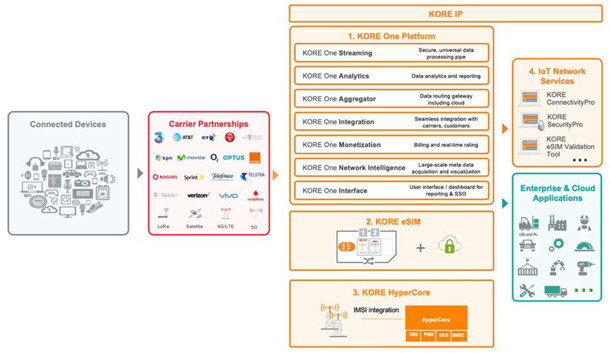

Full stack product suite

one-stop

shop for enterprise customers seeking to obtain multiple IoT services and solutions from a single provider. KORE’s product scope is as described below: | Product line |

Products |

Product description |

Primary pricing method | |||

| IoT Connectivity 68% and 74% of full year 2021 and 2020 revenue, respectively |

IoT Connectivity as a Service (CaaS) |

• IoT Connectivity services offered through our market leading IoT platform ‘KORE One’ ™ • Our connectivity solutions allow devices to seamlessly and securely connect anywhere in the world across any connected network, which we call our multiple devices, multiple locations, multiple carriers CaaS multi-value proposition • IoT Connectivity Management Platform as a Service (or individual KORE One engine) • Cellular Core Network as a Service (Cloud Native Evolved Packet Core “EPC”) |

Per subscriber per month for lifetime of device (7-10 years and growing)Multi-year contracts with automatic renewals | |||

| IoT Connectivity Enablement as a Service (CEaaS) | ||||||

| IoT Solutions 32% and 26% of full year 2021 and 2020 revenue, respectively |

IoT Device Management Services |

• Outsourced platform-enabled services (e.g., logistics, configuration, device management) Sourcing of third-party devices globally, device design and selection services |

Upfront fee per device or per device per month | |||

| IoT Security Location Based Services (LBS) |

• KORE’s SecurityPro ® SaaS platform• KORE’s PositionLogic ® SaaS platform and LBS APIs |

Per subscriber per month | ||||

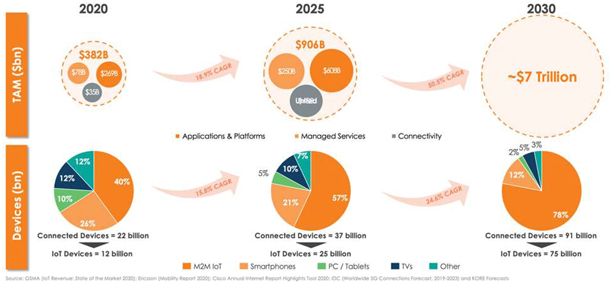

IoT Connectivity

KORE’s heritage is in delivering IoT Connectivity services, particularly cellular connectivity, which is needed in a large number of IoT use cases. Managing cellular connectivity for IoT devices is complex. Companies deploying IoT devices often do so in multiple countries and sometimes across multiple continents. Even within an individual country, it is often the case that no single carrier offers 100% network coverage or coverage across all cellular technologies. Among other

8