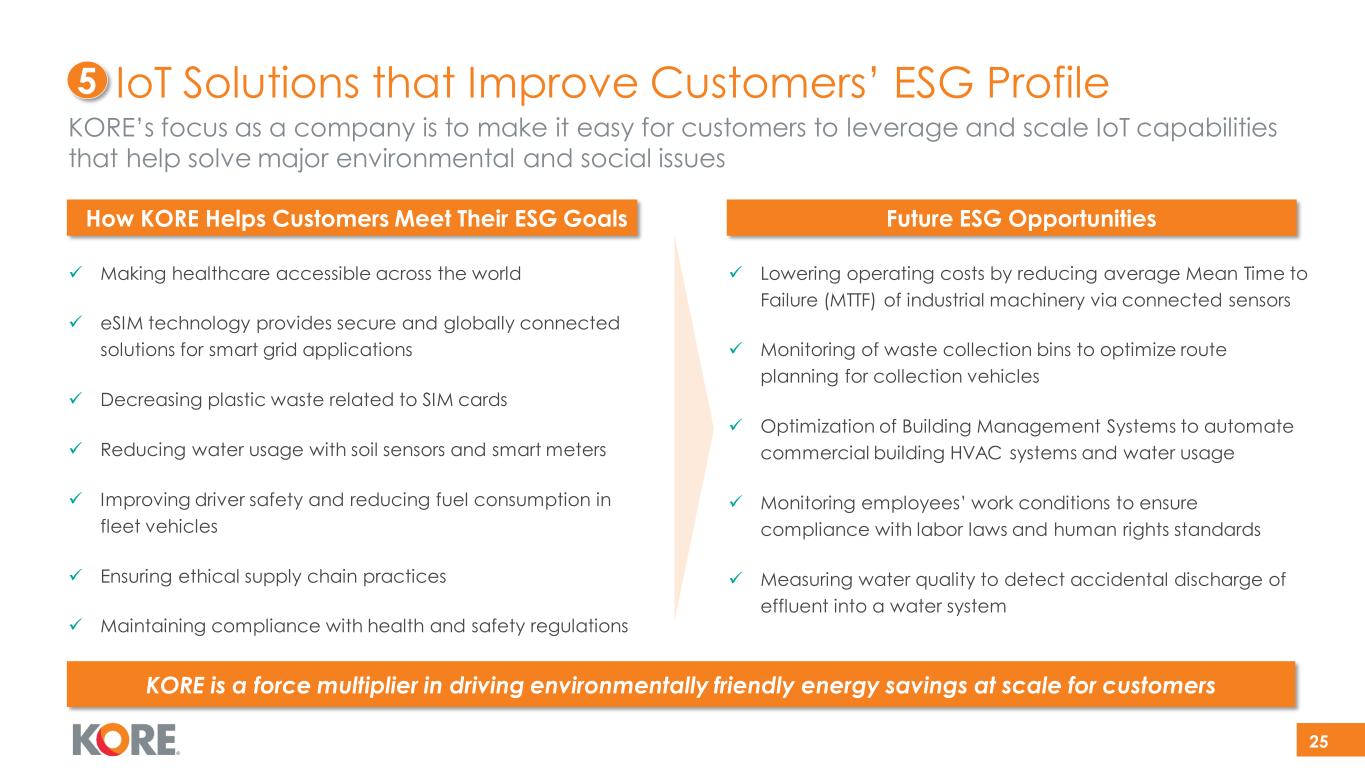

25 KORE’s focus as a company is to make it easy for customers to leverage and scale IoT capabilities that help solve major environmental and social issues ✓ Making healthcare accessible across the world ✓ eSIM technology provides secure and globally connected solutions for smart grid applications ✓ Decreasing plastic waste related to SIM cards ✓ Reducing water usage with soil sensors and smart meters ✓ Improving driver safety and reducing fuel consumption in fleet vehicles ✓ Ensuring ethical supply chain practices ✓ Maintaining compliance with health and safety regulations KORE is a force multiplier in driving environmentally friendly energy savings at scale for customers ✓ Lowering operating costs by reducing average Mean Time to Failure (MTTF) of industrial machinery via connected sensors ✓ Monitoring of waste collection bins to optimize route planning for collection vehicles ✓ Optimization of Building Management Systems to automate commercial building HVAC systems and water usage ✓ Monitoring employees’ work conditions to ensure compliance with labor laws and human rights standards ✓ Measuring water quality to detect accidental discharge of effluent into a water system Future ESG OpportunitiesHow KORE Helps Customers Meet Their ESG Goals IoT Solutions that Improve Customers’ ESG Profile5

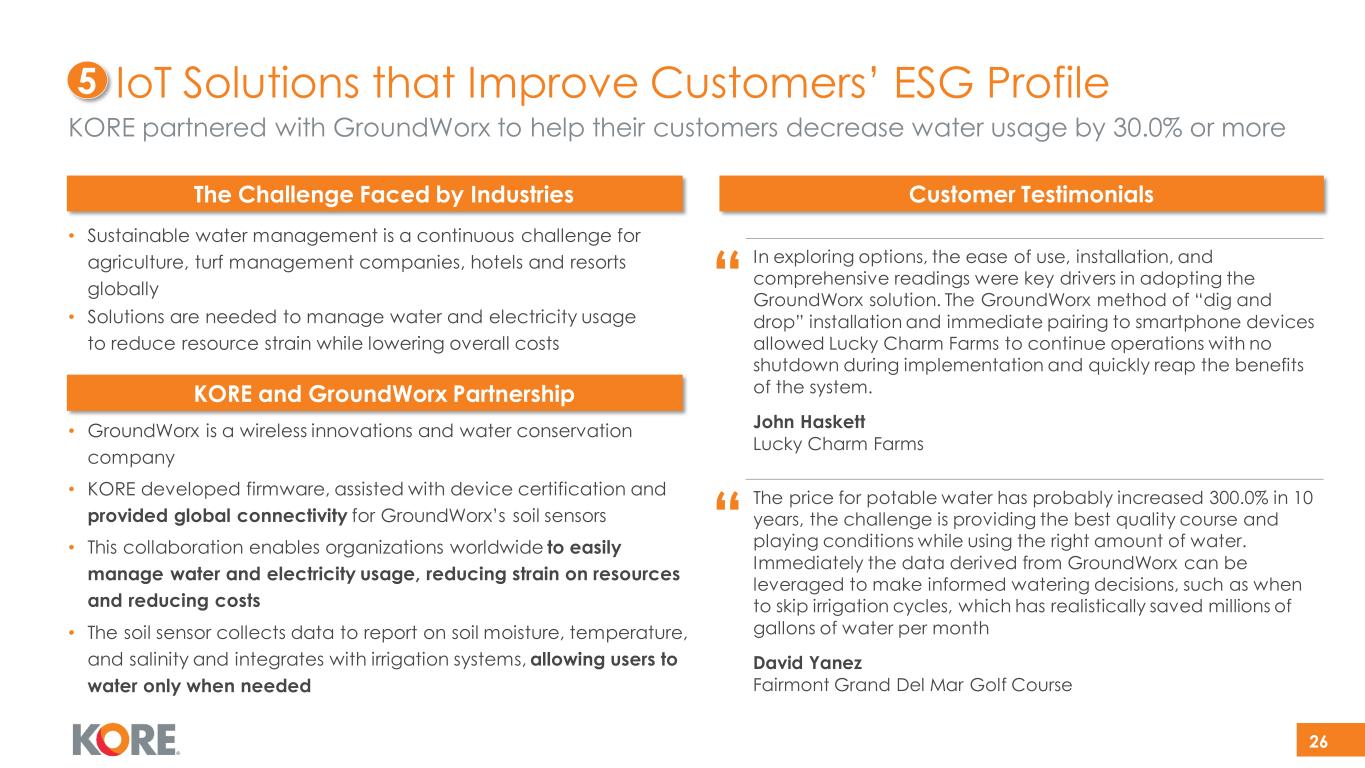

26 • GroundWorx is a wireless innovations and water conservation company • KORE developed firmware, assisted with device certification and provided global connectivity for GroundWorx’s soil sensors • This collaboration enables organizations worldwide to easily manage water and electricity usage, reducing strain on resources and reducing costs • The soil sensor collects data to report on soil moisture, temperature, and salinity and integrates with irrigation systems, allowing users to water only when needed The Challenge Faced by Industries “ In exploring options, the ease of use, installation, and comprehensive readings were key drivers in adopting the GroundWorx solution. The GroundWorx method of “dig and drop” installation and immediate pairing to smartphone devices allowed Lucky Charm Farms to continue operations with no shutdown during implementation and quickly reap the benefits of the system. John Haskett Lucky Charm Farms Customer Testimonials “ The price for potable water has probably increased 300.0% in 10 years, the challenge is providing the best quality course and playing conditions while using the right amount of water. Immediately the data derived from GroundWorx can be leveraged to make informed watering decisions, such as when to skip irrigation cycles, which has realistically saved millions of gallons of water per month David Yanez Fairmont Grand Del Mar Golf Course KORE and GroundWorx Partnership • Sustainable water management is a continuous challenge for agriculture, turf management companies, hotels and resorts globally • Solutions are needed to manage water and electricity usage to reduce resource strain while lowering overall costs KORE partnered with GroundWorx to help their customers decrease water usage by 30.0% or more IoT Solutions that Improve Customers’ ESG Profile5

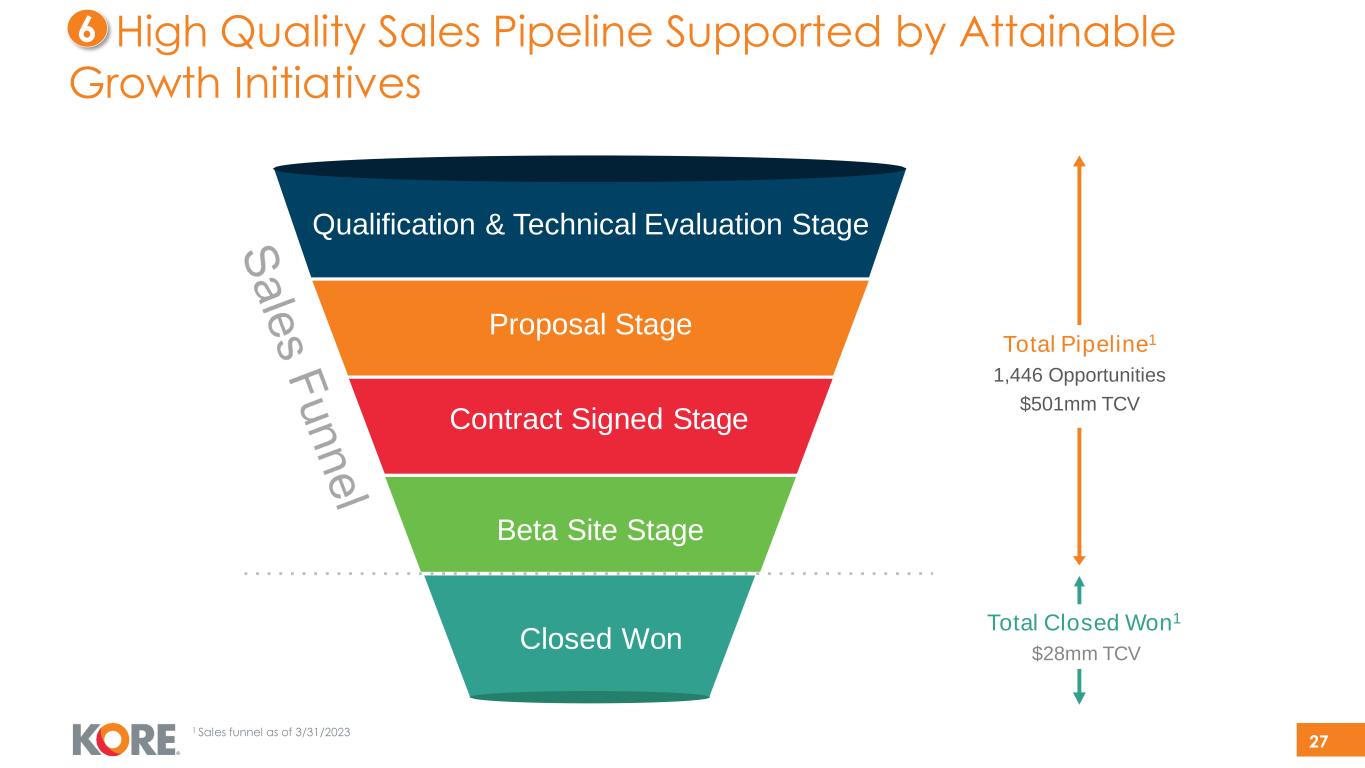

27 High Quality Sales Pipeline Supported by Attainable Growth Initiatives 6 Qualification & Technical Evaluation Stage Contract Signed Stage Beta Site Stage Total Closed Won1 $28mm TCV Closed Won Total Pipeline1 1,446 Opportunities $501mm TCV Proposal Stage 1 Sales funnel as of 3/31/2023

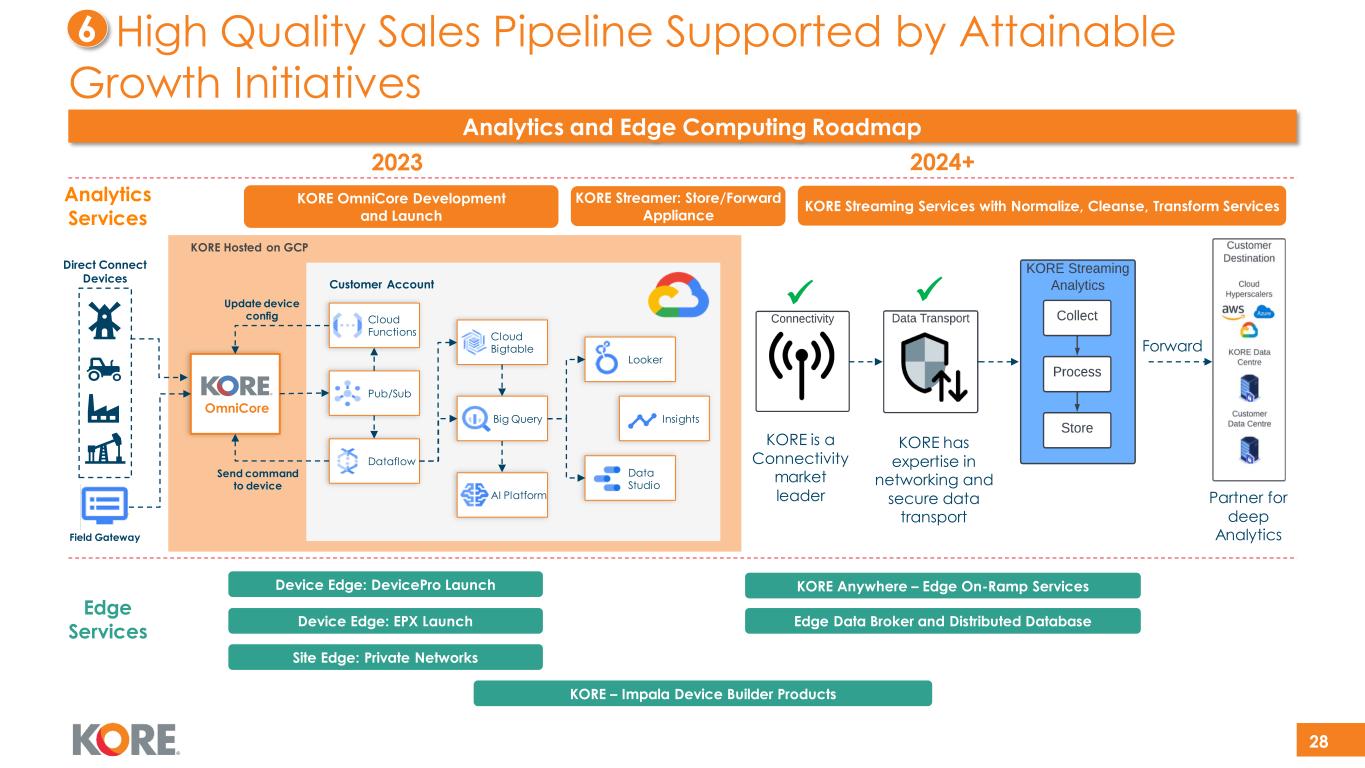

28 High Quality Sales Pipeline Supported by Attainable Growth Initiatives Device Edge: DevicePro Launch Device Edge: EPX Launch Site Edge: Private Networks KORE – Impala Device Builder Products Edge Data Broker and Distributed Database KORE Anywhere – Edge On-Ramp Services 2024+2023 Analytics Services Edge Services KORE OmniCore Development and Launch KORE Streamer: Store/Forward Appliance Direct Connect Devices Field Gateway KORE Hosted on GCP Looker Data Studio Insights Cloud Bigtable AI Platform Pub/Sub Customer Account OmniCore Update device config Send command to device Big Query Dataflow Cloud Functions KORE Streaming Services with Normalize, Cleanse, Transform Services KORE is a Connectivity market leader Partner for deep Analytics Forward ✓ ✓ KORE has expertise in networking and secure data transport Analytics and Edge Computing Roadmap 6

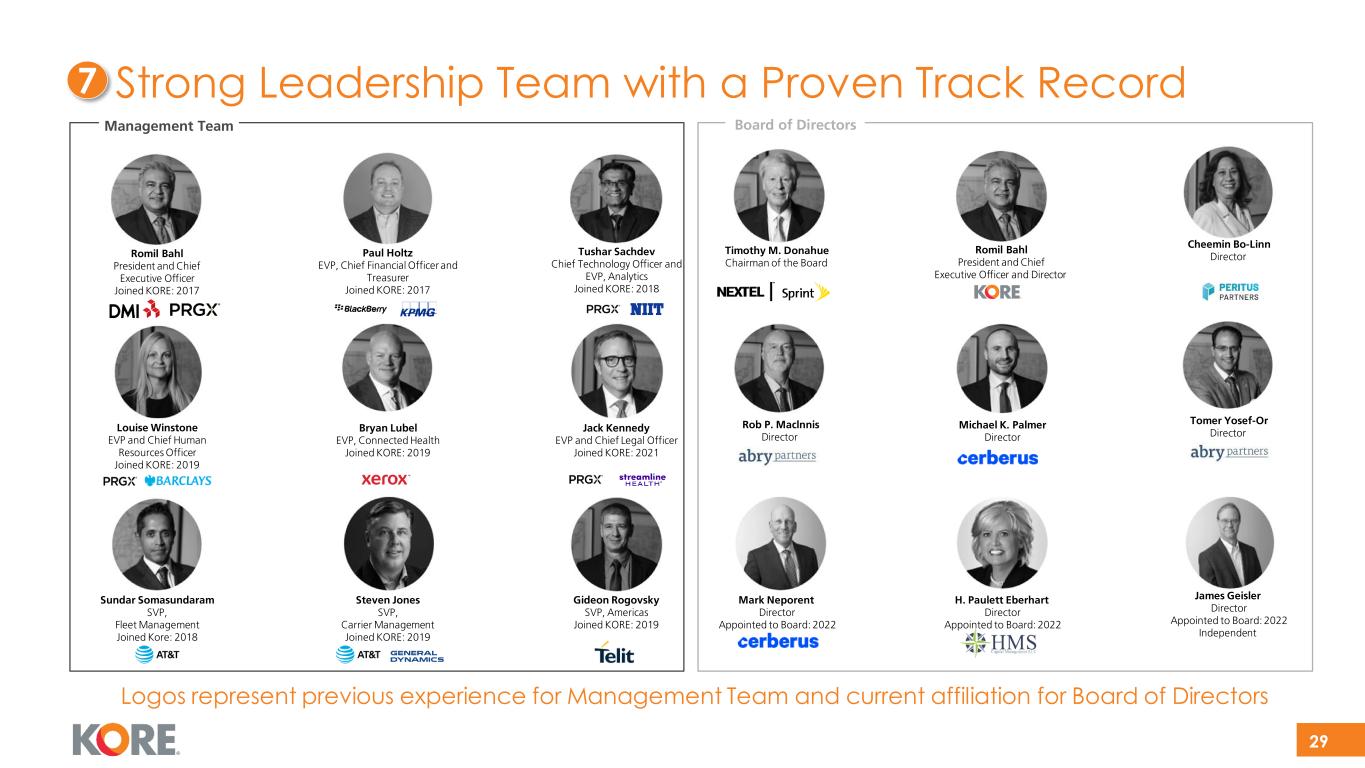

29 Management Team Board of Directors Timothy M. Donahue Chairman of the Board Mark Neporent Director Appointed to Board: 2022 Romil Bahl President and Chief Executive Officer Joined KORE: 2017 Louise Winstone EVP and Chief Human Resources Officer Joined KORE: 2019 Sundar Somasundaram SVP, Fleet Management Joined Kore: 2018 Tushar Sachdev Chief Technology Officer and EVP, Analytics Joined KORE: 2018 Jack Kennedy EVP and Chief Legal Officer Joined KORE: 2021 Gideon Rogovsky SVP, Americas Joined KORE: 2019 Paul Holtz EVP, Chief Financial Officer and Treasurer Joined KORE: 2017 Bryan Lubel EVP, Connected Health Joined KORE: 2019 Steven Jones SVP, Carrier Management Joined KORE: 2019 Cheemin Bo-Linn Director Tomer Yosef-Or Director James Geisler Director Appointed to Board: 2022 Independent Romil Bahl President and Chief Executive Officer and Director Michael K. Palmer Director H. Paulett Eberhart Director Appointed to Board: 2022 Rob P. Maclnnis Director Logos represent previous experience for Management Team and current affiliation for Board of Directors Strong Leadership Team with a Proven Track Record7

Financial Overview

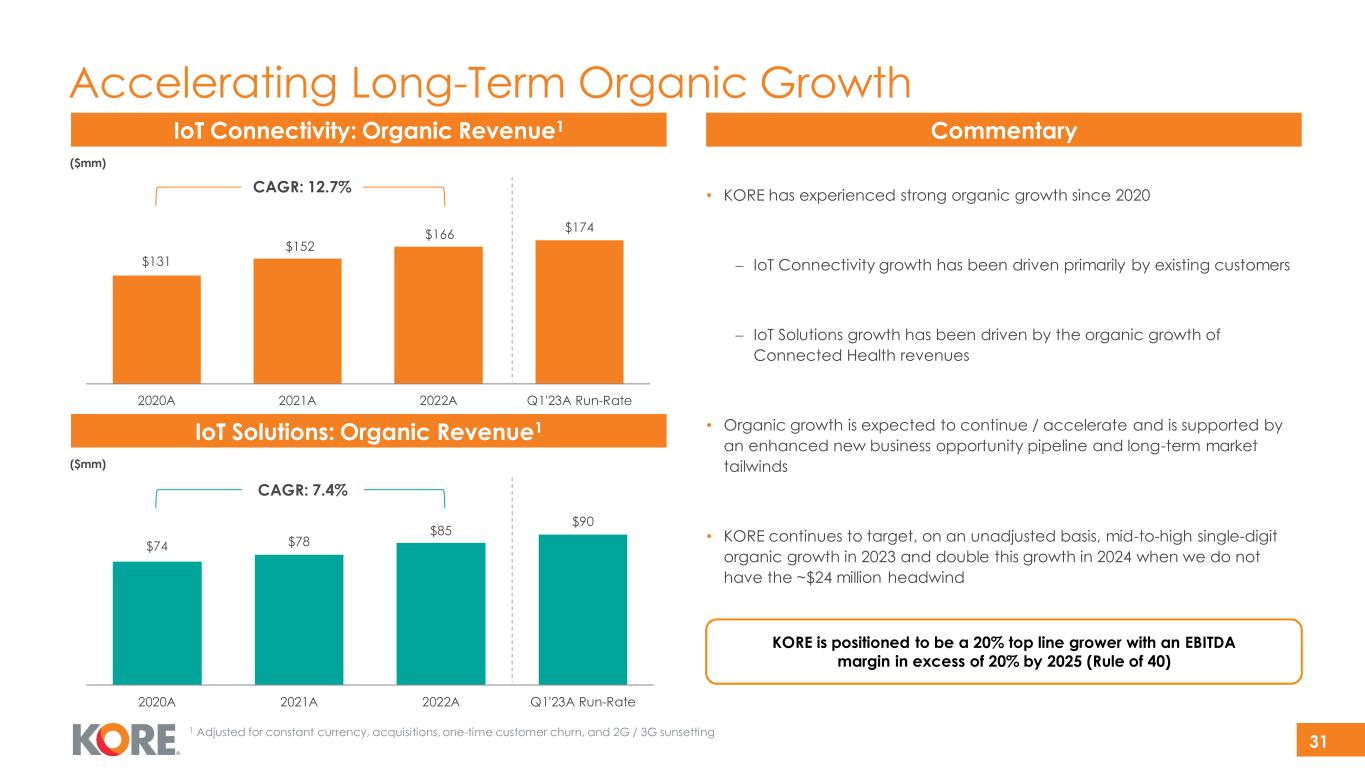

31 $131 $152 $166 $174 2020A 2021A 2022A Q1'23A Run-Rate $74 $78 $85 $90 2020A 2021A 2022A Q1'23A Run-Rate Accelerating Long-Term Organic Growth CommentaryIoT Connectivity: Organic Revenue1 1 Adjusted for constant currency, acquisitions, one-time customer churn, and 2G / 3G sunsetting CAGR: 12.7% IoT Solutions: Organic Revenue1 CAGR: 7.4% • KORE has experienced strong organic growth since 2020 − IoT Connectivity growth has been driven primarily by existing customers − IoT Solutions growth has been driven by the organic growth of Connected Health revenues • Organic growth is expected to continue / accelerate and is supported by an enhanced new business opportunity pipeline and long-term market tailwinds • KORE continues to target, on an unadjusted basis, mid-to-high single-digit organic growth in 2023 and double this growth in 2024 when we do not have the ~$24 million headwind KORE is positioned to be a 20% top line grower with an EBITDA margin in excess of 20% by 2025 (Rule of 40) ($mm) ($mm)

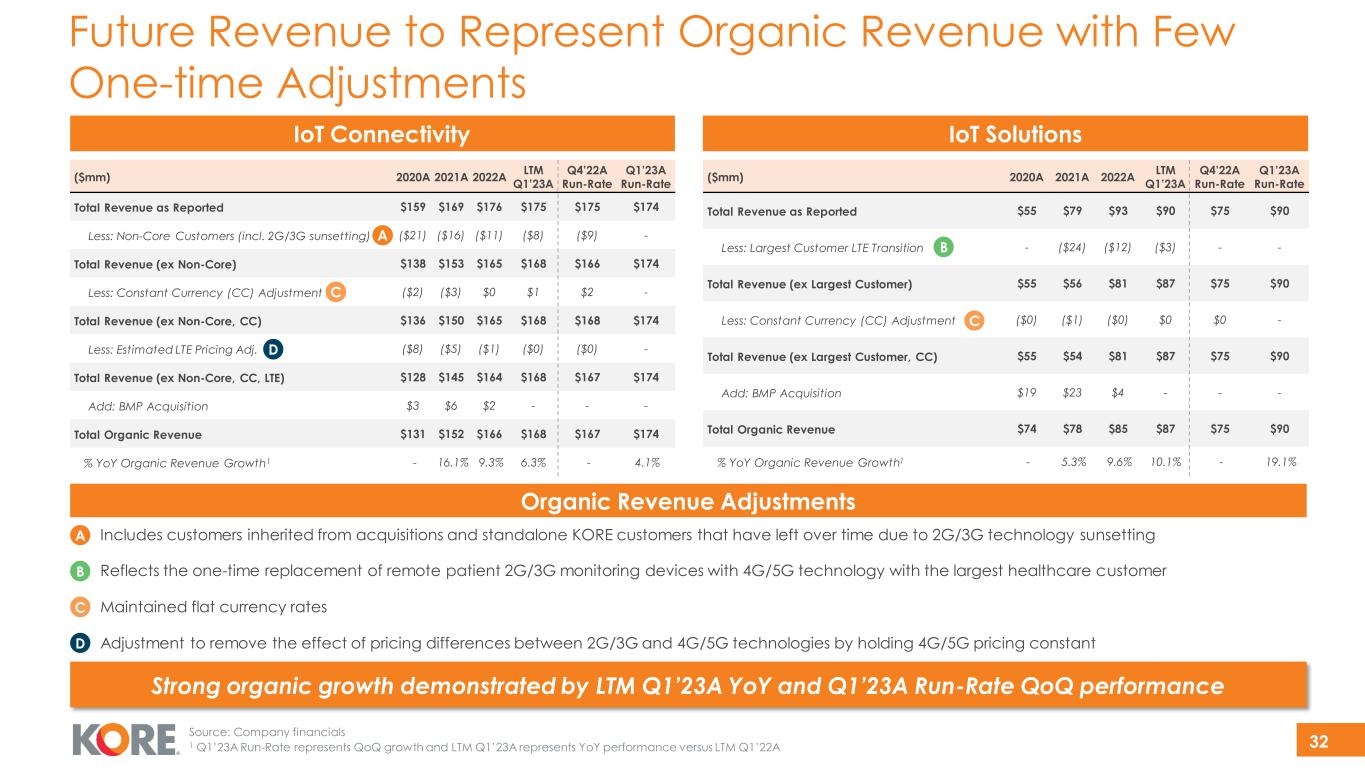

32 Source: Company financials 1 Q1’23A Run-Rate represents QoQ growth and LTM Q1’23A represents YoY performance versus LTM Q1’22A ($mm) 2020A 2021A 2022A LTM Q1’23A Q4’22A Run-Rate Q1’23A Run-Rate Total Revenue as Reported $159 $169 $176 $175 $175 $174 Less: Non-Core Customers (incl. 2G/3G sunsetting) ($21) ($16) ($11) ($8) ($9) - Total Revenue (ex Non-Core) $138 $153 $165 $168 $166 $174 Less: Constant Currency (CC) Adjustment ($2) ($3) $0 $1 $2 - Total Revenue (ex Non-Core, CC) $136 $150 $165 $168 $168 $174 Less: Estimated LTE Pricing Adj. ($8) ($5) ($1) ($0) ($0) - Total Revenue (ex Non-Core, CC, LTE) $128 $145 $164 $168 $167 $174 Add: BMP Acquisition $3 $6 $2 - - - Total Organic Revenue $131 $152 $166 $168 $167 $174 % YoY Organic Revenue Growth1 - 16.1% 9.3% 6.3% - 4.1% ($mm) 2020A 2021A 2022A LTM Q1’23A Q4’22A Run-Rate Q1’23A Run-Rate Total Revenue as Reported $55 $79 $93 $90 $75 $90 Less: Largest Customer LTE Transition - ($24) ($12) ($3) - - Total Revenue (ex Largest Customer) $55 $56 $81 $87 $75 $90 Less: Constant Currency (CC) Adjustment ($0) ($1) ($0) $0 $0 - Total Revenue (ex Largest Customer, CC) $55 $54 $81 $87 $75 $90 Add: BMP Acquisition $19 $23 $4 - - - Total Organic Revenue $74 $78 $85 $87 $75 $90 % YoY Organic Revenue Growth1 - 5.3% 9.6% 10.1% - 19.1% Future Revenue to Represent Organic Revenue with Few One-time Adjustments IoT SolutionsIoT Connectivity • Includes customers inherited from acquisitions and standalone KORE customers that have left over time due to 2G/3G technology sunsetting • Reflects the one-time replacement of remote patient 2G/3G monitoring devices with 4G/5G technology with the largest healthcare customer • Maintained flat currency rates • Adjustment to remove the effect of pricing differences between 2G/3G and 4G/5G technologies by holding 4G/5G pricing constant Organic Revenue Adjustments A D A D C B C B C Strong organic growth demonstrated by LTM Q1’23A YoY and Q1’23A Run-Rate QoQ performance

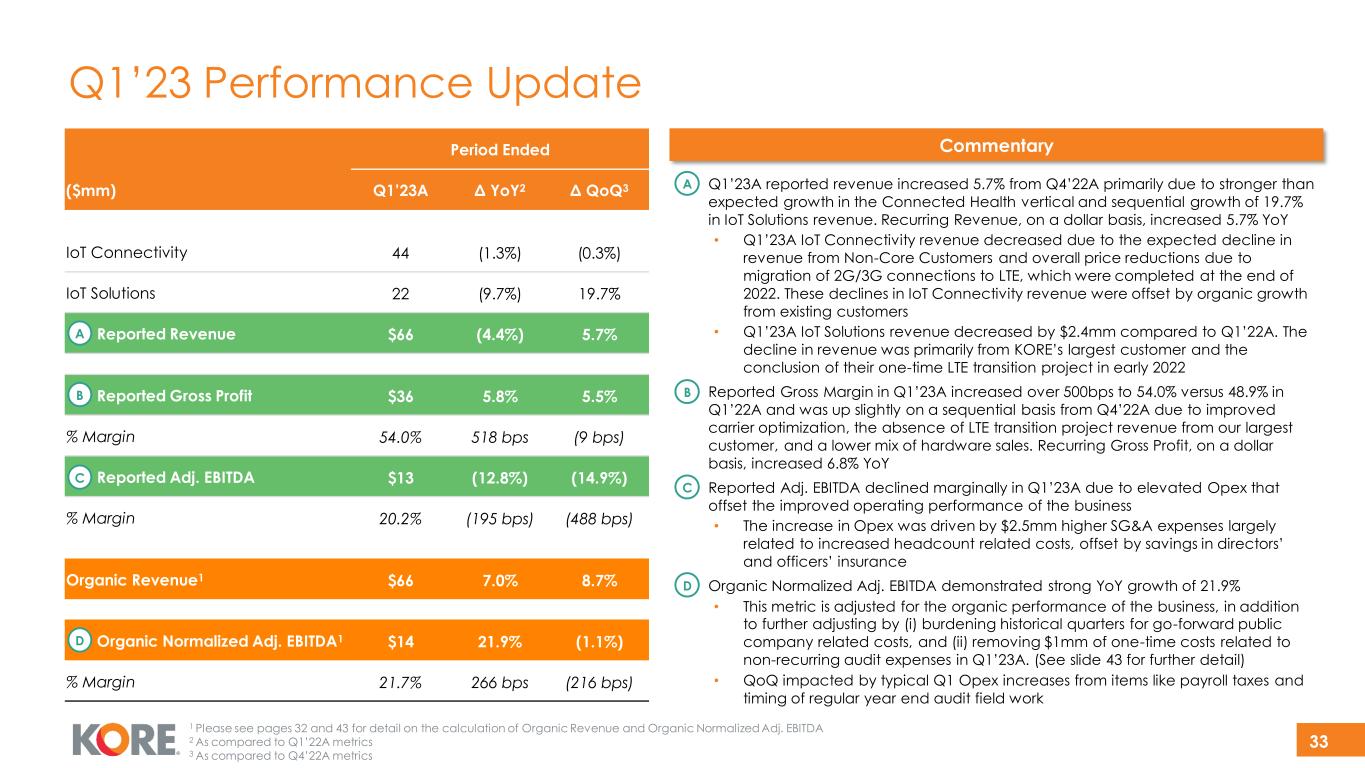

33 Q1’23 Performance Update Period Ended ($mm) Q1’23A Δ YoY2 Δ QoQ3 IoT Connectivity 44 (1.3%) (0.3%) IoT Solutions 22 (9.7%) 19.7% Reported Revenue $66 (4.4%) 5.7% Reported Gross Profit $36 5.8% 5.5% % Margin 54.0% 518 bps (9 bps) Reported Adj. EBITDA $13 (12.8%) (14.9%) % Margin 20.2% (195 bps) (488 bps) Organic Revenue1 $66 7.0% 8.7% Organic Normalized Adj. EBITDA1 $14 21.9% (1.1%) % Margin 21.7% 266 bps (216 bps) • Q1’23A reported revenue increased 5.7% from Q4’22A primarily due to stronger than expected growth in the Connected Health vertical and sequential growth of 19.7% in IoT Solutions revenue. Recurring Revenue, on a dollar basis, increased 5.7% YoY • Q1’23A IoT Connectivity revenue decreased due to the expected decline in revenue from Non-Core Customers and overall price reductions due to migration of 2G/3G connections to LTE, which were completed at the end of 2022. These declines in IoT Connectivity revenue were offset by organic growth from existing customers • Q1’23A IoT Solutions revenue decreased by $2.4mm compared to Q1’22A. The decline in revenue was primarily from KORE’s largest customer and the conclusion of their one-time LTE transition project in early 2022 • Reported Gross Margin in Q1’23A increased over 500bps to 54.0% versus 48.9% in Q1’22A and was up slightly on a sequential basis from Q4’22A due to improved carrier optimization, the absence of LTE transition project revenue from our largest customer, and a lower mix of hardware sales. Recurring Gross Profit, on a dollar basis, increased 6.8% YoY • Reported Adj. EBITDA declined marginally in Q1’23A due to elevated Opex that offset the improved operating performance of the business • The increase in Opex was driven by $2.5mm higher SG&A expenses largely related to increased headcount related costs, offset by savings in directors’ and officers’ insurance • Organic Normalized Adj. EBITDA demonstrated strong YoY growth of 21.9% • This metric is adjusted for the organic performance of the business, in addition to further adjusting by (i) burdening historical quarters for go-forward public company related costs, and (ii) removing $1mm of one-time costs related to non-recurring audit expenses in Q1’23A. (See slide 43 for further detail) • QoQ impacted by typical Q1 Opex increases from items like payroll taxes and timing of regular year end audit field work Commentary A B C A B C D D 1 Please see pages 32 and 43 for detail on the calculation of Organic Revenue and Organic Normalized Adj. EBITDA 2 As compared to Q1’22A metrics 3 As compared to Q4’22A metrics

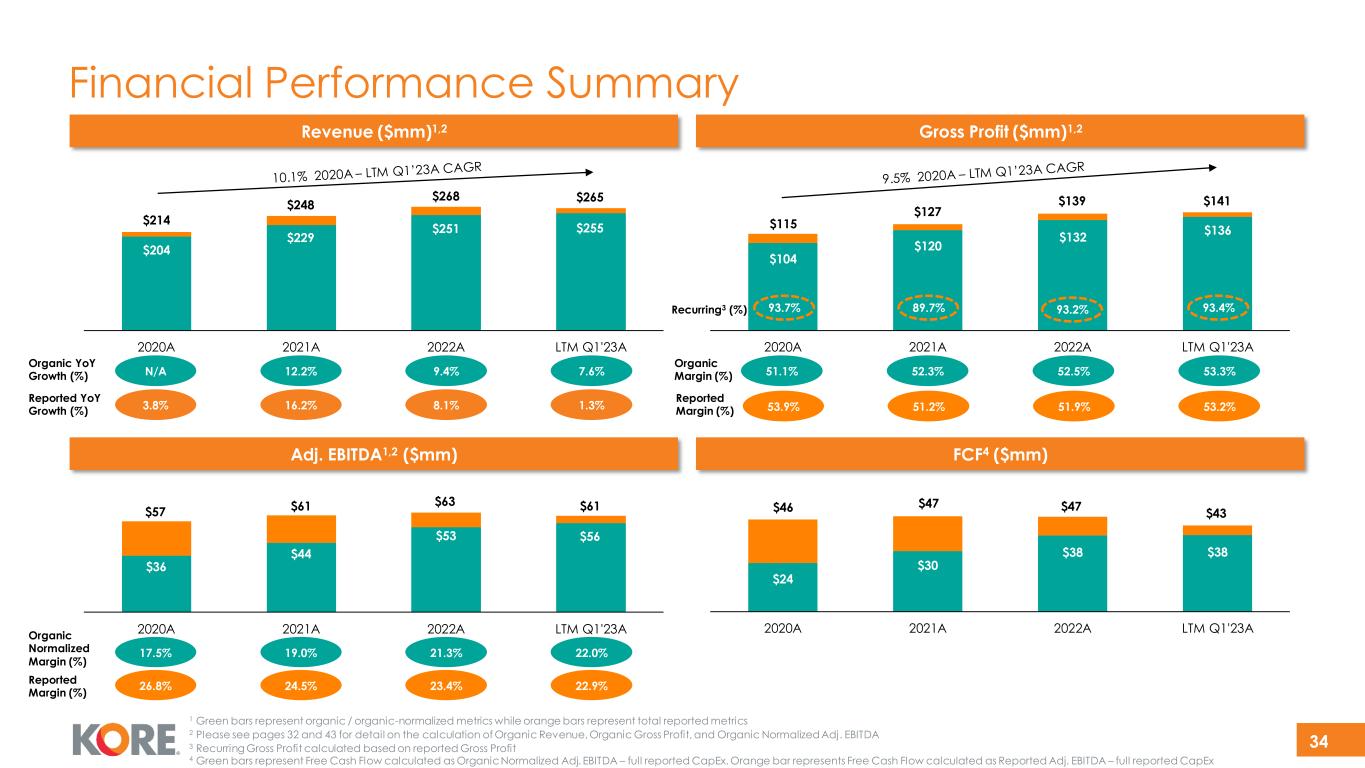

34 0 50 10 0 15 0 20 0 25 0 30 0 35 0 2020A 2021A 2022A LTM Q1'23A Financial Performance Summary $24 $30 $38 $38 0 10 20 30 40 50 60 70 80 2020A 2021A 2022A LTM Q1'23A $36 $44 $53 -5 5 15 25 35 45 55 65 75 2020A 2021A 2022A LTM Q1'23A $104 $120 $132 $136 -10 10 30 50 70 90 11 0 13 0 15 0 17 0 19 0 2020A 2021A 2022A LTM Q1'23A Revenue ($mm)1,2 Gross Profit ($mm)1,2 Adj. EBITDA1,2 ($mm) FCF4 ($mm) Reported Margin (%) 26.8% 24.5% 23.4% 1 Green bars represent organic / organic-normalized metrics while orange bars represent total reported metrics 2 Please see pages 32 and 43 for detail on the calculation of Organic Revenue, Organic Gross Profit, and Organic Normalized Adj. EBITDA 3 Recurring Gross Profit calculated based on reported Gross Profit 4 Green bars represent Free Cash Flow calculated as Organic Normalized Adj. EBITDA – full reported CapEx. Orange bar represents Free Cash Flow calculated as Reported Adj. EBITDA – full reported CapEx Organic Normalized Margin (%) 17.5% 19.0% 21.3% Organic YoY Growth (%) 53.9% 51.2% 51.9% Reported Margin (%) $204 $229 $251 $214 $248 $268 Reported YoY Growth (%) N/A 3.8% 12.2% 16.2% 9.4% 8.1% $255 7.6% 1.3% $265 53.2% 22.9% 22.0% 51.1% 52.3% 52.5% 53.3% Organic Margin (%) $115 $127 $139 $141 $56 $57 $61 $63 $61 93.7%Recurring3 (%) 89.7% 93.2% 93.4% $46 $47 $47 $43

35 Key Company Highlights Large and growing market with increasing demand for IoT connectivity and solutions over the next decade • Accelerating digital transformation and the increasing emphasis on a connected environment continues to drive rapid growth in the IoT market • $3 billion Low Power Wide Area connections by 2025 • 45% of total mobile data will be over 5G networks by 2027 Leading independent IoT solution provider backed by extensive IP that creates high barriers to entry • Market leader in enabling end-to-end IoT by delivering 45 of the 49 steps required to deploy an IoT solution • KORE’s IoT-in-a-box establishes high barriers to entry Strong recurring revenue, gross profit, and earnings profile that is resilient to macroeconomic cycles • 82%+ annual recurring revenue • 91%+ annual recurring gross profit Well-diversified revenue across blue-chip customer base with truly global coverage • Extensive coverage across North America, LATAM and EMEA regions serving customers in critical sectors (Connected Health, Communication Services, etc.) • No customer represents more than 6.0% of total gross profit for 2022 • Long track record of customer retention with Q1 2023A DBNER of 126.0%1 IoT solutions that improve customers’ ESG profile • Force multiplier in driving environmentally friendly energy savings at scale for customers • KORE partnered with GroundWorx to help decrease water usage by more than 30.0% High quality sales pipeline supported by attainable growth initiatives • Robust sales funnel with 1,400+ opportunities representing $500mm+ in TCV • Well-defined product roadmap for analytics services and edge computing Strong leadership team with a proven track record • Best-in-class management team with deep domain expertise and proven track record of execution 1 DBNER is calculated by dividing trailing twelve-month revenue by prior year trailing twelve-month revenue for the same customer cohort in both periods. Excludes revenue impact from the significant LTE Transition Program at our largest customer

Appendix

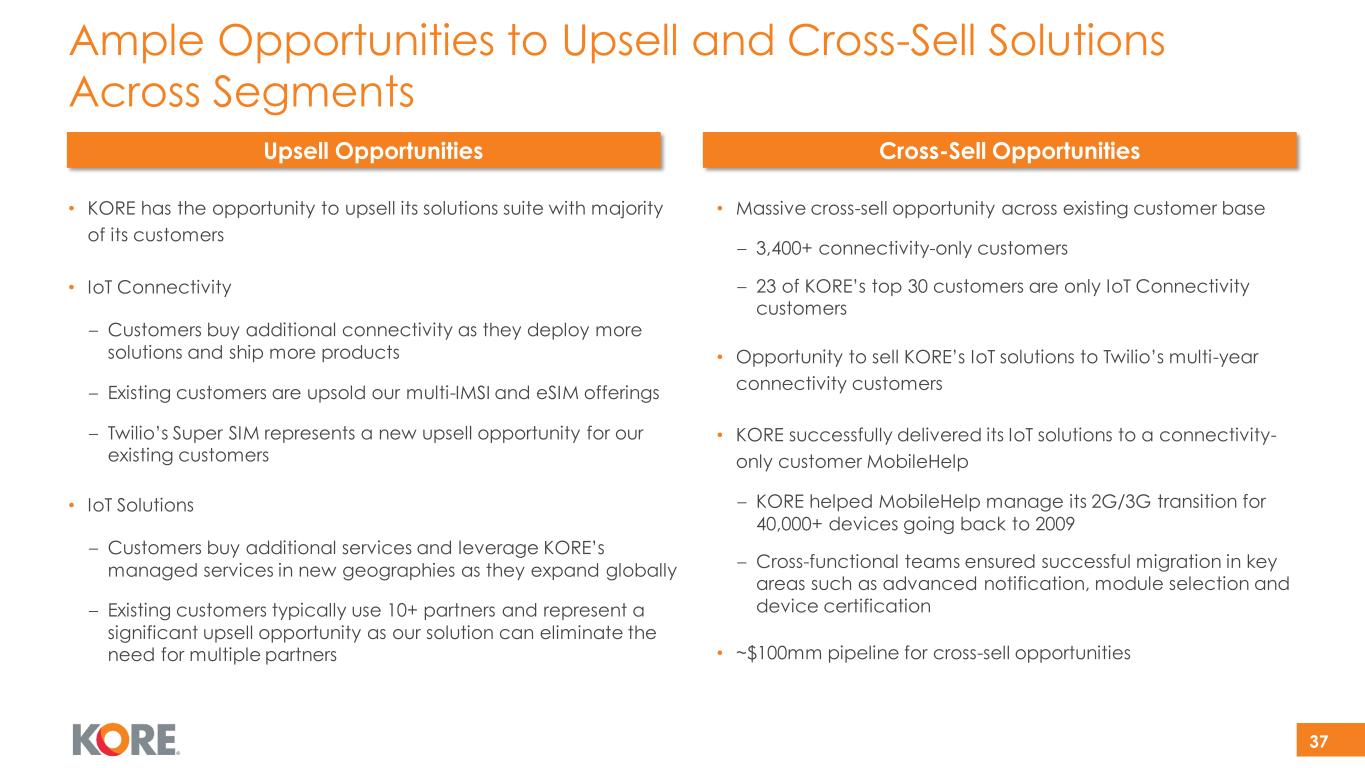

37 Cross-Sell OpportunitiesUpsell Opportunities • KORE has the opportunity to upsell its solutions suite with majority of its customers • IoT Connectivity – Customers buy additional connectivity as they deploy more solutions and ship more products – Existing customers are upsold our multi-IMSI and eSIM offerings – Twilio’s Super SIM represents a new upsell opportunity for our existing customers • IoT Solutions – Customers buy additional services and leverage KORE’s managed services in new geographies as they expand globally – Existing customers typically use 10+ partners and represent a significant upsell opportunity as our solution can eliminate the need for multiple partners Ample Opportunities to Upsell and Cross-Sell Solutions Across Segments • Massive cross-sell opportunity across existing customer base – 3,400+ connectivity-only customers – 23 of KORE’s top 30 customers are only IoT Connectivity customers • Opportunity to sell KORE’s IoT solutions to Twilio’s multi-year connectivity customers • KORE successfully delivered its IoT solutions to a connectivity- only customer MobileHelp – KORE helped MobileHelp manage its 2G/3G transition for 40,000+ devices going back to 2009 – Cross-functional teams ensured successful migration in key areas such as advanced notification, module selection and device certification • ~$100mm pipeline for cross-sell opportunities

38 Founded in 2003 Early machine-to-machine focus Established North America market position with AT&T and Rogers Launched first generation IoT platform PrismPro KORE 1.0 Establishing IoT Pioneer (2003 – 2013) ~1.5M devices Global geographic expansion Key acquisitions Expansion into different verticals and use cases Continuous development of product portfolio (location-based services, eSIM capability) Global ecosystem of channel partners KORE 2.0 Building Global Scale (2014 – 2018) ~3M devices Connectivity powered by KORE One: Advanced connectivity, global eSIM, core network & IoT MVNE Solutions delivered via comprehensive set of IoT deployment and managed services in healthcare, life sciences, asset management, fleet, and industrial Analytics including Data Transformation as a Service (DTaaS) and IoT security Application enablement leveraging API-based platform Key acquisitions enabling managed services capabilities and unique value offering highly regulated spaces KORE 3.0 Positioned for Growth (2019 – 2022) ~15M devices Established Vertical Experience with Connectivity, Solutions and Analytics services Enhanced worldwide connectivity with eSIM One-Stop-Shop to ease the complexities of IoT Build, Deploy, Manage and Scale for IoT deployments Unparalleled managed services & customer excellence Hyperscaler integrations with AWS and Google Cloud Key acquisition enabling enhanced global connectivity and digital experience for faster time to market, reduced CAC KORE 3.0+ Acceleration & Leadership (2023 and Beyond) ~15M+ devices IoT Business Unit Successful Track Record of Leadership and Innovation KORE is the only pure-play IoT solution company

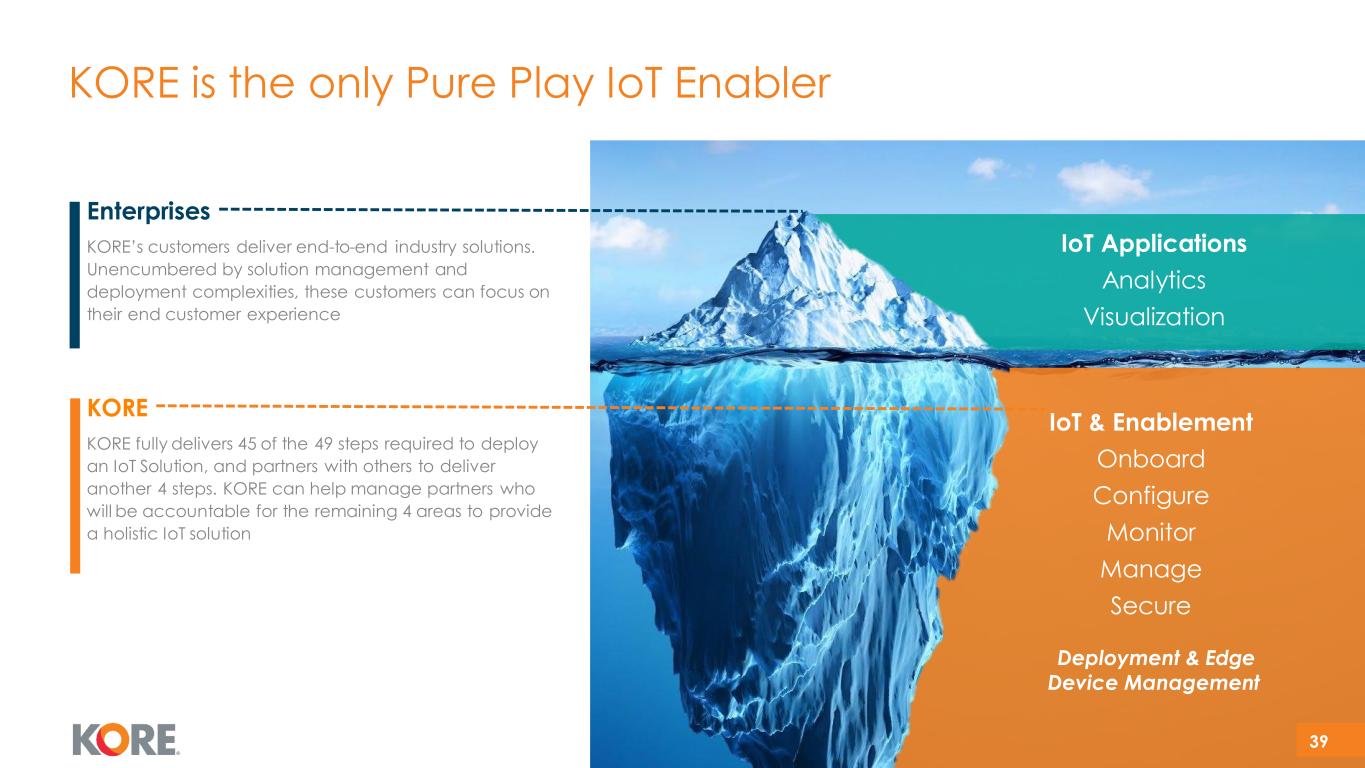

39 Enterprises IoT Applications Analytics Visualization KORE KORE fully delivers 45 of the 49 steps required to deploy an IoT Solution, and partners with others to deliver another 4 steps. KORE can help manage partners who will be accountable for the remaining 4 areas to provide a holistic IoT solution KORE’s customers deliver end-to-end industry solutions. Unencumbered by solution management and deployment complexities, these customers can focus on their end customer experience KORE is the only Pure Play IoT Enabler IoT & Enablement Onboard Configure Monitor Manage Secure Deployment & Edge Device Management

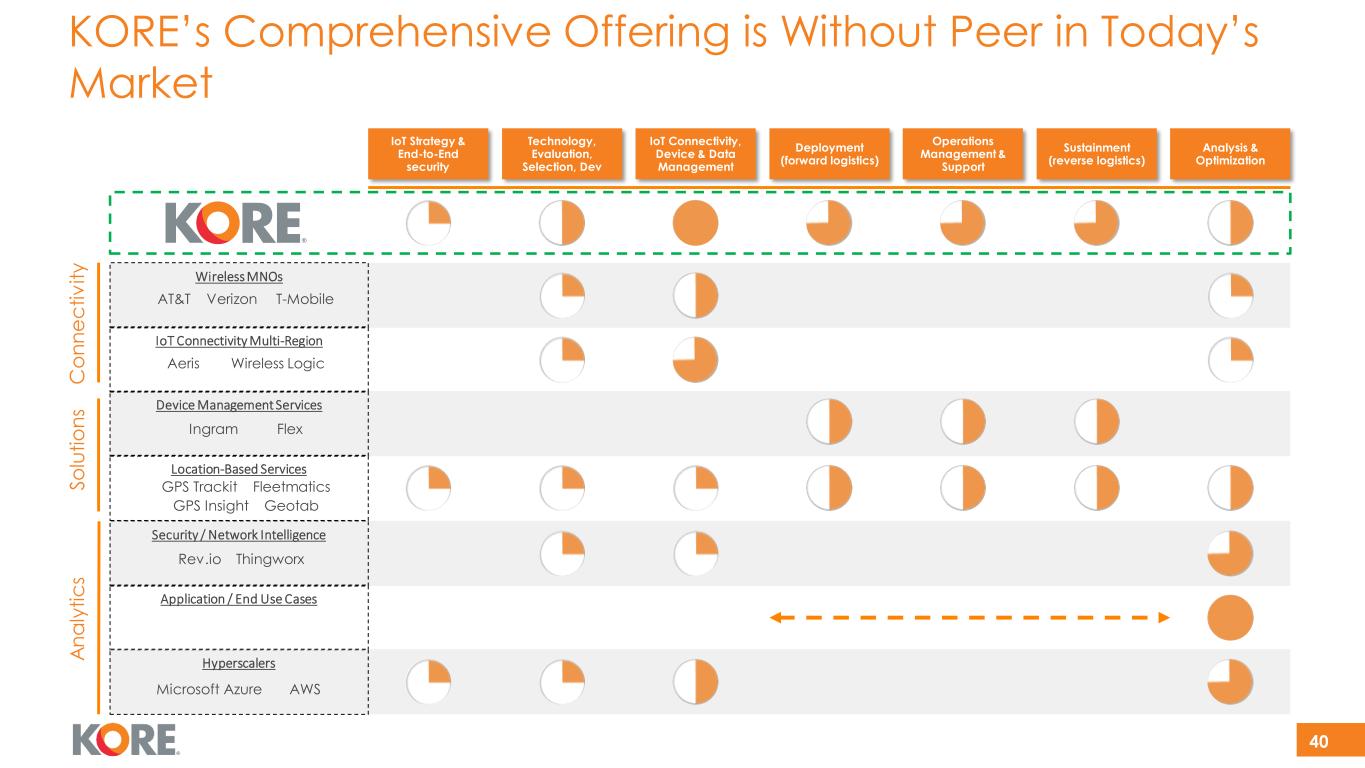

40 KORE’s Comprehensive Offering is Without Peer in Today’s Market IoT Strategy & End-to-End security Analysis & Optimization Technology, Evaluation, Selection, Dev IoT Connectivity, Device & Data Management Deployment (forward logistics) Operations Management & Support Sustainment (reverse logistics) A n a ly ti c s S o lu ti o n s C o n n e c ti v it y Device Management Services Ingram Flex Wireless MNOs AT&T Verizon T-Mobile IoT Connectivity Multi-Region Aeris Wireless Logic GPS Trackit Fleetmatics GPS Insight Geotab Security / Network Intelligence Rev.io Thingworx Application / End Use Cases Microsoft Azure AWS Location-Based Services Hyperscalers

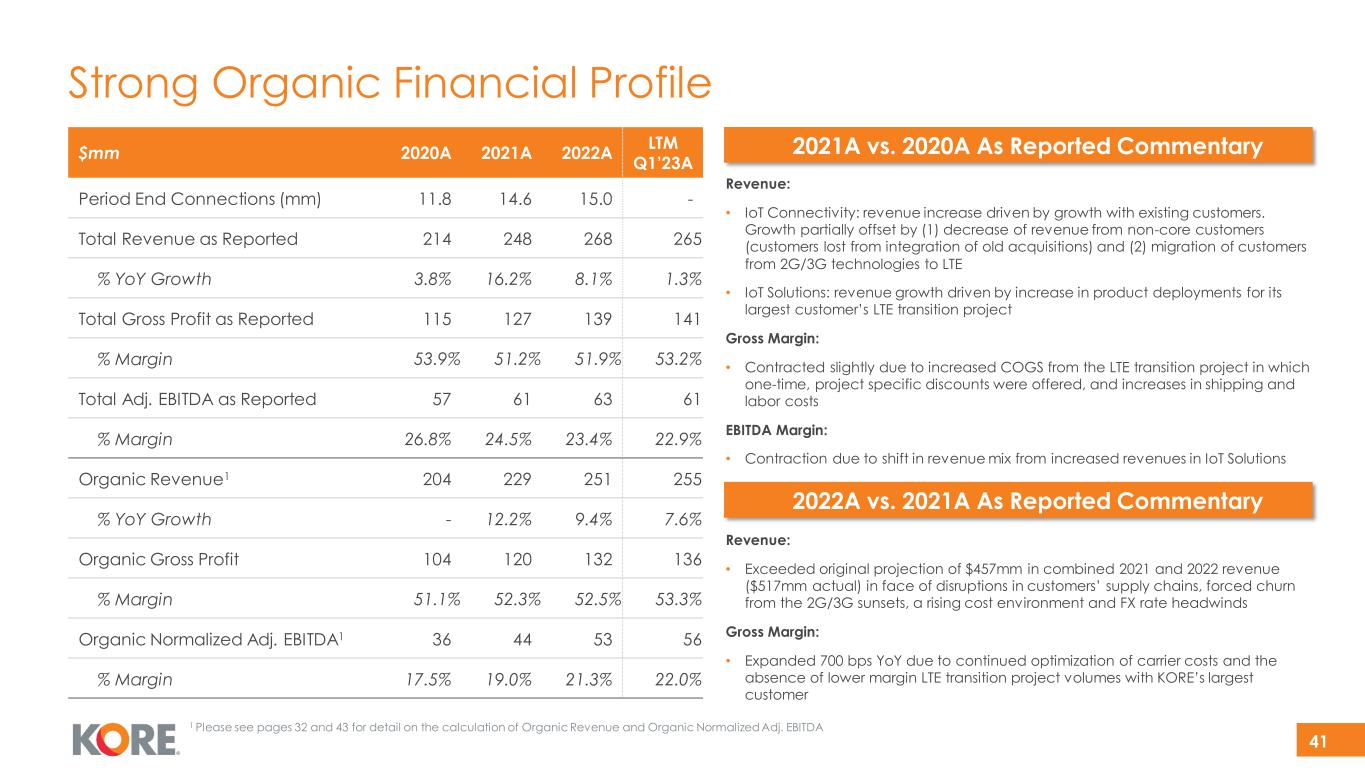

41 Strong Organic Financial Profile Revenue: • IoT Connectivity: revenue increase driven by growth with existing customers. Growth partially offset by (1) decrease of revenue from non-core customers (customers lost from integration of old acquisitions) and (2) migration of customers from 2G/3G technologies to LTE • IoT Solutions: revenue growth driven by increase in product deployments for its largest customer’s LTE transition project Gross Margin: • Contracted slightly due to increased COGS from the LTE transition project in which one-time, project specific discounts were offered, and increases in shipping and labor costs EBITDA Margin: • Contraction due to shift in revenue mix from increased revenues in IoT Solutions 2021A vs. 2020A As Reported Commentary 2022A vs. 2021A As Reported Commentary Revenue: • Exceeded original projection of $457mm in combined 2021 and 2022 revenue ($517mm actual) in face of disruptions in customers’ supply chains, forced churn from the 2G/3G sunsets, a rising cost environment and FX rate headwinds Gross Margin: • Expanded 700 bps YoY due to continued optimization of carrier costs and the absence of lower margin LTE transition project volumes with KORE’s largest customer 1 Please see pages 32 and 43 for detail on the calculation of Organic Revenue and Organic Normalized Adj. EBITDA $mm 2020A 2021A 2022A LTM Q1’23A Period End Connections (mm) 11.8 14.6 15.0 - Total Revenue as Reported 214 248 268 265 % YoY Growth 3.8% 16.2% 8.1% 1.3% Total Gross Profit as Reported 115 127 139 141 % Margin 53.9% 51.2% 51.9% 53.2% Total Adj. EBITDA as Reported 57 61 63 61 % Margin 26.8% 24.5% 23.4% 22.9% Organic Revenue1 204 229 251 255 % YoY Growth - 12.2% 9.4% 7.6% Organic Gross Profit 104 120 132 136 % Margin 51.1% 52.3% 52.5% 53.3% Organic Normalized Adj. EBITDA1 36 44 53 56 % Margin 17.5% 19.0% 21.3% 22.0%

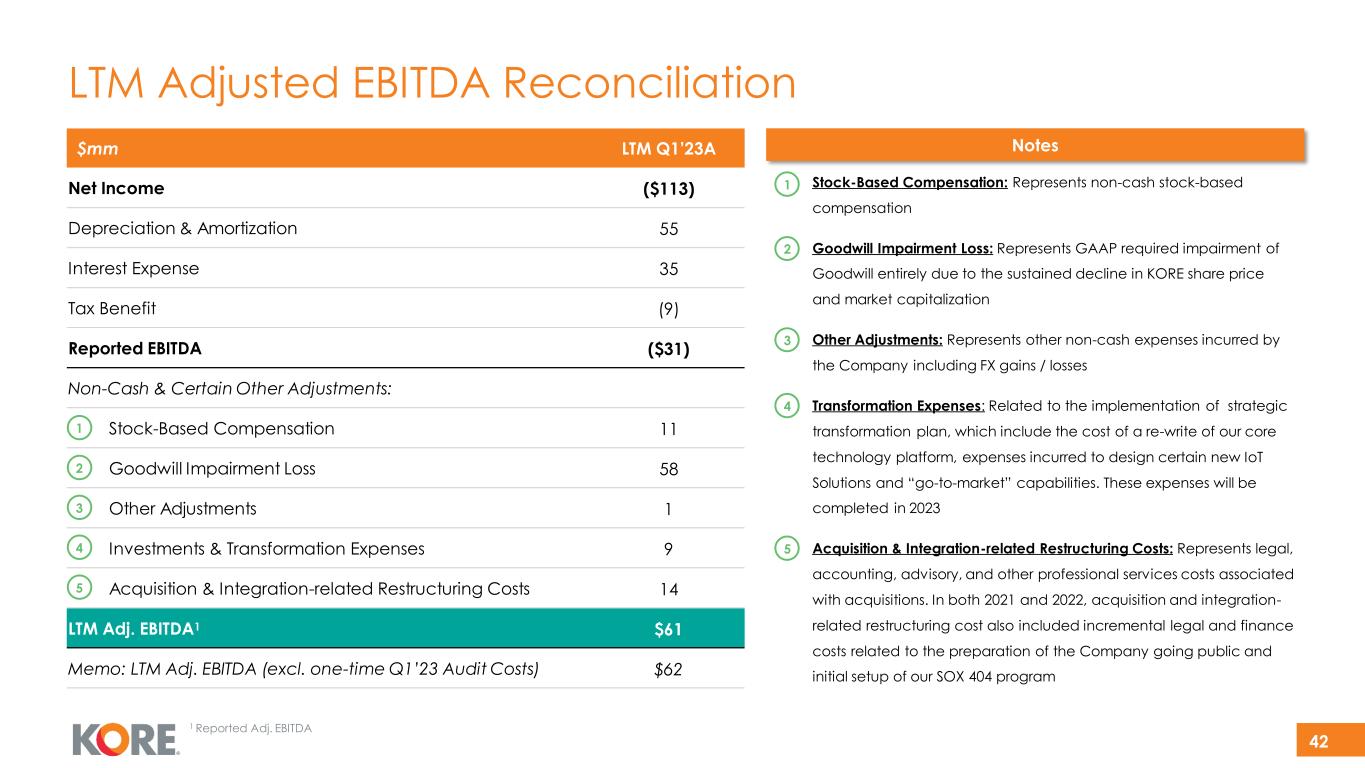

42 LTM Adjusted EBITDA Reconciliation $mm LTM Q1’23A Net Income ($113) Depreciation & Amortization 55 Interest Expense 35 Tax Benefit (9) Reported EBITDA ($31) Non-Cash & Certain Other Adjustments: Stock-Based Compensation 11 Goodwill Impairment Loss 58 Other Adjustments 1 Investments & Transformation Expenses 9 Acquisition & Integration-related Restructuring Costs 14 LTM Adj. EBITDA1 $61 Memo: LTM Adj. EBITDA (excl. one-time Q1’23 Audit Costs) $62 Stock-Based Compensation: Represents non-cash stock-based compensation Goodwill Impairment Loss: Represents GAAP required impairment of Goodwill entirely due to the sustained decline in KORE share price and market capitalization Other Adjustments: Represents other non-cash expenses incurred by the Company including FX gains / losses Transformation Expenses: Related to the implementation of strategic transformation plan, which include the cost of a re-write of our core technology platform, expenses incurred to design certain new IoT Solutions and “go-to-market” capabilities. These expenses will be completed in 2023 Acquisition & Integration-related Restructuring Costs: Represents legal, accounting, advisory, and other professional services costs associated with acquisitions. In both 2021 and 2022, acquisition and integration- related restructuring cost also included incremental legal and finance costs related to the preparation of the Company going public and initial setup of our SOX 404 program Notes 1 2 3 4 5 1 2 3 4 5 1 Reported Adj. EBITDA

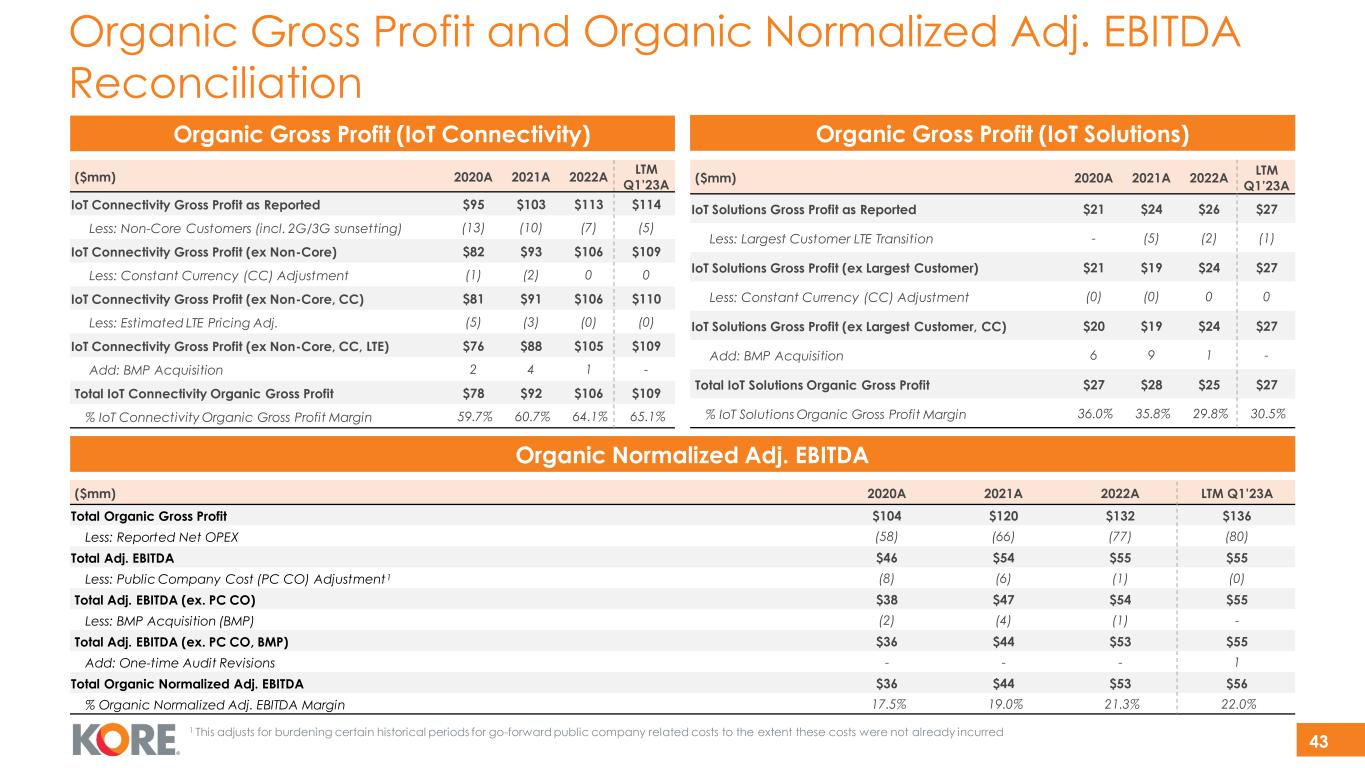

43 ($mm) 2020A 2021A 2022A LTM Q1’23A IoT Solutions Gross Profit as Reported $21 $24 $26 $27 Less: Largest Customer LTE Transition - (5) (2) (1) IoT Solutions Gross Profit (ex Largest Customer) $21 $19 $24 $27 Less: Constant Currency (CC) Adjustment (0) (0) 0 0 IoT Solutions Gross Profit (ex Largest Customer, CC) $20 $19 $24 $27 Add: BMP Acquisition 6 9 1 - Total IoT Solutions Organic Gross Profit $27 $28 $25 $27 % IoT Solutions Organic Gross Profit Margin 36.0% 35.8% 29.8% 30.5% 1 This adjusts for burdening certain historical periods for go-forward public company related costs to the extent these costs were not already incurred ($mm) 2020A 2021A 2022A LTM Q1’23A IoT Connectivity Gross Profit as Reported $95 $103 $113 $114 Less: Non-Core Customers (incl. 2G/3G sunsetting) (13) (10) (7) (5) IoT Connectivity Gross Profit (ex Non-Core) $82 $93 $106 $109 Less: Constant Currency (CC) Adjustment (1) (2) 0 0 IoT Connectivity Gross Profit (ex Non-Core, CC) $81 $91 $106 $110 Less: Estimated LTE Pricing Adj. (5) (3) (0) (0) IoT Connectivity Gross Profit (ex Non-Core, CC, LTE) $76 $88 $105 $109 Add: BMP Acquisition 2 4 1 - Total IoT Connectivity Organic Gross Profit $78 $92 $106 $109 % IoT Connectivity Organic Gross Profit Margin 59.7% 60.7% 64.1% 65.1% Organic Gross Profit and Organic Normalized Adj. EBITDA Reconciliation Organic Gross Profit (IoT Solutions)Organic Gross Profit (IoT Connectivity) ($mm) 2020A 2021A 2022A LTM Q1’23A Total Organic Gross Profit $104 $120 $132 $136 Less: Reported Net OPEX (58) (66) (77) (80) Total Adj. EBITDA $46 $54 $55 $55 Less: Public Company Cost (PC CO) Adjustment1 (8) (6) (1) (0) Total Adj. EBITDA (ex. PC CO) $38 $47 $54 $55 Less: BMP Acquisition (BMP) (2) (4) (1) - Total Adj. EBITDA (ex. PC CO, BMP) $36 $44 $53 $55 Add: One-time Audit Revisions - - - 1 Total Organic Normalized Adj. EBITDA $36 $44 $53 $56 % Organic Normalized Adj. EBITDA Margin 17.5% 19.0% 21.3% 22.0% Organic Normalized Adj. EBITDA

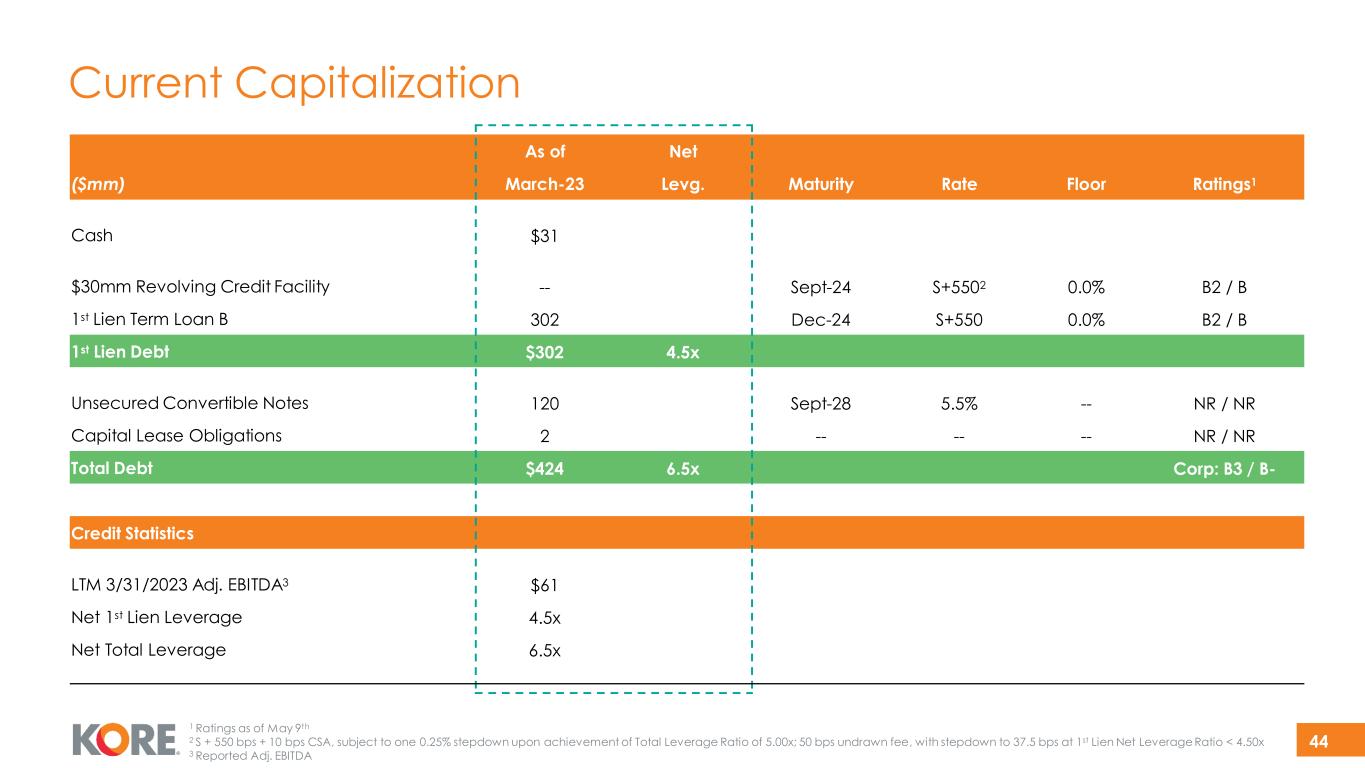

44 Current Capitalization As of Net ($mm) March-23 Levg. Maturity Rate Floor Ratings1 Cash $31 $30mm Revolving Credit Facility -- Sept-24 S+5502 0.0% B2 / B 1st Lien Term Loan B 302 Dec-24 S+550 0.0% B2 / B 1st Lien Debt $302 4.5x Unsecured Convertible Notes 120 Sept-28 5.5% -- NR / NR Capital Lease Obligations 2 -- -- -- NR / NR Total Debt $424 6.5x Corp: B3 / B- Credit Statistics LTM 3/31/2023 Adj. EBITDA3 $61 Net 1st Lien Leverage 4.5x Net Total Leverage 6.5x 1 Ratings as of May 9th 2 S + 550 bps + 10 bps CSA, subject to one 0.25% stepdown upon achievement of Total Leverage Ratio of 5.00x; 50 bps undrawn fee, with stepdown to 37.5 bps at 1st Lien Net Leverage Ratio < 4.50x 3 Reported Adj. EBITDA