Investor Presentation 1 November 16, 2022

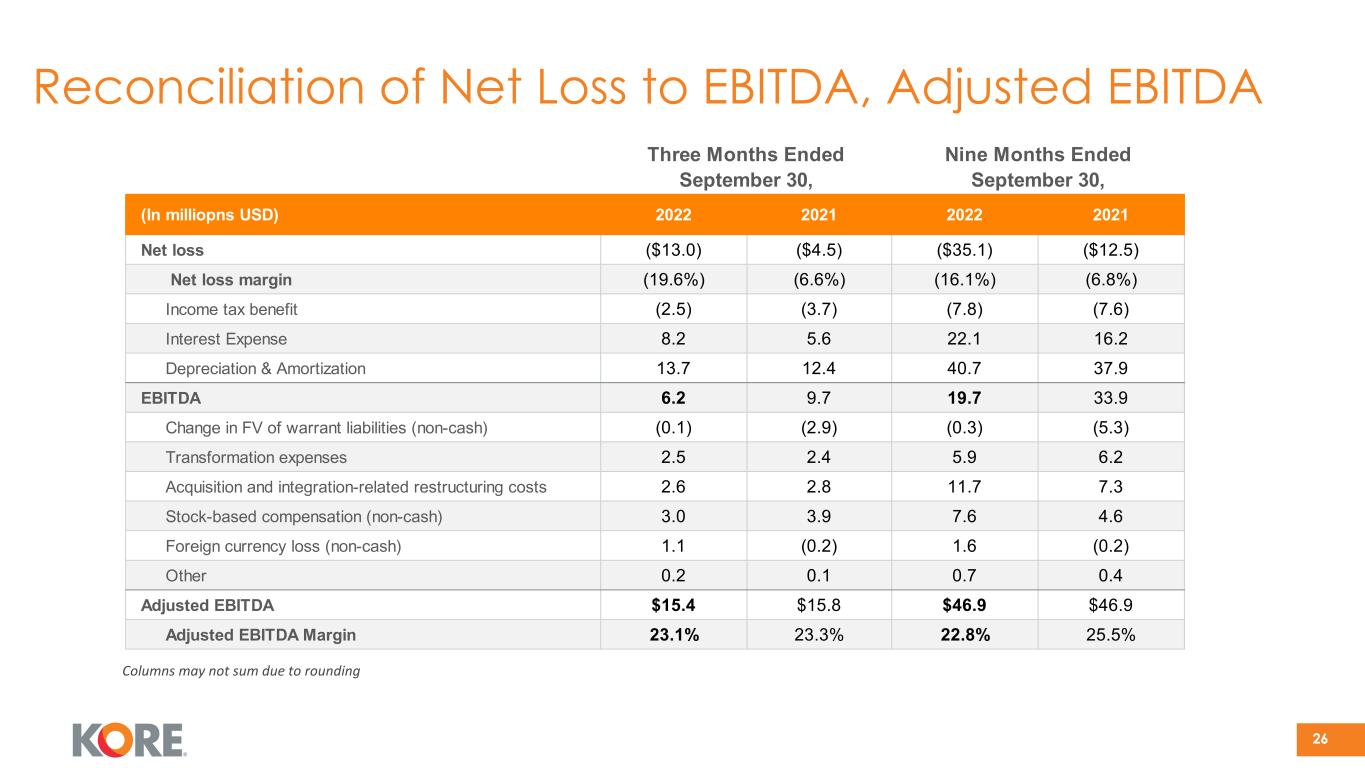

Disclaimers 2 Forward-Looking Statements This presentation includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. KORE's actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements generally are accompanied by words such as "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "should," "would," "plan," "predict," "potential," "seem," "seek," "future," "outlook,“ “target” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of revenue and other financial and performance metrics, future capital availability, projections regarding recent customer engagements, projections of market opportunity and conditions, the total contract value (TCV) of signed contracts and potential revenue opportunities in KORE’s sales funnel, and related expectations. These statements are based on various assumptions and on the current expectations of KORE’s management. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor or other person as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of KORE. These forward-looking statements are subject to a number of risks and uncertainties, including general economic, financial, legal, political and business conditions and changes in domestic and foreign markets; the potential effects of COVID-19; risks related to the rollout of KORE's business and the timing of expected business milestones; risks relating to the integration of KORE’s acquired companies, including Business Mobility Partners Inc and Simon IoT LLC, changes in the assumptions underlying KORE's expectations regarding its future business; our ability to negotiate and sign a definitive contract with a customer in our sales funnel; our ability to realize some or all of the Total Contract Value (TCV) of customer contracts as revenue, including any contractual options available to customers or contractual periods that are subject to termination for convenience provisions; the effects of competition on KORE's future business; and the outcome of judicial proceedings to which KORE is, or may become a party. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that KORE presently does not know or that KORE currently believes are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect KORE's expectations, plans or forecasts of future events and views as of the date of this presentation. KORE anticipates that subsequent events and developments will cause these assessments to change. However, while KORE may elect to update these forward- looking statements at some point in the future, KORE specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing KORE's assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Industry and Market Data In this presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which KORE expects to compete and other industry data. We obtained this information and these statistics from a variety of publicly available sources, including reports by market research firms and other public company filings. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, © or ® symbols, but KORE will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Use of Projections This presentation also contains certain financial forecasts of KORE. KORE's independent auditors have not studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of KORE's control. Accordingly, there can be no assurance that the prospective results are indicative of future performance of KORE or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Use of Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we believe the following non-GAAP measures are useful in evaluating our operational performance. We use the following non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors in assessing our operating performance. “EBITDA” is defined as net income (loss) before interest expense or interest income, income tax expense or benefit, and depreciation and amortization. “Adjusted EBITDA” is defined as EBITDA adjusted for unusual and other significant items that management views as distorting the operating results from period to period. Adjusted EBITDA margin represents adjusted EBITDA calculated as a percentage of revenue. Such adjustments may include stock-based compensation, integration and acquisition-related charges, tangible and intangible asset impairment charges, certain contingent liability reversals, transformation, and foreign currency transaction gains and losses. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are intended as supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. We believe that the use of EBITDA, Adjusted EBITDA and Adjusted EBITDA margin provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware that when evaluating EBITDA, Adjusted EBITDA and Adjusted EBITDA margin we may incur future expenses similar to those excluded when calculating these measures. In addition, our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate Adjusted EBITDA in the same fashion. Because of these limitations, EBITDA, Adjusted EBITDA and Adjusted EBITDA margin should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA, Adjusted EBITDA and Adjusted EBITDA margin on a supplemental basis. You should review the reconciliation of net loss to EBITDA, Adjusted EBITDA and Adjusted EBITDA margin below and not rely on any single financial measure to evaluate our business.

Attractive Story • Significant barriers to entry and sustainable competitive moat • Well positioned to capture market share in Connected Health and Fleet • Predominately recurring revenue with high switching costs • Q3’22 Total Net Leverage of 5.8x • Robust free cash flow and deleveraging ability KORE at a glance 3 • Market leader in enabling end-to-end IoT solutions for enterprises • Trusted advisor, enabling our customers to Deploy, Manage and Scale their IoT solutions • Blue chip customer base including market leading Fortune 500 enterprises and innovative solutions providers across high growth verticals such as connected health, industrial IoT, asset monitoring, fleet management and comms. services Proprietary IP-based services: IoT Connectivity, Solutions & Analytics Market leading IoT knowledge and experience to help navigate the complex IoT ecosystem Global independent IoT connectivity and solutions enabler with an integrated network of key partners Global Scale (as of 9/30/22) • 190+ countries coverage • 44 carrier integrations • 15.3 mm connections • 3,600+ customers • 550+ employees Significant Visibility & Profitability1 • 2021 Revenue $248mm • 2022 Q3 Revenue down 2% to $66.6mm • Annual recurring revenue is ~80%+ • 100% Net Retention • ~95% revenue visibility through 20222 • 2021 Gross margin 51%, Net loss margin 9.9%, and 24% adjusted EBITDA margin Leading global, independent provider of mission critical IoT solutions 1 Represents LTM as of Q4’21; 2 Revenue visibility is based on the installed base which includes customers which had a signed contract with KORE by the end of 2021, normalized for non-core customers from the acquisitions of Raco and Wyless Who We Are Why We Win Key Attributes

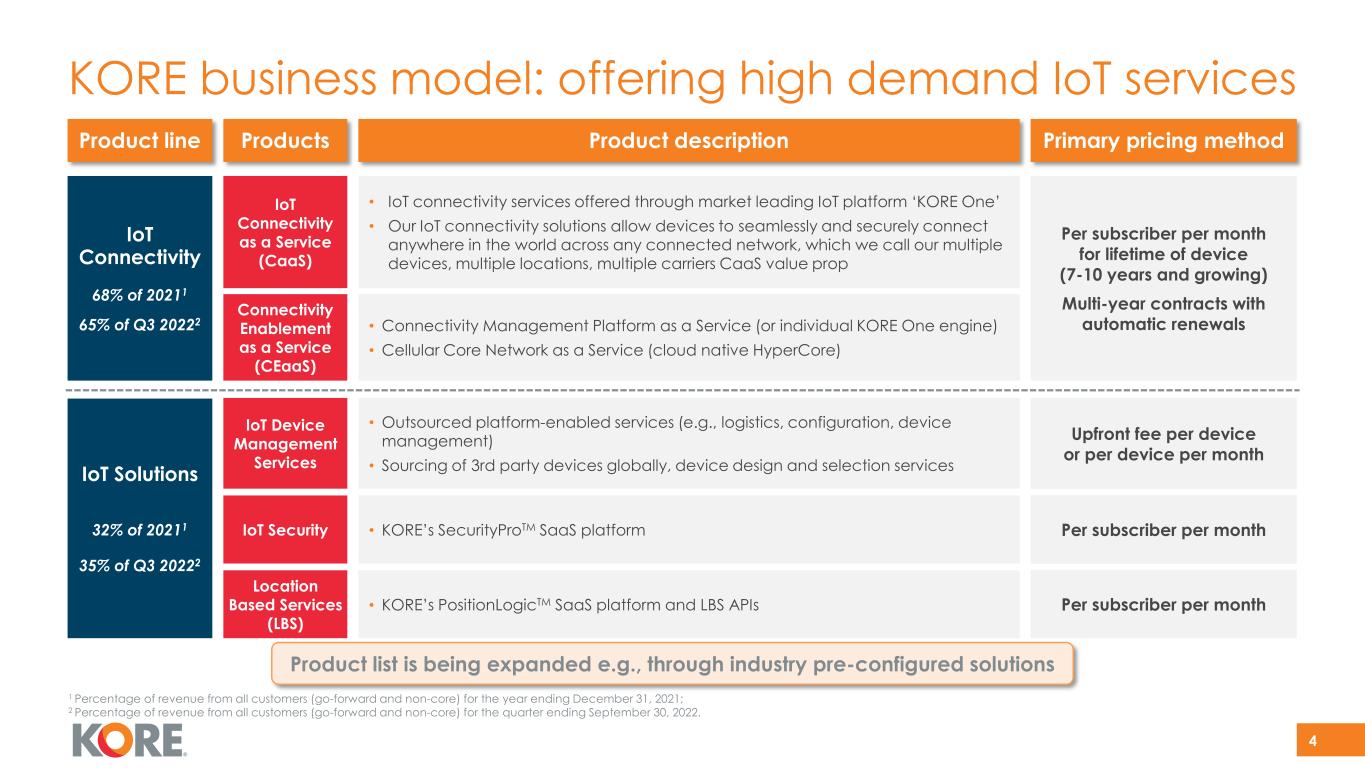

Primary pricing methodProduct line Product description IoT Connectivity 68% of 20211 65% of Q3 20222 Per subscriber per month for lifetime of device (7-10 years and growing) Multi-year contracts with automatic renewals IoT Solutions 32% of 20211 35% of Q3 20222 • IoT connectivity services offered through market leading IoT platform ‘KORE One’ • Our IoT connectivity solutions allow devices to seamlessly and securely connect anywhere in the world across any connected network, which we call our multiple devices, multiple locations, multiple carriers CaaS value prop • Connectivity Management Platform as a Service (or individual KORE One engine) • Cellular Core Network as a Service (cloud native HyperCore) Products IoT Connectivity as a Service (CaaS) Connectivity Enablement as a Service (CEaaS) IoT Device Management Services Location Based Services (LBS) • Outsourced platform-enabled services (e.g., logistics, configuration, device management) • Sourcing of 3rd party devices globally, device design and selection services IoT Security • KORE’s PositionLogicTM SaaS platform and LBS APIs Per subscriber per month • KORE’s SecurityProTM SaaS platform Per subscriber per month Upfront fee per device or per device per month 4 KORE business model: offering high demand IoT services Product list is being expanded e.g., through industry pre-configured solutions 1 Percentage of revenue from all customers (go-forward and non-core) for the year ending December 31, 2021; 2 Percentage of revenue from all customers (go-forward and non-core) for the quarter ending September 30, 2022.

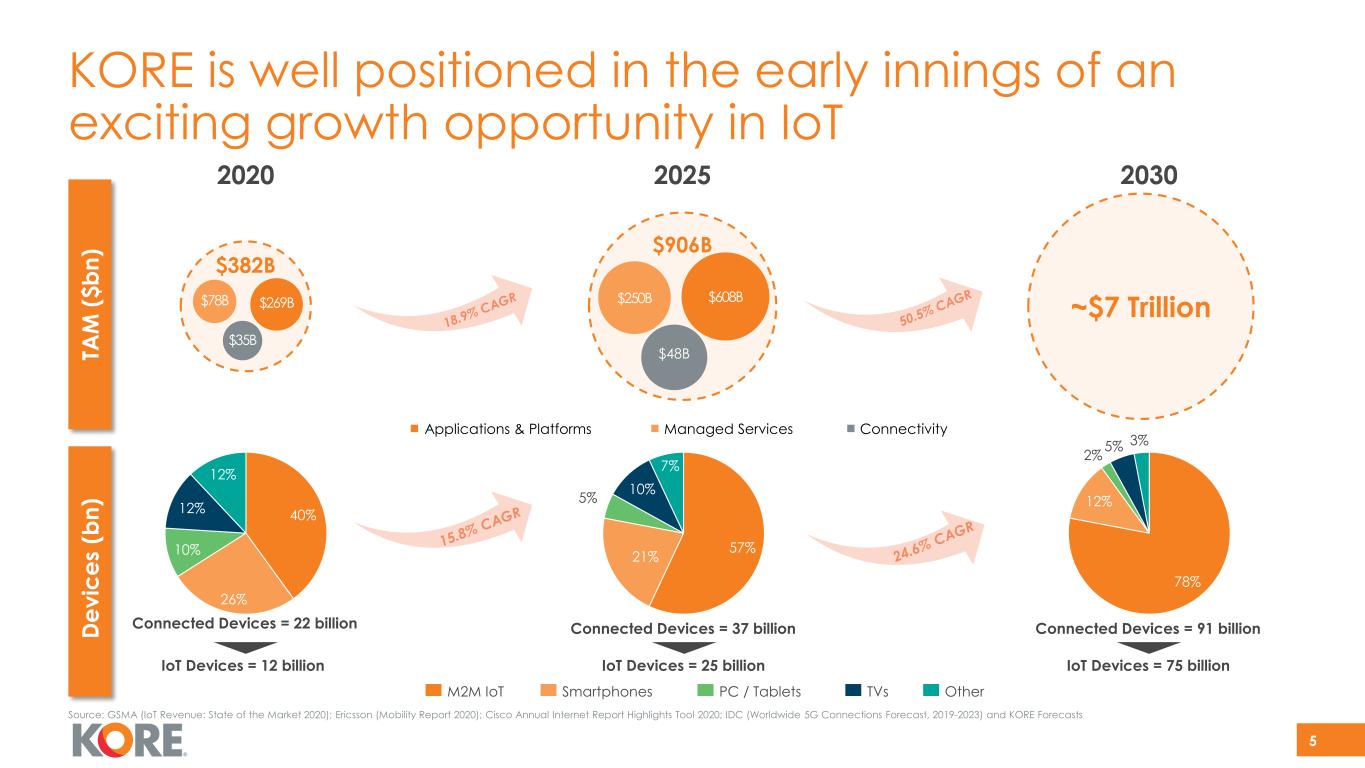

KORE is well positioned in the early innings of an exciting growth opportunity in IoT 5 2020 2025 2030 TA M ($ bn ) De vi ce s (b n) Applications & Platforms Managed Services Connectivity $906B ~$7 Trillion $382B $78B $35B $269B $250B $608B $48B IoT Devices = 12 billion Connected Devices = 22 billion IoT Devices = 25 billion Connected Devices = 37 billion IoT Devices = 75 billion Connected Devices = 91 billion 40% 26% 10% 12% 12% M2M IoT TVsSmartphones PC / Tablets Other 57%21% 10%5% 7% 78% 12% 2%5% 3% Source: GSMA (IoT Revenue: State of the Market 2020); Ericsson (Mobility Report 2020); Cisco Annual Internet Report Highlights Tool 2020; IDC (Worldwide 5G Connections Forecast, 2019-2023) and KORE Forecasts

IoT use cases are everywhere… deployments are complex • Top challenges in IoT deployments Inability to contextualize and analyze data Challenges in interoperability and compatibility Lack of solution deployment planning and experience Issues in compliance with regulations Fragmented ecosystem requiring multiple partners Lack of in- house IoT expertise and resources Risks and pitfalls in IoT Security 6 Fleet Mgmt. Connected Blood Sugar Monitors Connected Gas Tank Monitors Connected Alcohol Monitors Offender Trackers Smart Meters Smart City Lighting Systems Home Security • Sample IoT use cases

7 KORE is building the world’s first pure-play IoT enabler Connectivity. Solutions. Analytics. How we do it… ScaleManageDeploy What we do for customers...

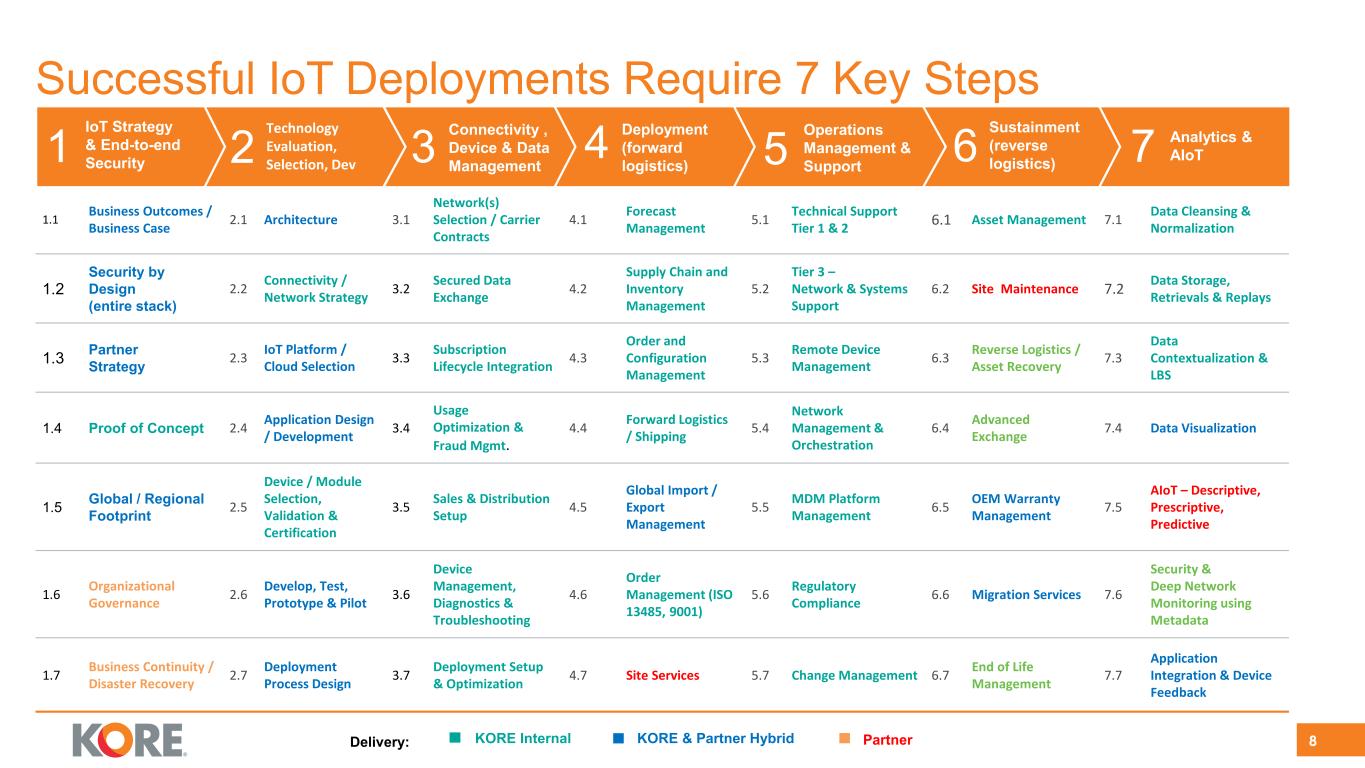

Successful IoT Deployments Require 7 Key Steps • How these services are delivered through KORE and Partners 8Delivery: KORE Internal KORE & Partner Hybrid Partner 1.1 Business Outcomes / Business Case 2.1 Architecture 3.1 Network(s) Selection / Carrier Contracts 4.1 Forecast Management 5.1 Technical Support Tier 1 & 2 6.1 Asset Management 7.1 Data Cleansing & Normalization 1.2 Security by Design (entire stack) 2.2 Connectivity / Network Strategy 3.2 Secured Data Exchange 4.2 Supply Chain and Inventory Management 5.2 Tier 3 – Network & Systems Support 6.2 Site Maintenance 7.2 Data Storage, Retrievals & Replays 1.3 Partner Strategy 2.3 IoT Platform / Cloud Selection 3.3 Subscription Lifecycle Integration 4.3 Order and Configuration Management 5.3 Remote Device Management 6.3 Reverse Logistics / Asset Recovery 7.3 Data Contextualization & LBS 1.4 Proof of Concept 2.4 Application Design / Development 3.4 Usage Optimization & Fraud Mgmt. 4.4 Forward Logistics / Shipping 5.4 Network Management & Orchestration 6.4 Advanced Exchange 7.4 Data Visualization 1.5 Global / Regional Footprint 2.5 Device / Module Selection, Validation & Certification 3.5 Sales & Distribution Setup 4.5 Global Import / Export Management 5.5 MDM Platform Management 6.5 OEM Warranty Management 7.5 AIoT – Descriptive, Prescriptive, Predictive 1.6 Organizational Governance 2.6 Develop, Test, Prototype & Pilot 3.6 Device Management, Diagnostics & Troubleshooting 4.6 Order Management (ISO 13485, 9001) 5.6 Regulatory Compliance 6.6 Migration Services 7.6 Security & Deep Network Monitoring using Metadata 1.7 Business Continuity / Disaster Recovery 2.7 Deployment Process Design 3.7 Deployment Setup & Optimization 4.7 Site Services 5.7 Change Management 6.7 End of Life Management 7.7 Application Integration & Device Feedback 1 3 4 5 6 72 IoT Strategy & End-to-end Security Technology Evaluation, Selection, Dev Connectivity , Device & Data Management Deployment (forward logistics) Operations Management & Support Sustainment (reverse logistics) Analytics & AIoT

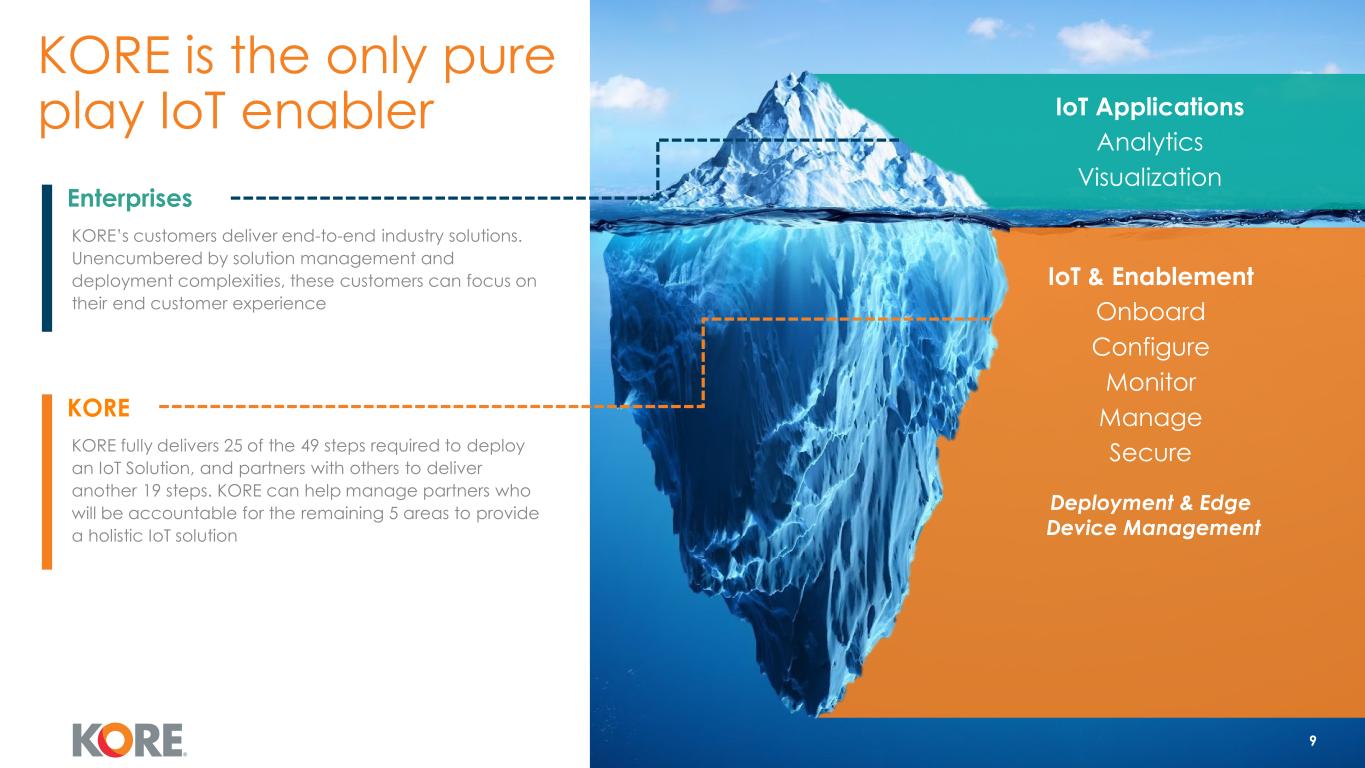

Enterprises IoT Applications Analytics Visualization IoT & Enablement Onboard Configure Monitor Manage Secure Deployment & Edge Device Management KORE KORE fully delivers 25 of the 49 steps required to deploy an IoT Solution, and partners with others to deliver another 19 steps. KORE can help manage partners who will be accountable for the remaining 5 areas to provide a holistic IoT solution KORE’s customers deliver end-to-end industry solutions. Unencumbered by solution management and deployment complexities, these customers can focus on their end customer experience 9 KORE is the only pure play IoT enabler

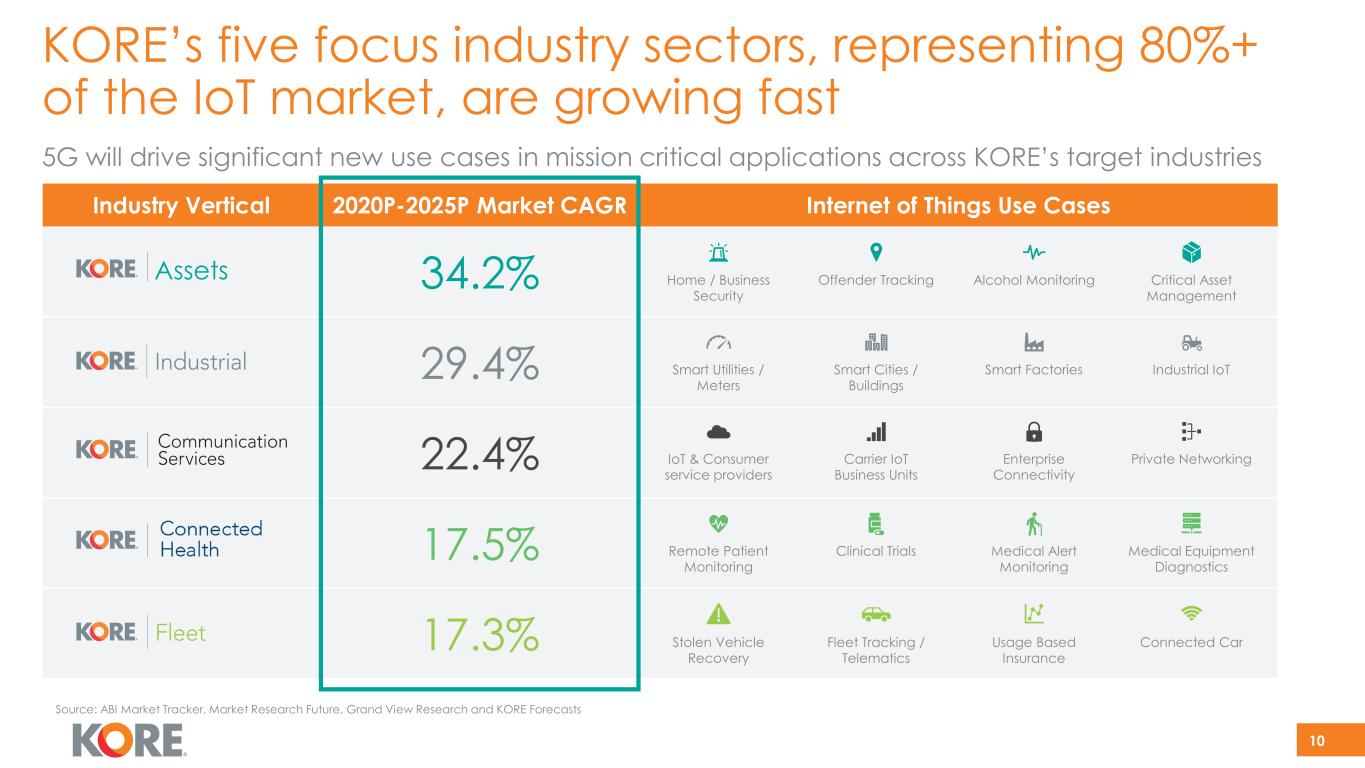

KORE’s five focus industry sectors, representing 80%+ of the IoT market, are growing fast 5G will drive significant new use cases in mission critical applications across KORE’s target industries Industry Vertical 2020P-2025P Market CAGR Internet of Things Use Cases 34.2% 29.4% 22.4% 17.5% 17.3% Remote Patient Monitoring Clinical Trials Medical Alert Monitoring Medical Equipment Diagnostics Stolen Vehicle Recovery Fleet Tracking / Telematics Usage Based Insurance Connected Car IoT & Consumer service providers Carrier IoT Business Units Enterprise Connectivity Private Networking Smart Utilities / Meters Smart Cities / Buildings Smart Factories Industrial IoT Home / Business Security Offender Tracking Critical Asset Management Alcohol MonitoringAssets 10 Source: ABI Market Tracker, Market Research Future, Grand View Research and KORE Forecasts

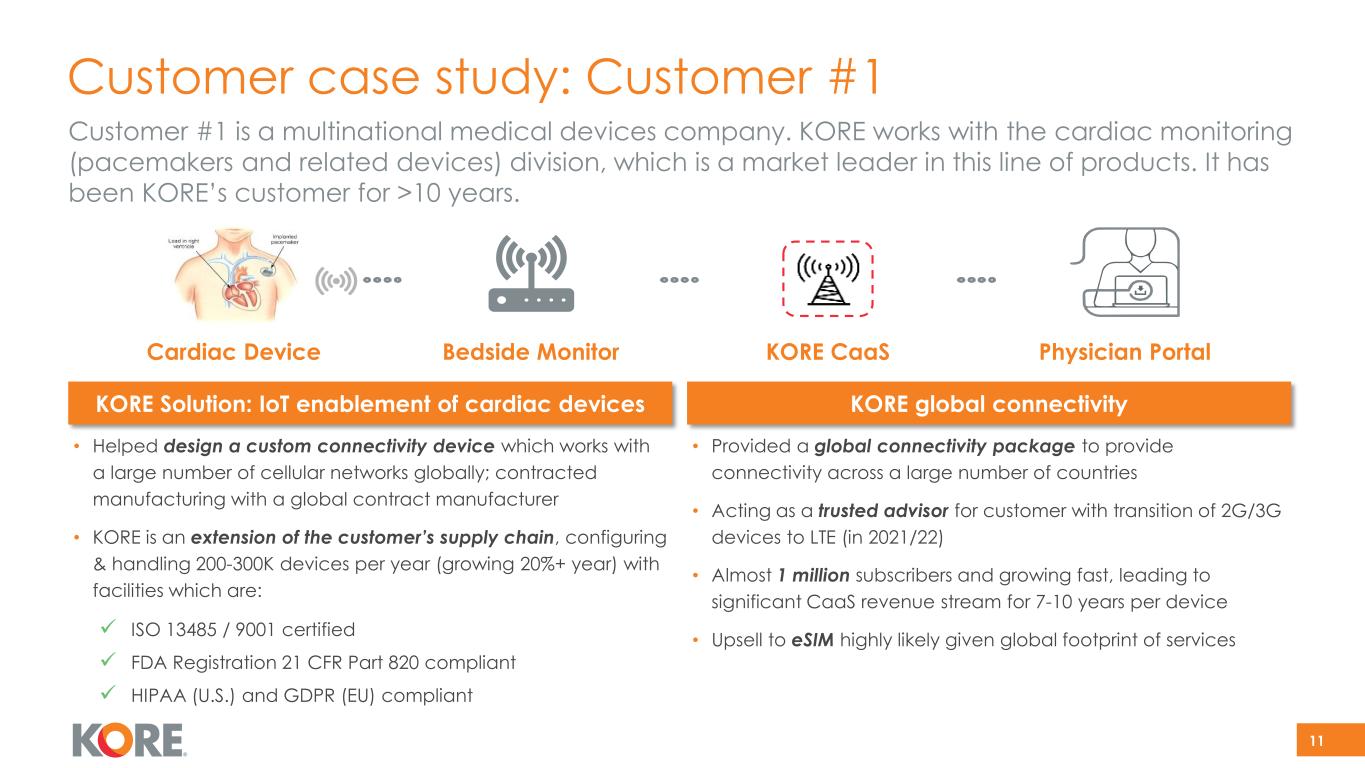

Customer case study: Customer #1 KORE global connectivity • Provided a global connectivity package to provide connectivity across a large number of countries • Acting as a trusted advisor for customer with transition of 2G/3G devices to LTE (in 2021/22) • Almost 1 million subscribers and growing fast, leading to significant CaaS revenue stream for 7-10 years per device • Upsell to eSIM highly likely given global footprint of services KORE Solution: IoT enablement of cardiac devices • Helped design a custom connectivity device which works with a large number of cellular networks globally; contracted manufacturing with a global contract manufacturer • KORE is an extension of the customer’s supply chain, configuring & handling 200-300K devices per year (growing 20%+ year) with facilities which are: ISO 13485 / 9001 certified FDA Registration 21 CFR Part 820 compliant HIPAA (U.S.) and GDPR (EU) compliant Physician PortalKORE CaaSCardiac Device Bedside Monitor 11 Customer #1 is a multinational medical devices company. KORE works with the cardiac monitoring (pacemakers and related devices) division, which is a market leader in this line of products. It has been KORE’s customer for >10 years.

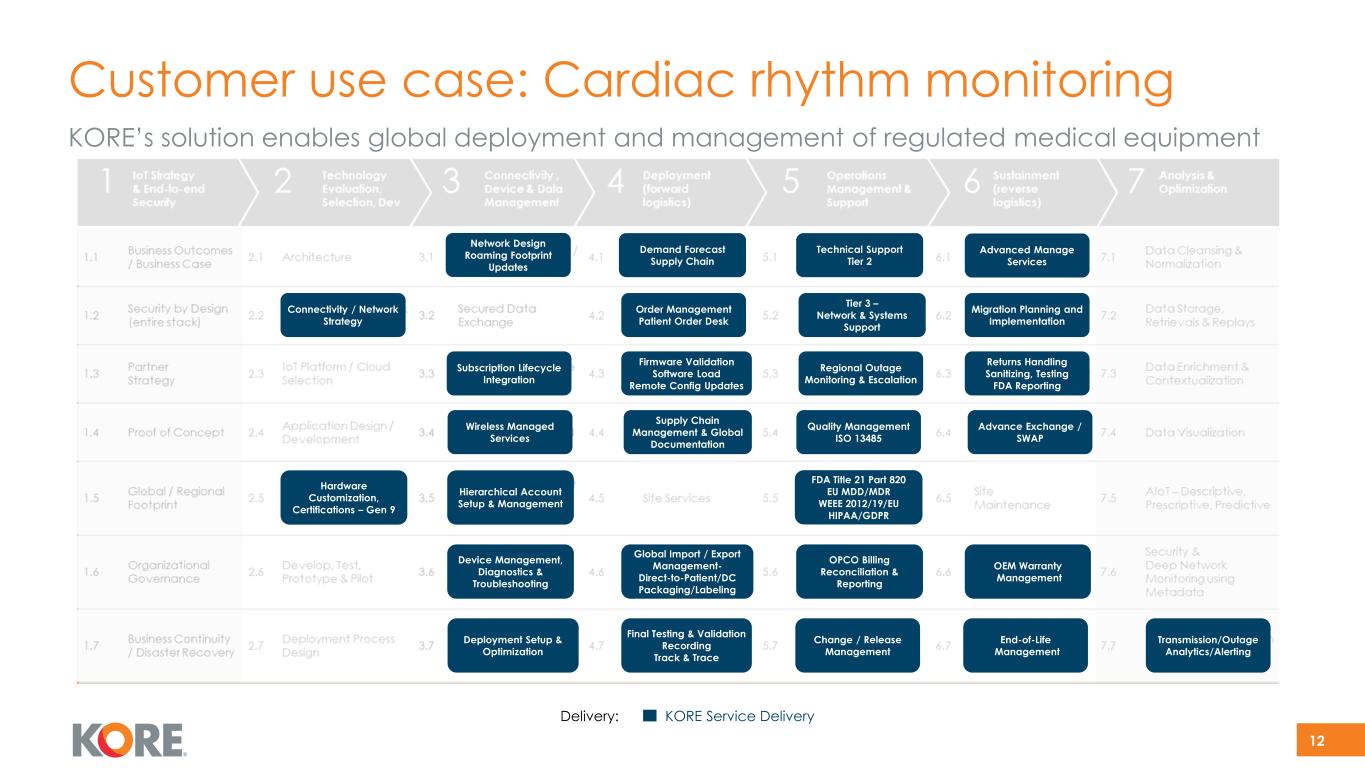

Customer use case: Cardiac rhythm monitoring KORE Service DeliveryDelivery: 12 Hardware Customization, Certifications – Gen 9 Demand Forecast Supply Chain Deployment Setup & Optimization Subscription Lifecycle Integration Network Design Roaming Footprint Updates Wireless Managed Services OPCO Billing Reconciliation & Reporting Transmission/Outage Analytics/Alerting Firmware Validation Software Load Remote Config Updates Advanced Manage Services FDA Title 21 Part 820 EU MDD/MDR WEEE 2012/19/EU HIPAA/GDPR Quality Management ISO 13485 Returns Handling Sanitizing, Testing FDA Reporting Final Testing & Validation Recording Track & Trace Global Import / Export Management- Direct-to-Patient/DC Packaging/Labeling Hierarchical Account Setup & Management Device Management, Diagnostics & Troubleshooting Order Management Patient Order Desk Supply Chain Management & Global Documentation Technical Support Tier 2 Tier 3 – Network & Systems Support Regional Outage Monitoring & Escalation Change / Release Management Advance Exchange / SWAP Migration Planning and Implementation OEM Warranty Management End-of-Life Management Connectivity / Network Strategy KORE’s solution enables global deployment and management of regulated medical equipment

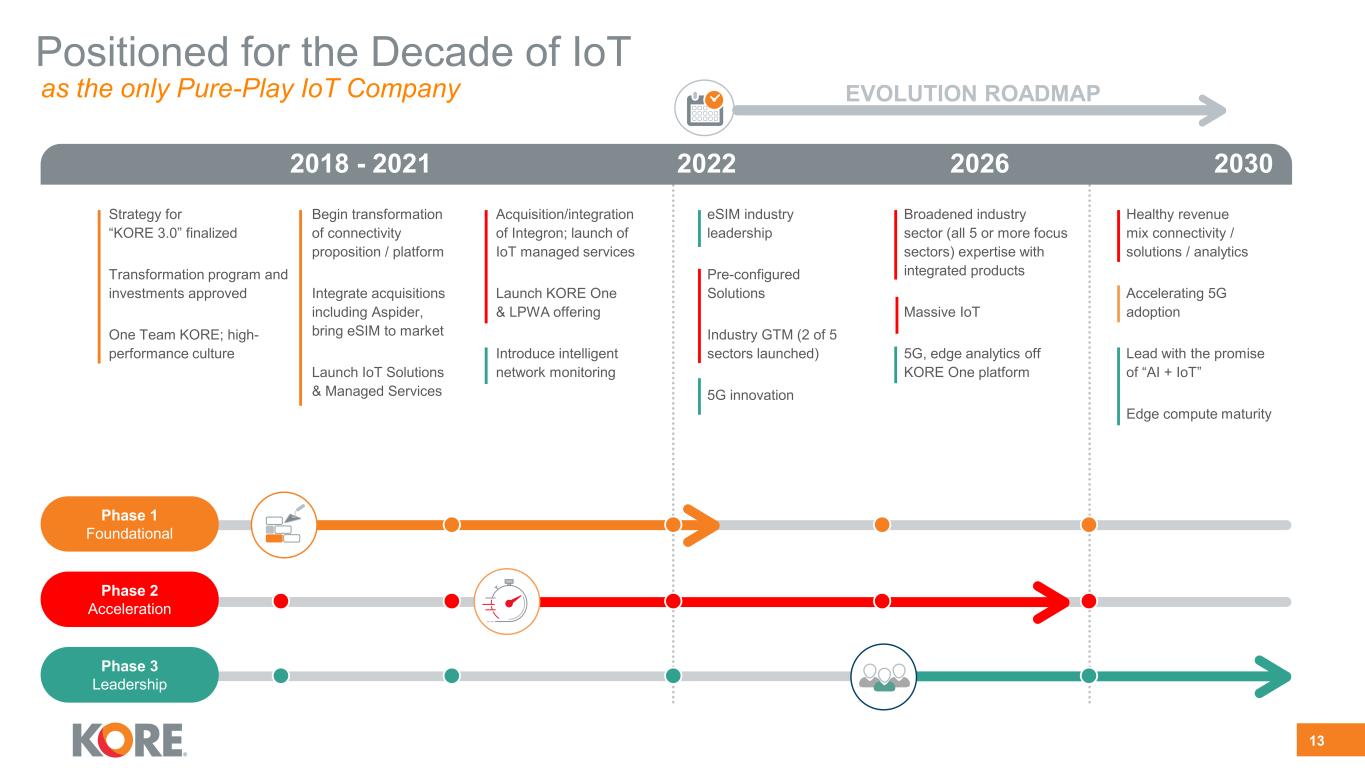

Strategy for “KORE 3.0” finalized Transformation program and investments approved One Team KORE; high- performance culture Begin transformation of connectivity proposition / platform Integrate acquisitions including Aspider, bring eSIM to market Launch IoT Solutions & Managed Services Acquisition/integration of Integron; launch of IoT managed services Launch KORE One & LPWA offering Introduce intelligent network monitoring eSIM industry leadership Pre-configured Solutions Industry GTM (2 of 5 sectors launched) 5G innovation Broadened industry sector (all 5 or more focus sectors) expertise with integrated products Massive IoT 5G, edge analytics off KORE One platform Healthy revenue mix connectivity / solutions / analytics Accelerating 5G adoption Lead with the promise of “AI + IoT” Edge compute maturity 13 as the only Pure-Play IoT Company Positioned for the Decade of IoT 2022 20302018 - 2021 Phase 1 Foundational Phase 2 Acceleration Phase 3 Leadership EVOLUTION ROADMAP 2026

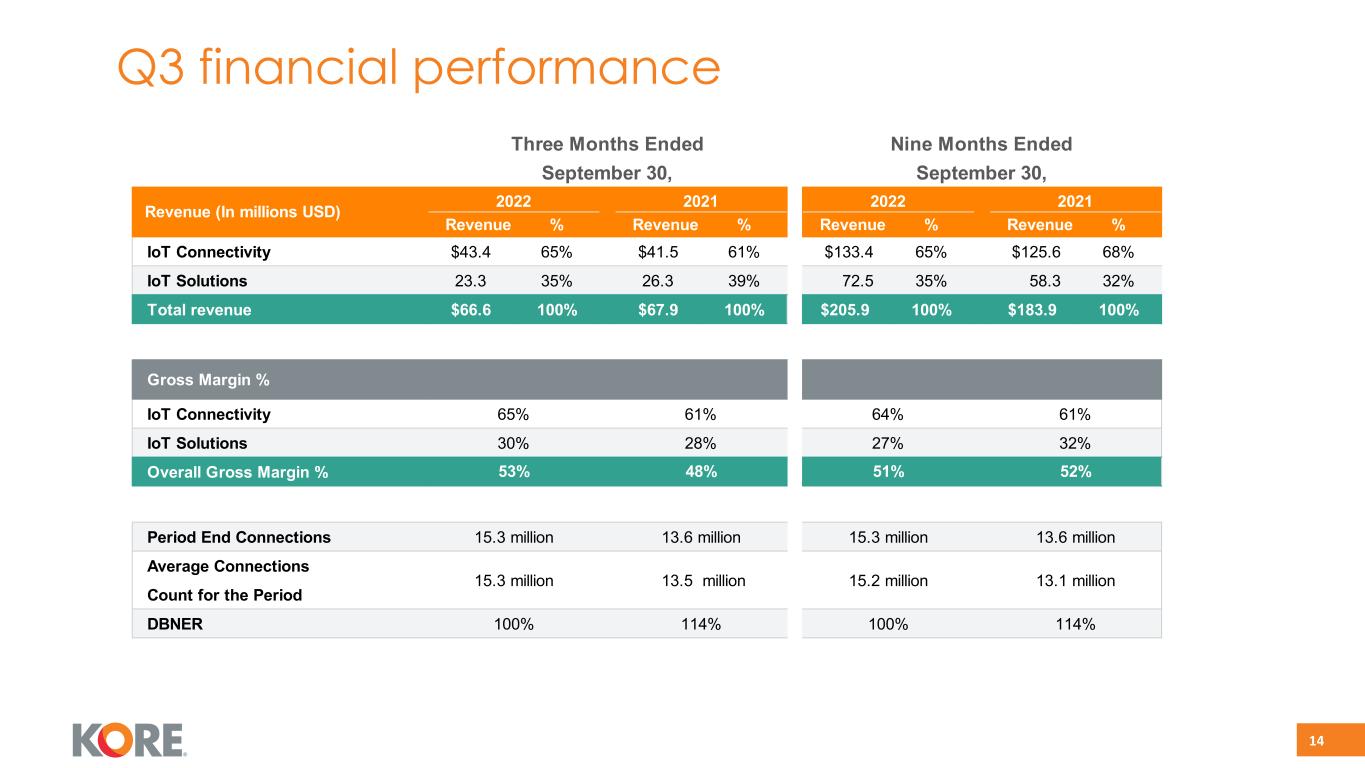

14 Q3 financial performance Revenue % Revenue % Revenue % Revenue % IoT Connectivity $43.4 65% $41.5 61% $133.4 65% $125.6 68% IoT Solutions 23.3 35% 26.3 39% 72.5 35% 58.3 32% Total revenue $66.6 100% $67.9 100% $205.9 100% $183.9 100% Gross Margin % IoT Connectivity IoT Solutions Overall Gross Margin % Period End Connections Average Connections Count for the Period DBNER Three Months Ended Nine Months Ended Revenue (In millions USD) 15.3 million 13.5 million 15.2 million 13.1 million 65% 61% 64% 61% 30% 28% 27% 32% September 30, 52% 15.3 million 13.6 million 15.3 million 13.6 million September 30, 2022 2021 2022 2021 100% 114% 100% 114% 53% 48% 51%

Appendix

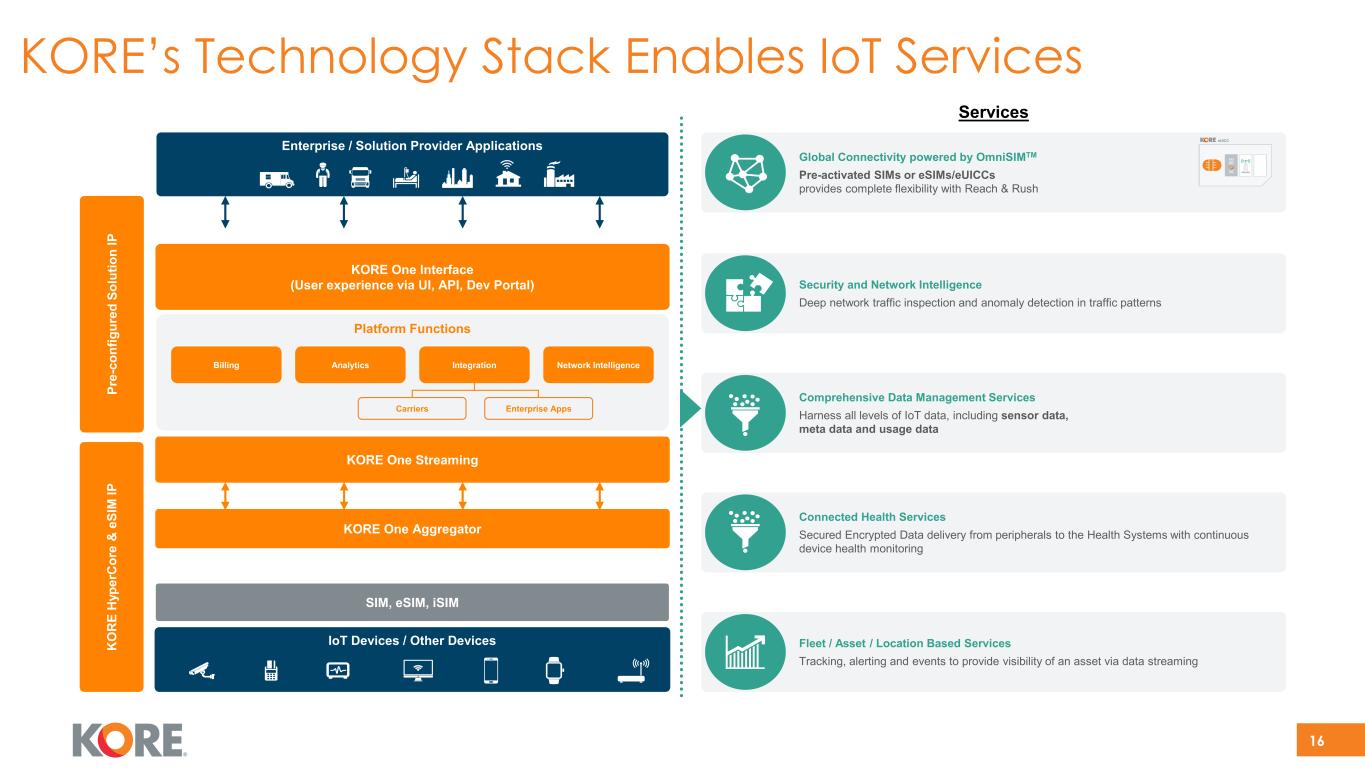

16 KORE’s Technology Stack Enables IoT Services IoT Devices / Other Devices SIM, eSIM, iSIM Enterprise / Solution Provider Applications KORE One Streaming KORE One Aggregator Platform Functions AnalyticsBilling Network IntelligenceIntegration Carriers Enterprise Apps KORE One Interface (User experience via UI, API, Dev Portal) K O R E H yp er C or e & e SI M IP Pr e- co nf ig ur ed S ol ut io n IP Global Connectivity powered by OmniSIMTM Pre-activated SIMs or eSIMs/eUICCs provides complete flexibility with Reach & Rush Security and Network Intelligence Deep network traffic inspection and anomaly detection in traffic patterns Comprehensive Data Management Services Harness all levels of IoT data, including sensor data, meta data and usage data Connected Health Services Secured Encrypted Data delivery from peripherals to the Health Systems with continuous device health monitoring Fleet / Asset / Location Based Services Tracking, alerting and events to provide visibility of an asset via data streaming Services

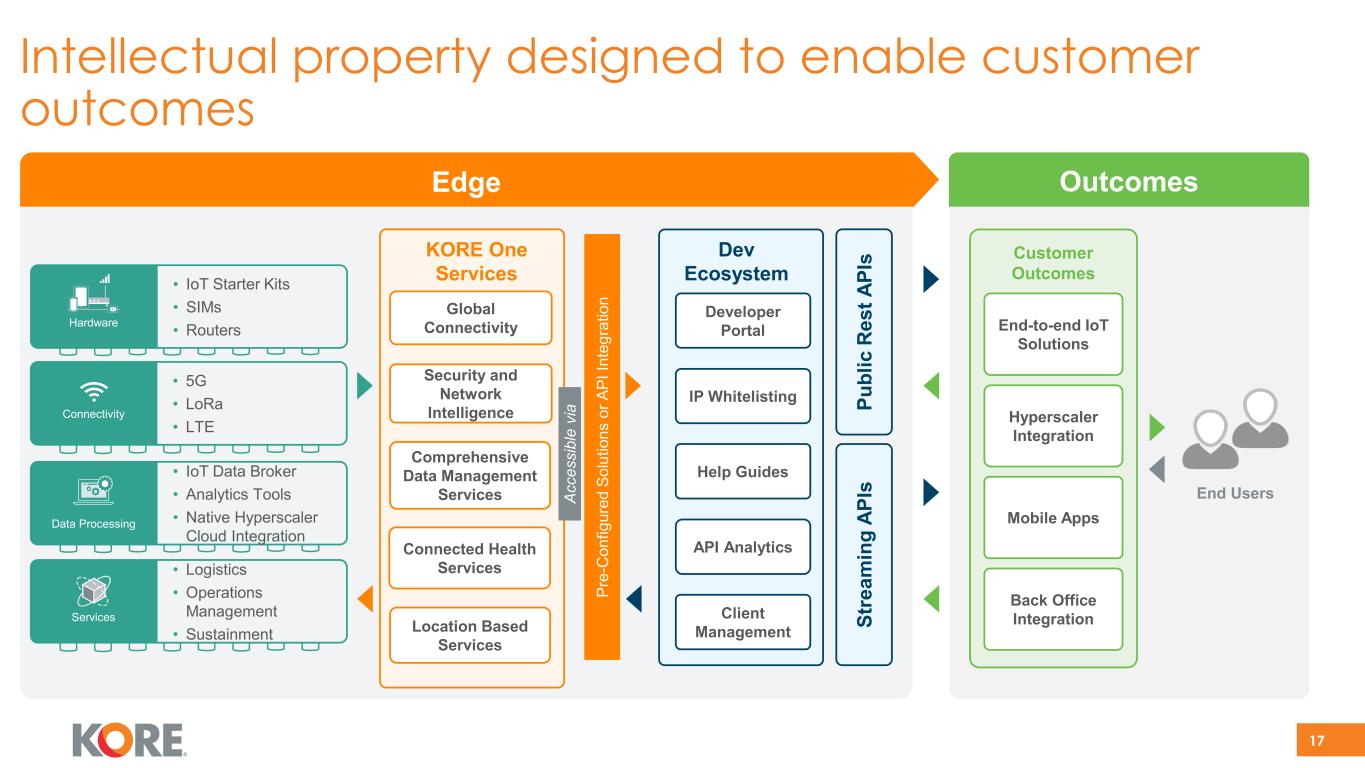

17 Intellectual property designed to enable customer outcomes Edge Global Connectivity Comprehensive Data Management Services Security and Network Intelligence Location Based Services KORE One Services Connected Health Services Customer Outcomes End-to-end IoT Solutions Dev Ecosystem Pu bl ic R es t A PI s Developer Portal IP Whitelisting Help Guides API Analytics Client Management St re am in g AP Is Hyperscaler Integration Mobile Apps Back Office Integration End Users Outcomes Pr e- C on fig ur ed S ol ut io ns o r A PI In te gr at io n A cc es si bl e vi a • 5G • LoRa • LTE Connectivity • IoT Starter Kits • SIMs • RoutersHardware • Logistics • Operations Management • Sustainment Services • IoT Data Broker • Analytics Tools • Native Hyperscaler Cloud Integration Data Processing

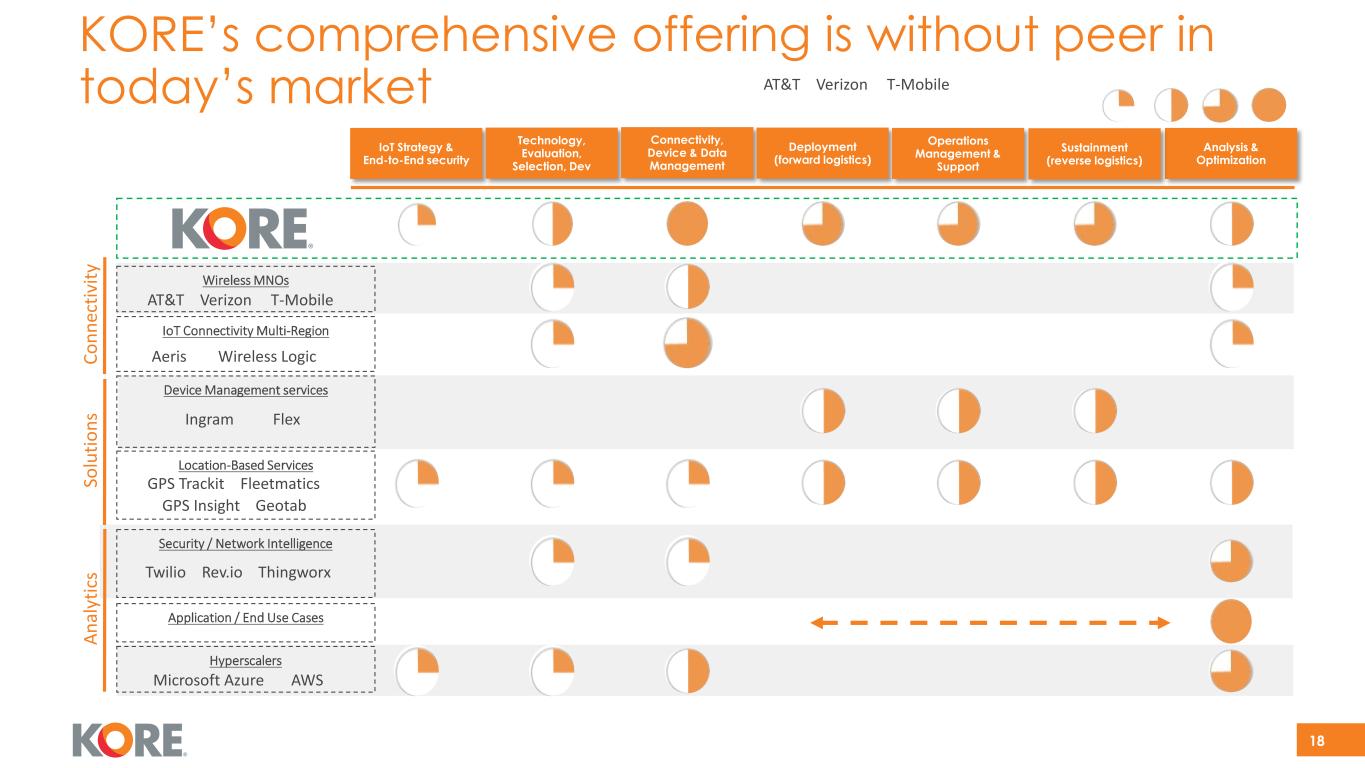

18 KORE’s comprehensive offering is without peer in today’s market 18 IoT Strategy & End-to-End security Analysis & Optimization Technology, Evaluation, Selection, Dev Connectivity, Device & Data Management Deployment (forward logistics) Operations Management & Support Sustainment (reverse logistics) Wireless MNOs IoT Connectivity Multi-Region Device Management services Location-Based Services Security / Network Intelligence Application / End Use Cases Hyperscalers An al yt ic s So lu tio ns Co nn ec tiv ity AT&T Verizon T-Mobile Aeris Wireless Logic Ingram Flex GPS Trackit Fleetmatics AT&T Verizon T-Mobile Microsoft Azure AWS GPS Insight Geotab Twilio Rev.io Thingworx

19 IoT market is accelerating, driven by significant tailwinds for the next decade1 Leading IoT offering, backed by extensive IP, creates sustainable competitive moat2 Well-diversified customer base3 Highly recurring revenue with long term visibility4 Long track record of customer retention5 Key Highlights

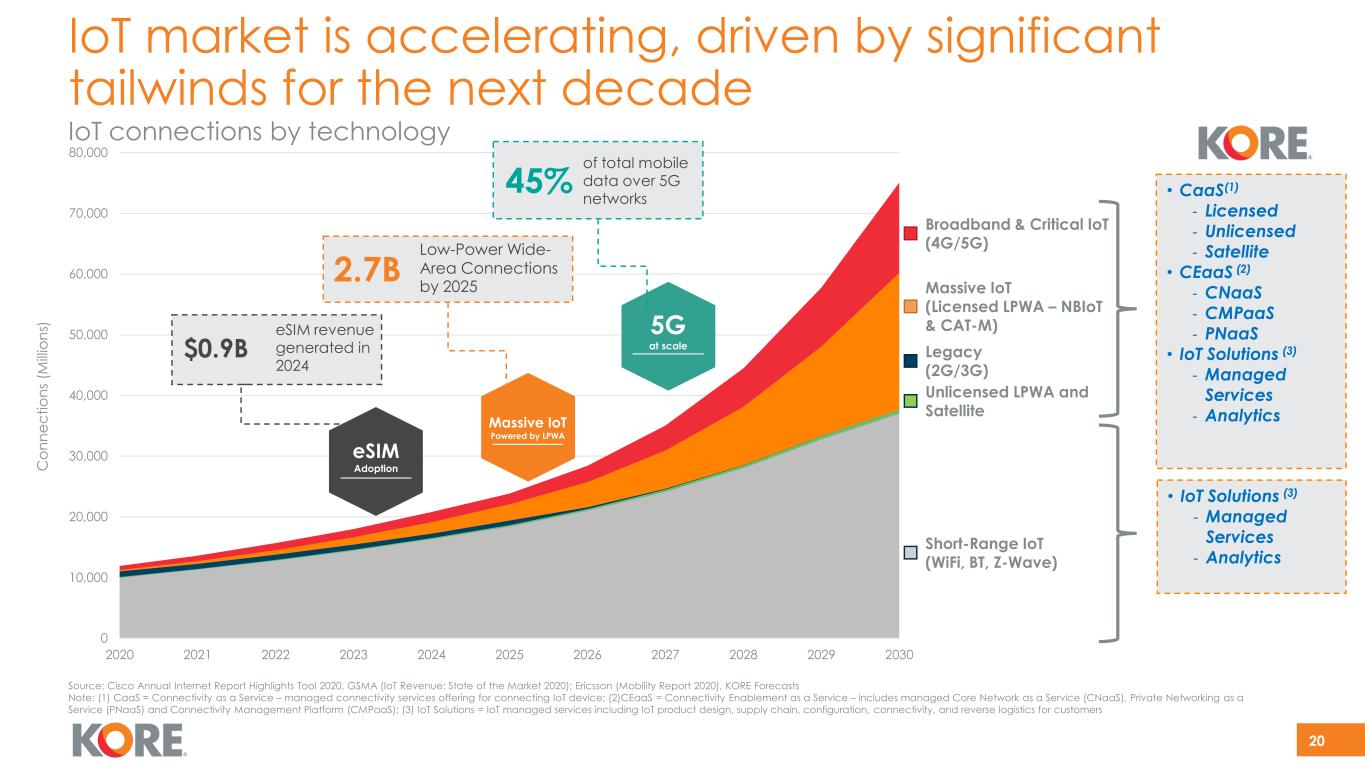

• CaaS(1) - Licensed - Unlicensed - Satellite • CEaaS (2) - CNaaS - CMPaaS - PNaaS • IoT Solutions (3) - Managed Services - Analytics 20 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 C on ne ct io ns (M illi on s) IoT market is accelerating, driven by significant tailwinds for the next decade IoT connections by technology Massive IoT Powered by LPWA 2.7B Low-Power Wide- Area Connections by 2025 5G at scale of total mobile data over 5G networks 45% eSIM Adoption eSIM revenue generated in 2024 $0.9B Broadband & Critical IoT (4G/5G) Massive IoT (Licensed LPWA – NBIoT & CAT-M) Legacy (2G/3G) Unlicensed LPWA and Satellite Short-Range IoT (WiFi, BT, Z-Wave) • IoT Solutions (3) - Managed Services - Analytics Source: Cisco Annual Internet Report Highlights Tool 2020, GSMA (IoT Revenue: State of the Market 2020); Ericsson (Mobility Report 2020), KORE Forecasts Note: (1) CaaS = Connectivity as a Service – managed connectivity services offering for connecting IoT device; (2)CEaaS = Connectivity Enablement as a Service – includes managed Core Network as a Service (CNaaS), Private Networking as a Service (PNaaS) and Connectivity Management Platform (CMPaaS); (3) IoT Solutions = IoT managed services including IoT product design, supply chain, configuration, connectivity, and reverse logistics for customers

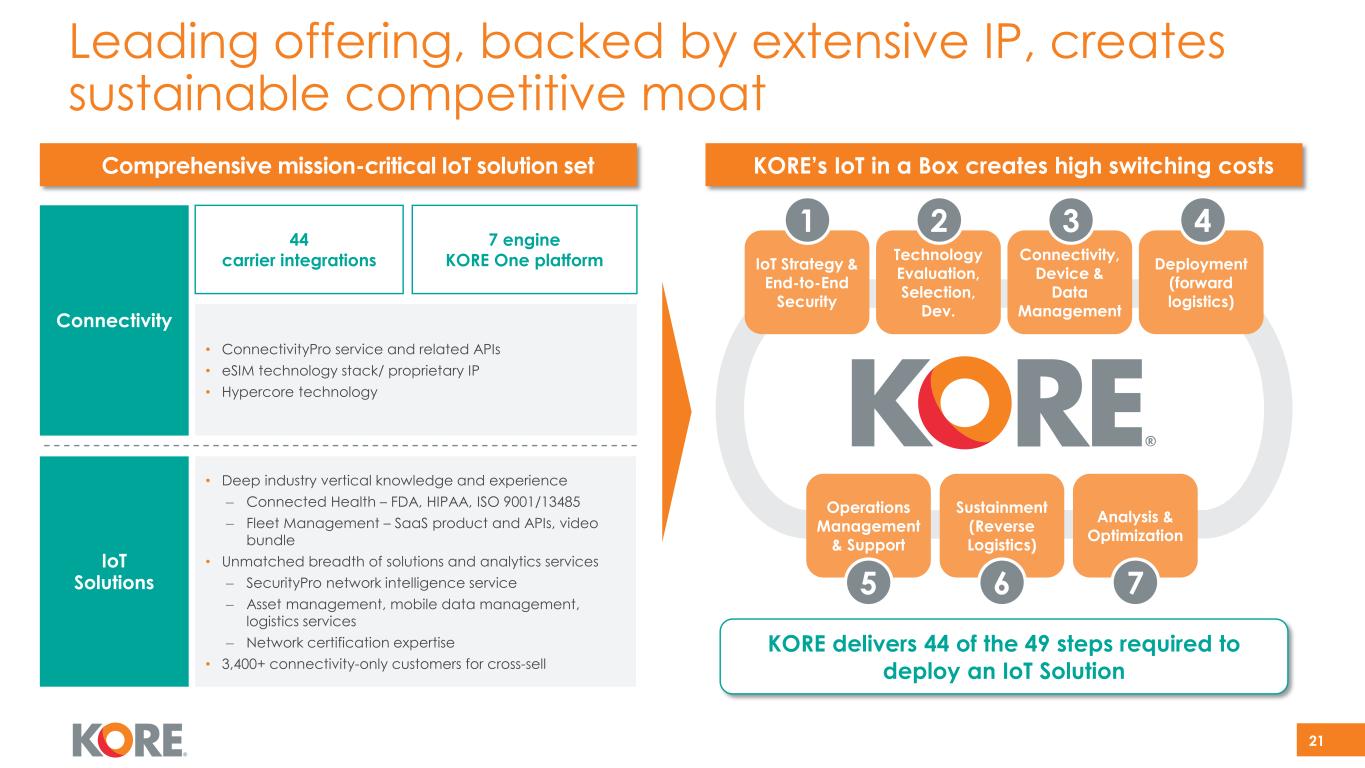

Leading offering, backed by extensive IP, creates sustainable competitive moat 21 • ConnectivityPro service and related APIs • eSIM technology stack/ proprietary IP • Hypercore technology Connectivity IoT Solutions • Deep industry vertical knowledge and experience ‒ Connected Health – FDA, HIPAA, ISO 9001/13485 ‒ Fleet Management – SaaS product and APIs, video bundle • Unmatched breadth of solutions and analytics services ‒ SecurityPro network intelligence service ‒ Asset management, mobile data management, logistics services ‒ Network certification expertise • 3,400+ connectivity-only customers for cross-sell • Comprehensive mission-critical IoT solution set • KORE’s IoT in a Box creates high switching costs IoT Strategy & End-to-End Security Technology Evaluation, Selection, Dev. Connectivity, Device & Data Management Deployment (forward logistics) Operations Management & Support Sustainment (Reverse Logistics) Analysis & Optimization 1 2 3 4 5 6 7 KORE delivers 44 of the 49 steps required to deploy an IoT Solution 44 carrier integrations 7 engine KORE One platform

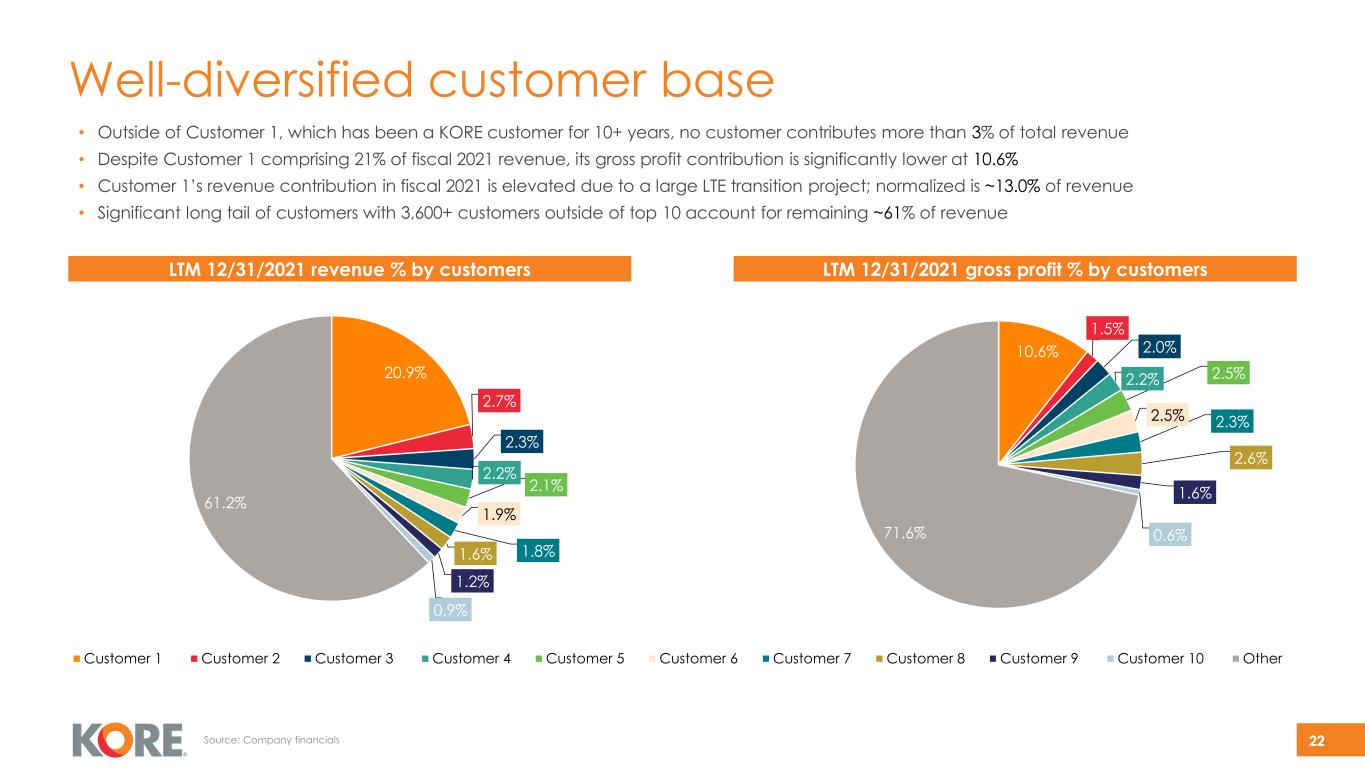

22Source: Company financials Well-diversified customer base • Outside of Customer 1, which has been a KORE customer for 10+ years, no customer contributes more than 3% of total revenue • Despite Customer 1 comprising 21% of fiscal 2021 revenue, its gross profit contribution is significantly lower at 10.6% • Customer 1’s revenue contribution in fiscal 2021 is elevated due to a large LTE transition project; normalized is ~13.0% of revenue • Significant long tail of customers with 3,600+ customers outside of top 10 account for remaining ~61% of revenue LTM 12/31/2021 revenue % by customers LTM 12/31/2021 gross profit % by customers 20.9% 2.7% 2.3% 2.2% 2.1% 1.9% 1.8% 1.6% 1.2% 0.9% 61.2% Customer 1 Customer 2 Customer 3 Customer 4 Customer 5 Customer 6 Customer 7 Customer 8 Customer 9 Customer 10 Other 10.6% 1.5% 2.0% 2.2% 2.5% 2.5% 2.3% 2.6% 1.6% 0.6% 71.6%

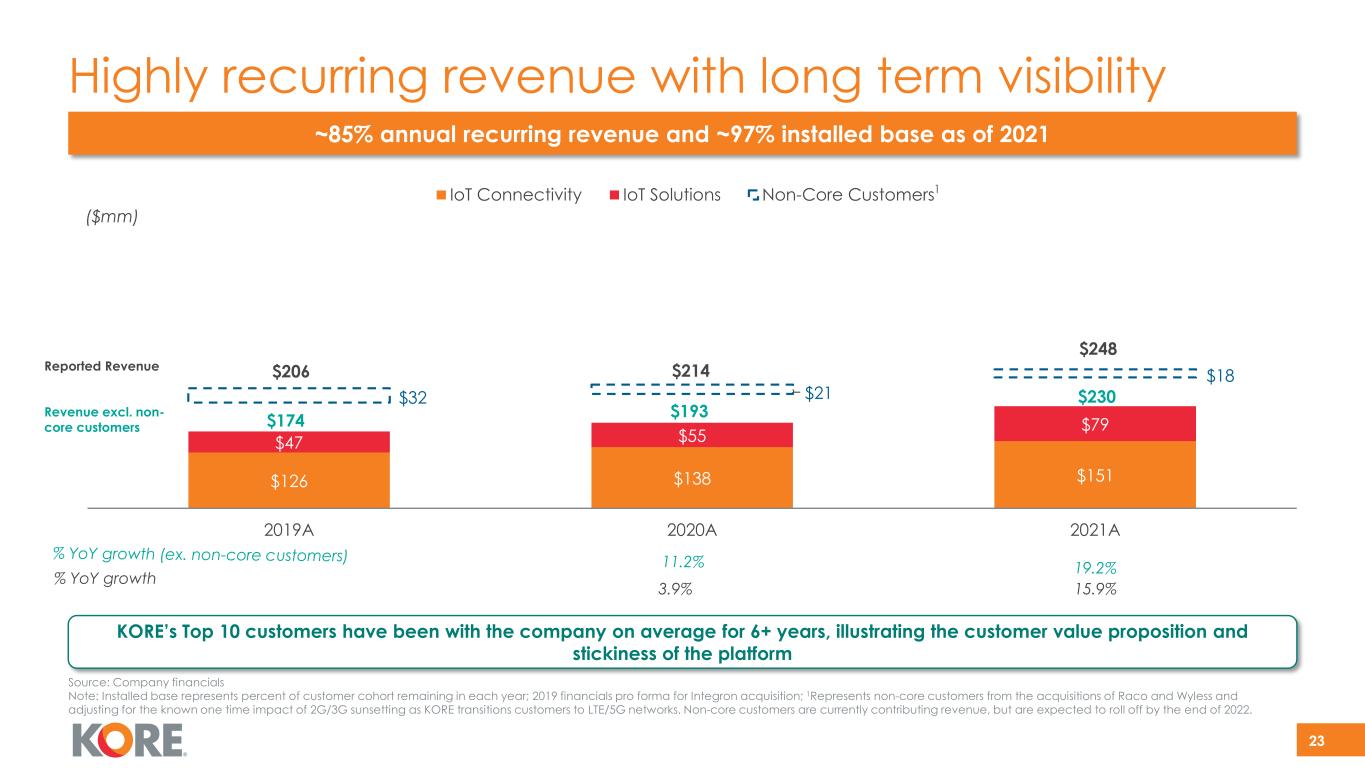

~85% annual recurring revenue and ~97% installed base as of 2021 23 Highly recurring revenue with long term visibility $206 $214 $248 $126 $138 $151 $47 $55 $79 $32 $21 $18 2019A 2020A 2021A IoT Connectivity IoT Solutions Non-Core Customers ($mm) KORE’s Top 10 customers have been with the company on average for 6+ years, illustrating the customer value proposition and stickiness of the platform $193Revenue excl. non- core customers Source: Company financials Note: Installed base represents percent of customer cohort remaining in each year; 2019 financials pro forma for Integron acquisition; 1Represents non-core customers from the acquisitions of Raco and Wyless and adjusting for the known one time impact of 2G/3G sunsetting as KORE transitions customers to LTE/5G networks. Non-core customers are currently contributing revenue, but are expected to roll off by the end of 2022. $174 Reported Revenue 1 % YoY growth 3.9% $230 15.9%

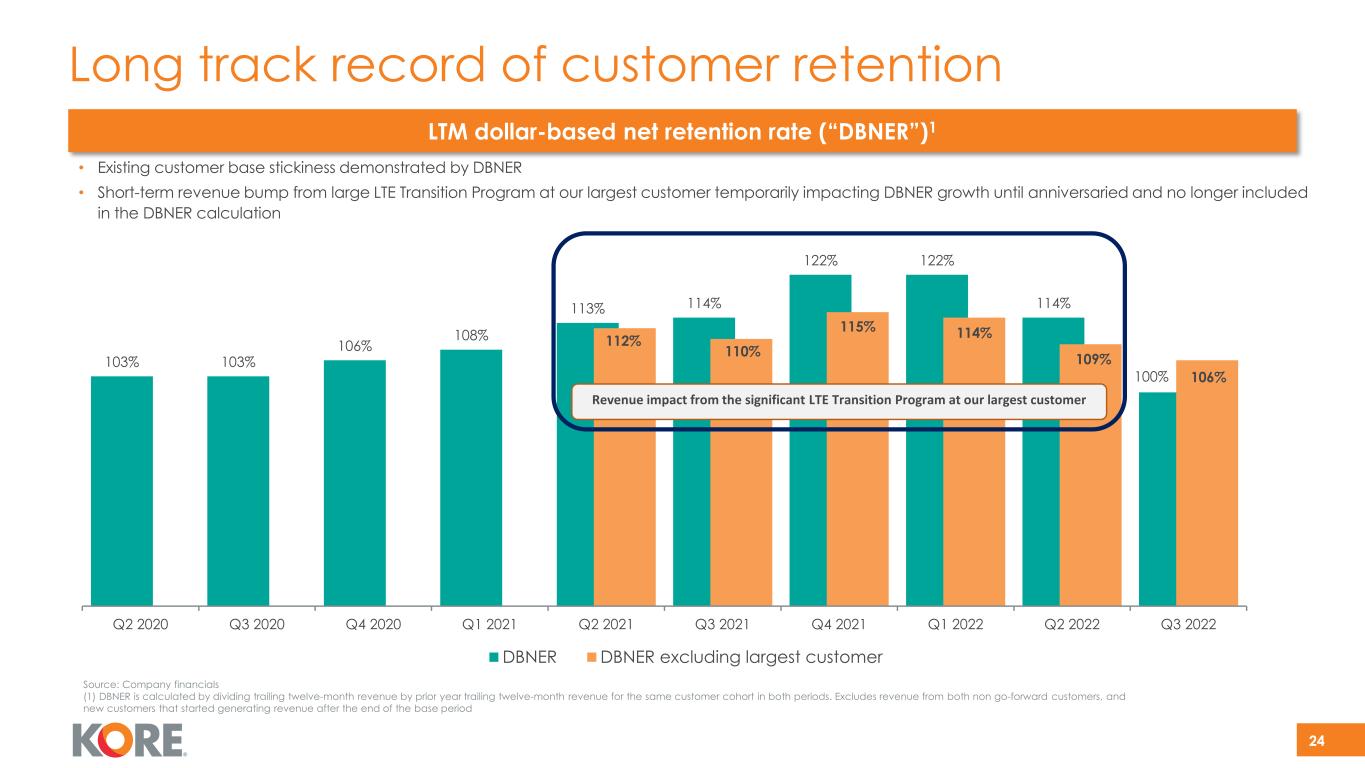

24 Long track record of customer retention 103% 103% 106% 108% 113% 114% 122% 122% 114% 100% 112% 110% 115% 114% 109% 106% Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 DBNER DBNER excluding largest customer Revenue impact from the significant LTE Transition Program at our largest customer Source: Company financials (1) DBNER is calculated by dividing trailing twelve-month revenue by prior year trailing twelve-month revenue for the same customer cohort in both periods. Excludes revenue from both non go-forward customers, and new customers that started generating revenue after the end of the base period LTM dollar-based net retention rate (“DBNER”)1 • Existing customer base stickiness demonstrated by DBNER • Short-term revenue bump from large LTE Transition Program at our largest customer temporarily impacting DBNER growth until anniversaried and no longer included in the DBNER calculation

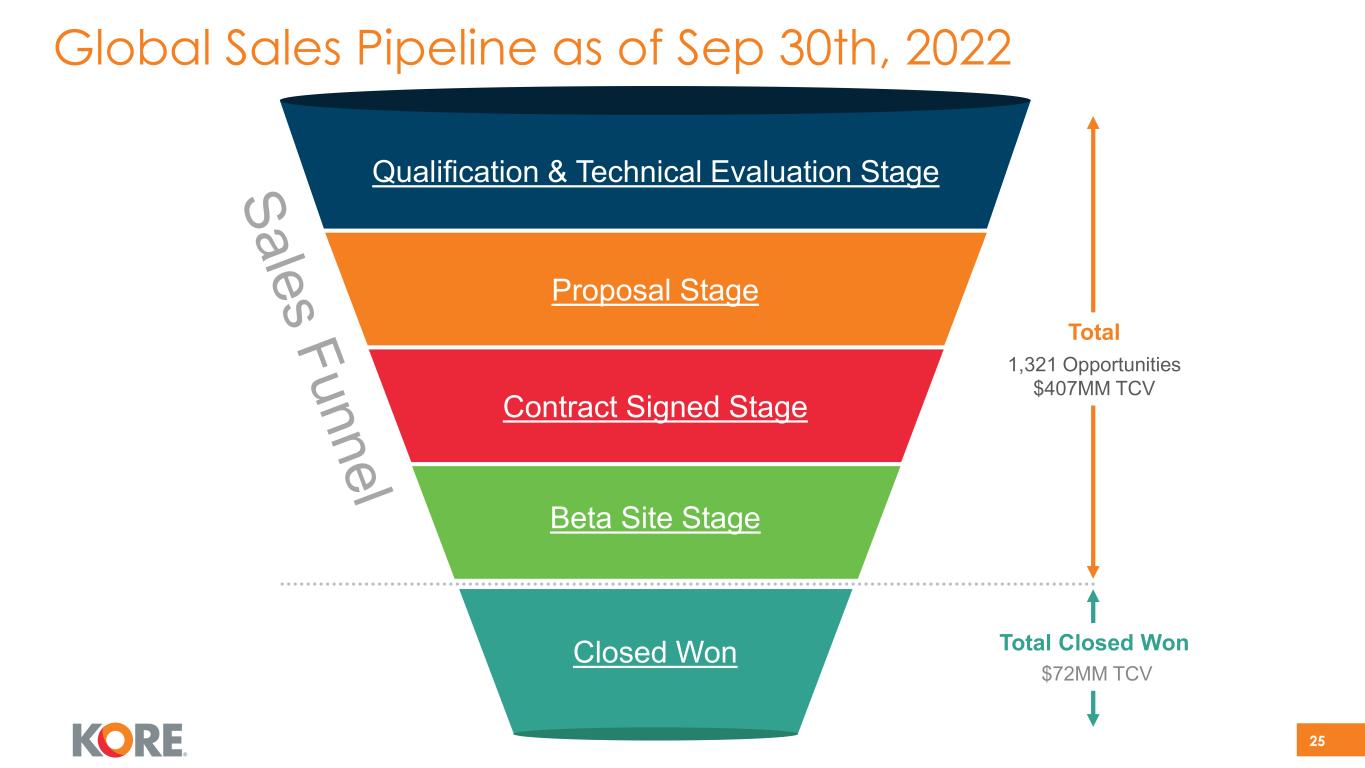

Global Sales Pipeline as of Sep 30th, 2022 25 Total Qualification & Technical Evaluation Stage Proposal Stage Contract Signed Stage Beta Site Stage Total Closed Won $72MM TCV Closed Won 1,321 Opportunities $407MM TCV

Reconciliation of Net Loss to EBITDA, Adjusted EBITDA 26 Columns may not sum due to rounding (In milliopns USD) 2022 2021 2022 2021 Net loss ($13.0) ($4.5) ($35.1) ($12.5) Net loss margin (19.6%) (6.6%) (16.1%) (6.8%) Income tax benefit (2.5) (3.7) (7.8) (7.6) Interest Expense 8.2 5.6 22.1 16.2 Depreciation & Amortization 13.7 12.4 40.7 37.9 EBITDA 6.2 9.7 19.7 33.9 Change in FV of warrant liabilities (non-cash) (0.1) (2.9) (0.3) (5.3) Transformation expenses 2.5 2.4 5.9 6.2 Acquisition and integration-related restructuring costs 2.6 2.8 11.7 7.3 Stock-based compensation (non-cash) 3.0 3.9 7.6 4.6 Foreign currency loss (non-cash) 1.1 (0.2) 1.6 (0.2) Other 0.2 0.1 0.7 0.4 Adjusted EBITDA $15.4 $15.8 $46.9 $46.9 Adjusted EBITDA Margin 23.1% 23.3% 22.8% 25.5% Three Months Ended September 30, Nine Months Ended September 30,

27 Financial Policy Overview Leverage • Target senior net leverage(1) of ~3x within ~24 months • Target total net leverage(2) of ~4x within ~24 months M&A • Target ‘tuck-in’ opportunities to expand geographically, build out capabilities in industry verticals, enhance technical and analytical know-how, as well as 5G and Edge Compute readiness • Target accretive, deleveraging transactions (combination of cash and equity) Capital Allocation • No shareholder distribution expected in the near-term • Free cash flow will be re-invested in the business, used for M&A or to pay down debt (1) Senior net leverage – ((indebtedness under UBS term loan, less cash and cash equivalents) / last 12 months’ Adjusted EBITDA)) (2) Total net leverage – ((total debt, including convertible notes issued pursuant to backstop financing, less cash and cash equivalents) / last 12 months’ Adjusted EBITDA))