Important Notice Regarding the Availability of Proxy Material for the Special Meeting of Shareholders To view the Proxy

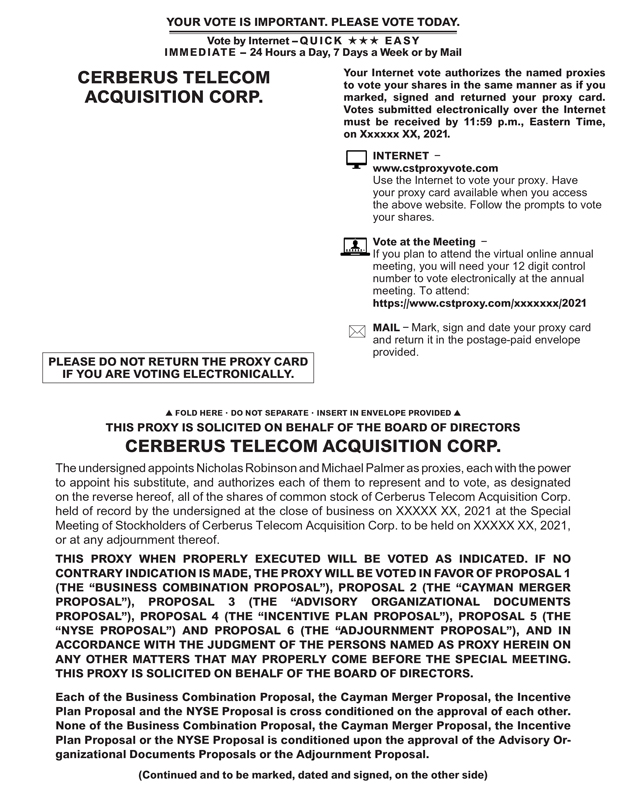

Statement/Prospectus and to Attend the Special Meeting, please go to: http://www.cstproxy.com/xxxxxxxx/2021 PROXY CARD Please mark THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2, 3(A)-(D), 4, 5, and 6. your votes X like this

Proposal No. 1 — The Business Combina- FOR AGAINST ABSTAIN tion Proposal — To consider and vote upon a proposal to approve the business combination described in the proxy statement/prospectus, including (a) adopting the Agreement and Plan

of Merger, dated as of March 12, 2021 (the “Merger Agreement”), by and among Cerberus Telecom Acquisition Corporation (“CTAC”), King Pubco, Inc. (“Pubco”), a Delaware corporation and wholly owned subsidiary of Cerberus

Telecom Acquisition Holdings, LLC (the “Sponsor”), a Delaware limited liability company and an affiliate of CTAC, King Corp Merger Sub, Inc. (“Corp Merger Sub”), a Delaware corporation and direct, wholly owned subsidiary of

Sponsor, King LLC Merger Sub, LLC (“LLC Merger Sub”), a Delaware limited liability company and direct, wholly owned subsidiary of Pubco, and Maple Holdings Inc.(“KORE”), a Delaware corporation, a copy of which is attached to the

proxy statement/prospectus as Annex A, which, among other things, provides for (i) on the day immediately prior to the date on which the Mergers are consummated, the merger of CTAC with and into LLC Merger Sub, a subsidiary of Pubco (the “Pubco

Merger”), with LLC Merger Sub being the surviving entity of the Pubco Merger and Pubco as parent of the surviving entity, (ii) on the Closing Date and immediately prior to the First Merger (as defined below), the contribution by Sponsor of 100%

of its equity interests in Corp Merger Sub to Pubco (the “Corp Merger Sub Contribution”), as a result of which Corp Merger Sub will become a wholly owned subsidiary of Pubco,(iii) following the Corp Merger Sub Contribution, the merger of

Corp Merger Sub with and into KORE (the “First Merger”), with KORE being the surviving corporation of the First Merger, and (iv) immediately following the First Merger and as part of the same overall transaction as the First Merger, the

merger of KORE with and into LLC Merger Sub (the “Second Merger”, and, together with the First Merger, being collectively referred to as the Mergers” and together with the other transactions contemplated by the Merger Agreement, and

the related agreements described in the proxy statement/prospectus, the “Transactions”), with LLC Merger Sub being the surviving entity of the Second Merger and Pubco being the sole member of LLC Merger Sub; and (b) approving the

Transactions and the related agreements described in the proxy statement/prospectus. Proposal No. 2 — The Cayman Merger FOR AGAINST ABSTAIN Proposal — To consider and vote upon, as a special resolution, a proposal to approve the Pubco Plan

of Merger attached to the proxy statement/prospectus as Annex 1 and to authorize the merger of CTAC with and into LLC Merger Sub, with LLC Merger Sub surviving the merger as a wholly owned subsidiary of Pubco. Proposal No. 3 — The Advisory

Organizational Documents Proposal — To consider and vote upon, on a non-binding basis, on proposals with respect to material differences between KORE’s amended and restated certificate of incorporation, and amended and restated bylaws and

Pubco’s amended and restated certificate of incorporation and amended and restated bylaws that will be the certificate of incorporation and bylaws of Pubco following the Transactions, which are being presented separately in accordance with SEC

guidance to give stockholders the opportunity to present their separate views on important corporate governance provisions, as 4 sub-proposals: Proposal No. 3(A) — Advisory Organizational FOR AGAINST ABSTAIN Document Proposal A — To

provide that Pub-co’s board of directors will be a classified board of directors with staggered, three-year terms. Proposal No. 3(B) — Advisory Organizational FOR AGAINST ABSTAIN Document Proposal B — To eliminate the ability for any

action required or permitted to be taken by Pubco common stockholders to be effected by written consent. Proposal No. 3(C) — Advisory Organization- FOR AGAINST ABSTAIN al Document Proposal C — To increase the required stockholder vote

threshold to amend the bylaws of Pubco. Proposal No. 3(D) — Advisory Organizational FOR AGAINST ABSTAIN Documents Proposal D — To provide that the Court of Chancery of the State of Delaware or, if such court does not have subject matter

jurisdiction thereof, another state or federal court located within the State of Delaware, shall be the exclusive forum for certain actions and claims. Proposal No. 4 — The Incentive Plan Proposal — FOR AGAINST ABSTAIN To consider and vote

on a proposal to approve the Pubco 2021 Incentive Award Plan. Proposal No. 5 — NYSE Proposal — FOR AGAINST ABSTAIN To consider and vote upon a proposal in accordance with the applicable provisions of Section 312.03 of the New York Stock

Exchange Listed Company Manual, to issue more than 20% of the issued and outstanding shares of Pubco Common Stock in connection with the business combination, including, without limitation, the PIPE Investment (as described below). Proposal No. 6

— The Adjournment Proposal — FOR AGAINST ABSTAIN To consider and vote upon a proposal to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are

insufficient votes for, or otherwise in connection with, the approval of the business combination proposal, the Cayman merger proposal, the advisory organizational documents proposals, the incentive plan proposal or the NYSE proposal.