Filed Pursuant to Rule 424B3

Registration No. 333-255121

PROXY STATEMENT FOR

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

CERBERUS TELECOM ACQUISITION CORP.

(A CAYMAN ISLANDS EXEMPTED COMPANY)

PROSPECTUS FOR

67,814,463

SHARES OF COMMON STOCK

8,911,745 WARRANTS TO PURCHASE SHARES OF COMMON STOCK AND

8,911,745 SHARES OF COMMON STOCK UNDERLYING WARRANTS

OF KING PUBCO, INC. WHICH WILL BE RENAMED “KORE GROUP HOLDINGS, INC.”

IN CONNECTION WITH THE BUSINESS COMBINATION DESCRIBED HEREIN

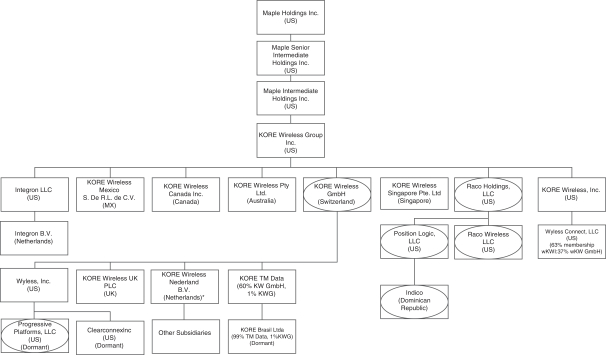

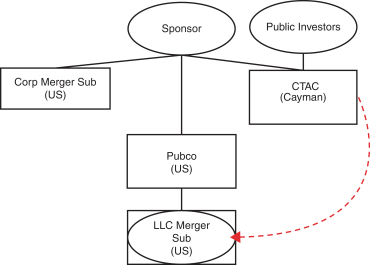

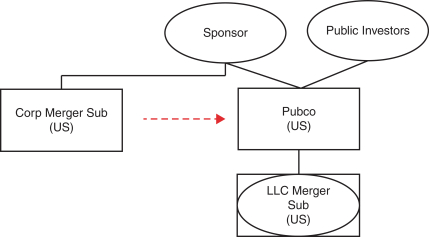

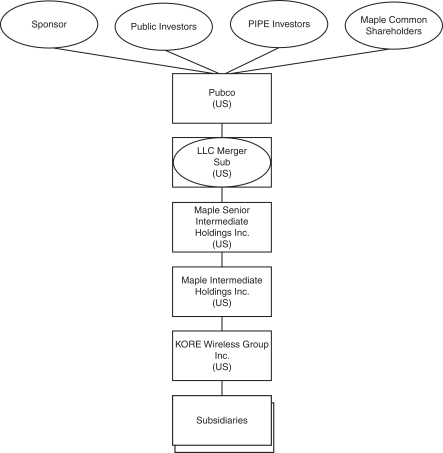

The board of directors of

Cerberus Telecom Acquisition Corp., a Cayman Islands exempted company (“CTAC”, “we” or “our”), has unanimously approved the business combination of CTAC with Maple Holdings Inc., a Delaware

corporation (“KORE”) pursuant to the terms and conditions of the Agreement and Plan of Merger, dated as of March 12, 2021, as amended on July 27, 2021 (the “Merger Agreement”), by and among CTAC, King Pubco,

Inc. (“Pubco”), Corp Merger Sub, Inc. (“Corp Merger Sub”), LLC Merger Sub, LLC (“LLC Merger Sub”), and KORE, as more fully described in this proxy statement/prospectus. Upon consummation of the

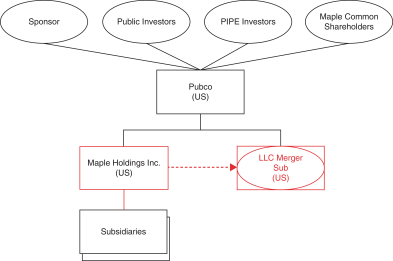

proposed mergers and the other transactions contemplated by the Merger Agreement (collectively, the “Transactions”), Pubco will be listed on the New York Stock Exchange (“NYSE”) and change its name to “KORE

Group Holdings, Inc.”

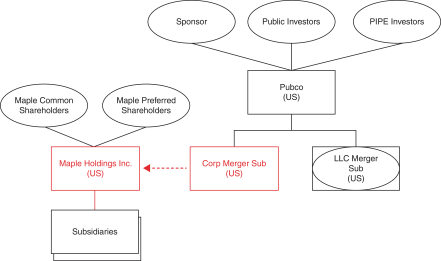

As a result of the proposed business combination, all shares of common stock, preferred stock, warrants and options of KORE, in

each case, outstanding immediately prior to the effective time of the first step contemplated by the proposed merger, will be cancelled in exchange for the right to receive a portion of the “Closing Cash Consideration” and/or the

“Closing Share Consideration”, each as more fully described in this proxy statement/prospectus. The maximum aggregate Closing Cash Consideration shall be equal to $267,142,251, assuming the Closing of the Transactions (the

“Closing”) occurs prior to October 12, 2021, which is the termination date of the Merger Agreement, and the maximum Closing Share Consideration shall be equal to 34,600,000 shares of common stock of Pubco.

In connection with the proposed merger, each Class A ordinary share of CTAC, Class B ordinary share of CTAC and warrant of CTAC outstanding immediately prior

to the proposed merger shall automatically convert to securities of Pubco on a one-to-one basis. As a result, an aggregate of 33,214,463 shares of common stock and 8,911,745 warrants of Pubco will be issued to holders of CTAC securities.

CTAC has also entered into subscription agreements (containing commitments to funding that are subject to conditions that generally align with the conditions

set forth in the Merger Agreement) with certain investors (the “PIPE Investors”), pursuant to which the PIPE Investors have agreed to buy from Pubco 22,500,000 shares of common stock of Pubco at a purchase price of $10.00 per share

for an aggregate cash purchase price of $225,000,000.

The Merger Agreement provides that the consummation of the Transactions is conditioned upon, among

other things, CTAC having at least $5,000,001 of net tangible assets remaining after giving effect to all public shareholders that properly and timely demand redemption of their shares for cash. Additionally, the obligations of the parties to

consummate the Transactions are conditioned upon, among other things, the (i) Available Closing CTAC Cash plus (ii) cash freely available in KORE’s and its subsidiaries’ bank accounts, being least $345,000,000.

CTAC’s units, Class A ordinary shares, and public warrants are currently listed on the NYSE under the symbol “CTAC.U” “CTAC” and

“CTAC WS,” respectively. Pubco intends to apply for listing, effective at the time of the Closing, of Pubco Common Stock and Pubco warrants on the NYSE under the symbol “KORE” and “KORE WS,” respectively. Pubco will not

have units traded following the Closing.

This proxy statement/prospectus provides shareholders of CTAC with detailed information about the proposed

business combination and other matters to be considered at the special meeting of CTAC. We encourage you to read this entire document, including the Annexes and other documents referred to herein, carefully and in their entirety. You should also

carefully consider the risk factors described in the section entitled “Risk Factors” beginning on page 68 of this proxy statement/prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS

PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY

CONSTITUTES A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated August 13, 2021, and is first being mailed to

CTAC’s shareholders on or about August 16, 2021.