KORE Group Holdings, Inc.

3 Ravinia Drive NE, Suite 500

Atlanta, Georgia 30346

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD June 15, 2023

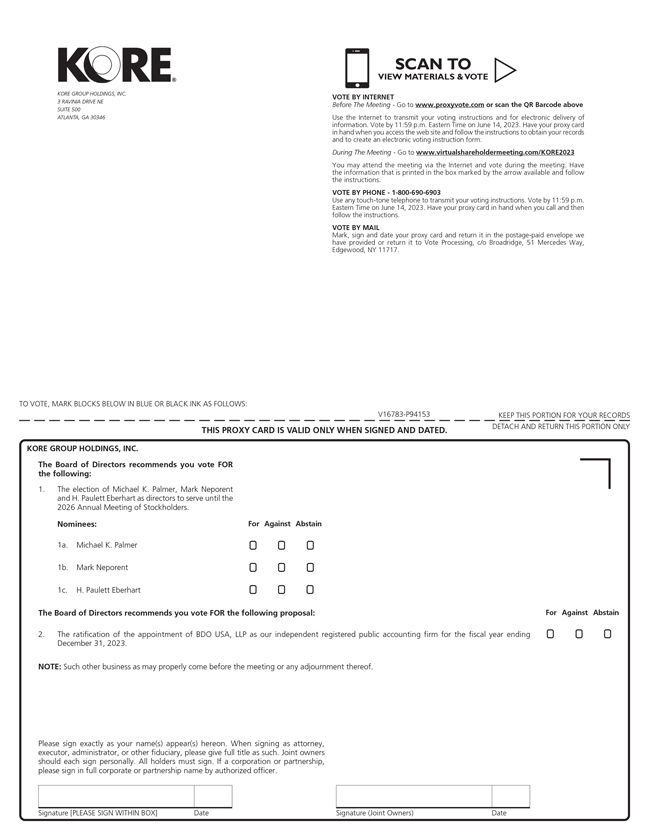

The Annual Meeting of Stockholders (the “Annual Meeting”) of KORE Group Holdings, Inc., a Delaware corporation (the “Company”), will be held at 9:00 a.m. Eastern time on June 15, 2023. The Annual Meeting will be a completely virtual meeting and will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/KORE2023 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will be held for the following purposes:

| • | to elect Michael K. Palmer, Mark Neporent and H. Paulett Eberhart as Class II directors to serve until the 2026 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified; |

| • | to ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

| • | postponement or adjournment of the Annual Meeting. |

Holders of record of our common stock as of the close of business on April 20, 2023, are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to Jack W. Kennedy Jr., Executive Vice President, Chief Legal Officer and Secretary, at investors@korewireless.com, stating the purpose of the request and providing proof of ownership of Company stock. The list of these stockholders will also be available on the bottom of your screen during the Annual Meeting after entering the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. You may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

| By Order of the Board of Directors |

| /s/ Jack W. Kennedy Jr. |

| Jack W. Kennedy Jr. |

| Executive Vice President, Chief Legal Officer and Secretary Atlanta, Georgia May 1, 2023 |

2